Exploring the Role of Payday Loans During Economic Changes

In-Depth Look at Payday Loans: Definition and Functionality

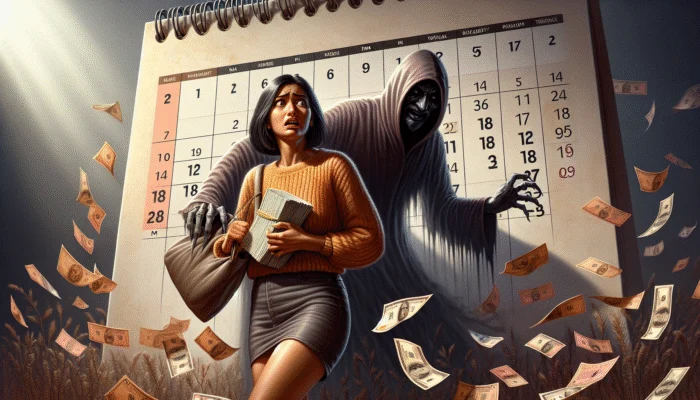

payday loans, known for their short-term and high-interest characteristics, serve as a crucial financial tool for individuals experiencing sudden financial emergencies. These loans operate on the principle of borrowing against future earnings, making them particularly appealing during periods of economic instability. When individuals find traditional credit sources unavailable, they often turn to payday loans as a critical financial resource. This immediate influx of cash can help cover essential expenses such as unforeseen medical bills or urgent home maintenance. However, it is important to recognize the significant burden of the high interest rates associated with these loans, which can trap borrowers in a cycle of debt if not managed properly. Gaining a comprehensive understanding of how payday loans work is vital for anyone contemplating this financial option, especially in times of economic uncertainty.

The Effects of Economic Downturns on Payday Loan Demand

Economic downturns profoundly impact consumer behavior, particularly in the realm of financial decision-making. As job security diminishes and living expenses rise, a growing number of Americans turn to payday loans as a necessary financial buffer. This increased demand underscores the significant role payday loans play in the financial ecosystem, especially for individuals living paycheck to paycheck. Recent research indicates that the demand for payday loans surges during recessions or local economic slowdowns, as individuals seek quick cash solutions to fill income gaps. Employers may resort to reducing hours or initiating layoffs, heightening the financial strain on families and driving them toward these high-interest borrowing options. Understanding this shift in demand is crucial for policymakers and financial institutions, as it highlights the importance of implementing responsible lending practices and enhancing consumer education.

Navigating the Regulatory Landscape and Market Changes

The regulatory framework surrounding payday loans has a profound impact on their availability and terms, especially during periods of market volatility. Both state and federal regulations dictate how payday loans are offered, which directly influences interest rates and repayment conditions. For example, states like Texas have specific regulations governing payday lending, and these laws can shift in response to changing economic landscapes. In times of economic instability, some states may tighten regulations to safeguard consumers, while others may ease them to encourage borrowing. This duality creates a complex situation for borrowers, who must navigate a fragmented set of regulations that can significantly affect their access to financial resources. Awareness of these regulatory fluctuations is essential for borrowers, as it can directly influence their borrowing options and overall financial well-being.

Understanding Texas Market Dynamics and Payday Loans

Current Economic Trends Impacting Texas

Texas boasts a diverse economic landscape, significantly shaped by its various industries, including oil, agriculture, and technology. Each sector undergoes its own market fluctuations, which directly influences the demand for payday loans. For instance, during periods of declining oil prices, workers in the energy sector may face layoffs or reduced hours, leading to an increase in payday loan applications. Conversely, when the tech sector experiences growth, it can create temporary financial stability for workers, thus reducing the immediate need for quick cash solutions. Understanding these economic trends is essential for both lenders and borrowers in Texas, as regional economic fluctuations can dramatically affect financial behaviors and borrowing needs.

The Impact of Local Industries on Payday Loan Demand

The various local industries in Texas play a critical role in shaping the payday loan market landscape. In times of price volatility within sectors like agriculture, rural Texans often find themselves in need of immediate financial assistance. For example, if crop yields are low or market prices experience significant downturns, farmers and agricultural workers may resort to payday loans to cover essential living expenses until the next harvest. In urban areas where the tech industry flourishes, the demand for payday loans may differ, with a more transient workforce potentially relying on these loans during periods of short-term employment gaps. The interconnectedness of local industries highlights how economic conditions dictate financial needs and borrowing behaviors, emphasizing the importance of understanding these dynamics.

Analyzing Consumer Behavior Patterns in Texas

Texans exhibit unique financial habits that are influenced by their economic environment. Many individuals in the state prefer to manage their financial challenges independently, often seeking payday loans when traditional bank loans are inaccessible. This behavior becomes particularly evident during economic downturns when individuals prioritize immediate cash flow over long-term financial stability. Insights into consumer behavior suggest that many Texans lack a comprehensive understanding of the implications associated with payday loans, including the potential for exorbitant interest rates and hidden fees. A considerable portion of the population may not fully grasp the long-term effects of borrowing, highlighting the need for robust financial education initiatives aimed at breaking the cycle of debt and fostering informed financial decision-making.

Examining the Regulatory Framework for Payday Loans in Texas

The regulatory environment governing payday loans in Texas is both intricate and evolving. The state has enacted laws that impose caps on interest rates and establish specific repayment terms, aiming to safeguard consumers from predatory lending practices. However, during periods of economic fluctuation, these regulations may undergo revisions to address the needs of both lenders and borrowers. For instance, during economic downturns, discussions may emerge regarding the relaxation of certain regulations to stimulate lending, despite the inherent risks to borrowers. A thorough understanding of this regulatory landscape is essential for both consumers and lenders, as it directly impacts the accessibility and affordability of payday loans across Texas.

Proven Strategies for Effectively Managing Payday Loans During Economic Changes

Establishing a Budget and Financial Plan

Effective budgeting serves as a cornerstone for navigating the challenges posed by payday loans, particularly during times of economic fluctuations. A well-organized budget enables individuals to forecast expenses and prepare for unexpected financial needs without solely relying on short-term loans. By diligently tracking income and expenditures, Texans can establish a financial buffer that significantly reduces the need for payday loans. Furthermore, integrating a savings strategy—even if modest—can provide a safety net during emergencies. Educational programs focused on personal finance can empower individuals to cultivate these skills, nurturing a culture of financial literacy that encourages independence from high-interest loans and promotes long-term financial health.

Exploring Viable Alternatives to Payday Loans

Investigating alternatives to payday loans can substantially alleviate financial pressure during economic shifts. Options such as personal loans from traditional banks or credit unions typically offer lower interest rates, making them more sustainable over time. Additionally, community programs, credit counseling services, and peer-to-peer lending platforms present viable alternatives. These resources not only grant quick access to cash but also promote responsible borrowing practices. Awareness of these alternatives is crucial, as they can lead to improved financial outcomes, allowing consumers to sidestep the debt trap commonly associated with payday loans. By exploring these options, individuals can make more informed financial decisions that better serve their long-term interests.

Implementing Effective Debt Management Strategies

Utilizing effective debt management techniques can significantly alleviate the burden of payday loans, especially during economic downturns. Strategies such as debt consolidation enable borrowers to merge multiple loans into a single payment with a lower interest rate, thereby simplifying repayment. Additionally, establishing structured payment plans that prioritize higher-interest debts can prevent the accumulation of penalties and late fees. Engaging with financial advisors or debt counselors can provide tailored strategies for effective debt management. By understanding and applying these techniques, Texas consumers can navigate market fluctuations without falling deeper into financial distress, ultimately promoting a healthier financial future.

Analyzing the Effects of Market Changes on Payday Loan Terms

Understanding Interest Rate Variations

Market fluctuations can lead to substantial changes in payday loan interest rates, which directly impact the overall cost for borrowers. During times of economic instability, lenders may increase interest rates to offset risk, placing additional financial strain on consumers already grappling with uncertainty. Conversely, a stable or recovering economy can result in lower interest rates, making payday loans somewhat more manageable. Grasping these interest rate fluctuations is essential for borrowers, as it equips them to anticipate costs and make informed decisions about when to seek loans. Staying informed about market conditions and lender policies empowers consumers to navigate these changes with confidence and prudence.

Loan Availability and Changing Restrictions

Economic developments can also influence the availability and terms of payday loans, affecting consumers’ access to quick cash solutions. During economic downturns, lenders may tighten approval criteria due to concerns about potential defaults, leading to stricter application processes. This tightening can leave many individuals without the financial assistance they require during critical moments. Texas borrowers need to remain vigilant about these changes and understand their implications for loan accessibility. Staying informed about the shifting lending landscape can help consumers prepare for potential challenges and explore alternative financial solutions when necessary, ensuring they are not left without options in times of need.

Adapting to Lender Policies and Practices

Lenders frequently adjust their policies and practices in response to the economic conditions in Texas, which significantly affects payday loan access. Economic downturns often compel lenders to implement stricter credit checks or alter repayment terms to protect their interests. For borrowers, understanding these lender adjustments is critical, as these changes can directly affect their loan options and associated costs. Additionally, fostering relationships with local lenders who possess a deeper understanding of community needs can result in more favorable terms and increased support during challenging times. This awareness cultivates a more informed borrowing environment, ultimately benefiting consumers by providing them with the resources they need to navigate financial difficulties.

Case Studies: Payday Loans and Market Shifts in Texas

The Impact of Oil Industry Downturns on Payday Loan Demand

The cyclical nature of the oil industry in Texas has significant implications for the usage of payday loans. When oil prices decline sharply, workers often face immediate financial challenges, resulting in a noticeable increase in payday loan applications. For example, during the 2014 oil market collapse, numerous Texas workers were compelled to seek urgent financial relief through payday loans to cover essential living expenses. These case studies illustrate the direct correlation between the performance of local industries and the demand for payday loans, providing valuable insights for policymakers and financial institutions. By addressing these trends, stakeholders can develop more tailored support systems for affected communities, ultimately fostering resilience in the face of economic challenges.

The Influence of Agricultural Market Volatility on Borrowing Behavior

Volatility in agricultural prices significantly impacts rural Texans and their reliance on payday loans. When crop prices fluctuate dramatically, farmers may find themselves in precarious financial situations, leading them to seek short-term loans to manage cash flow. For instance, during periods of drought, reduced crop yields compel many individuals in the agricultural sector to consider payday loans to sustain themselves until the next planting season. Understanding this volatility is essential for creating support systems that can ease financial pressures on these communities, promoting sustainable financial practices and reducing dependence on high-interest loans. By fostering financial resilience among agricultural workers, stakeholders can contribute to healthier economic outcomes in these regions.

The Dynamics of Tech Sector Booms and Busts on Payday Loan Demand

The rapid growth and subsequent contractions of the tech industry in urban Texas create a distinctive dynamic in the demand for payday loans. During tech booms, job creation and economic stability can lead to decreased reliance on payday loans, as individuals experience enhanced financial security. However, when the industry encounters downturns, even well-compensated tech workers may find themselves in need of quick cash due to job losses or reduced hours. These cyclical patterns underscore the necessity for financial products that can adapt to the fast-paced nature of the tech industry, ensuring that consumers have access to appropriate lending solutions during both economic growth and decline. This adaptability is crucial for maintaining financial well-being in a rapidly changing economic landscape.

Future Projections for Payday Loans in Texas

Anticipated Economic Trends and Their Influence on Loan Markets

As Texas forges ahead into its economic future, various predictions suggest how emerging scenarios may shape the payday loan market. Analysts anticipate that as the state diversifies its economy beyond traditional sectors like oil and agriculture, there could be shifts in borrowing behavior and loan conditions. An increase in fintech solutions may provide consumers with expanded options, potentially leading to more competitive interest rates. Understanding these anticipated trends is essential for both borrowers and lenders, as it prepares them for future financial landscapes that may differ significantly from current conditions. By staying informed and adaptable, all stakeholders can navigate the evolving economic environment more effectively.

Possible Regulatory Adjustments and Their Implications

Potential regulatory changes could have substantial effects on payday lending practices in Texas. As lawmakers respond to consumer advocacy and shifting economic conditions, we may witness adjustments to interest rates, fees, and borrowing limits. These modifications could either enhance consumer protections or restrict access to loans, depending on the structure of the regulations. For borrowers, remaining informed about potential updates is crucial, as these changes directly affect loan accessibility and overall financial well-being. Engaging with advocacy groups and participating in public discussions can empower Texans to influence regulatory conversations effectively, ensuring that their voices are heard in shaping the future of payday lending.

The Role of Technological Innovations in Transforming Lending Practices

Technological innovations are set to revolutionize the payday loan landscape in Texas. The emergence of fintech solutions is creating alternative lending options that may offer lower interest rates and more flexible repayment terms. For instance, peer-to-peer lending platforms are gaining popularity, providing consumers with diverse choices beyond conventional payday loans. As technology continues to reshape the lending environment, understanding these developments becomes essential for borrowers seeking alternatives and lenders striving to meet evolving consumer needs. Embracing technology can lead to more responsible lending practices, ultimately benefiting Texas communities by fostering financial inclusion and accessibility.

Shifts in Consumer Behavior and Demand for Payday Loans

The future landscape of payday loans in Texas will also be influenced by evolving consumer behavior and preferences. As financial literacy improves and alternative lending solutions become more widely available, the demand for payday loans may gradually decline. Consumers are increasingly seeking transparency and responsible lending practices, prompting lenders to adapt their offerings accordingly. Understanding these behavioral shifts is vital for both borrowers and financial institutions aiming to navigate the changing landscape. By recognizing and responding to the evolving expectations of consumers, stakeholders can help cultivate a more sustainable payday loan market in Texas, ultimately benefiting all parties involved.

Helpful Resources for Payday Loan Borrowers in Texas

Essential Financial Education Programs

Access to financial education programs is a crucial resource for Texans considering payday loans. These programs provide vital knowledge about budgeting, credit management, and responsible borrowing practices, equipping individuals to make informed decisions regarding their financial futures. Local non-profit organizations and community groups often offer workshops and courses aimed at enhancing financial literacy. By participating in these educational initiatives, Texans can effectively navigate financial challenges, reducing their dependence on high-interest payday loans and fostering a culture of long-term financial stability and independence.

Valuable Debt Counseling Services

Professional debt counseling services provide invaluable support for Texans grappling with payday loans. Certified counselors offer personalized guidance, assisting individuals in creating manageable repayment plans and devising strategies for reducing overall debt. These services can be especially beneficial during economic downturns when financial pressures intensify. Gaining access to professional advice empowers individuals to take control of their financial situations, encouraging healthier financial habits and enabling them to avoid the pitfalls associated with predatory lending practices. Through these counseling services, many Texans can find a path to financial recovery and sustainability.

Legal Assistance Resources for Payday Loan Challenges

Understanding consumer rights is paramount for Texans facing difficulties with payday loans. Several legal assistance options are available to help individuals navigate conflicts with lenders and evaluate their options for addressing payday loan issues. Organizations that provide free or low-cost legal aid can assist borrowers in understanding their rights under Texas law and advocate on their behalf during negotiations. By utilizing these resources, Texans can protect themselves from unfair lending practices and gain clarity on their financial obligations, ultimately leading to improved outcomes and greater financial security.

Frequently Asked Questions About Payday Loans

What defines payday loans, and what is their operational mechanism?

Payday loans are short-term, high-interest loans designed to provide quick cash based on the borrower’s anticipated future income, typically due on the next payday.

What drives individuals to seek payday loans in Texas?

Many Texans turn to payday loans during economic downturns or unexpected expenses, as these loans offer immediate financial relief when conventional credit options are unavailable.

What are the potential risks associated with payday loans?

The primary risks include high interest rates, the potential for entering into debt cycles, and negative impacts on credit scores if loans are not repaid punctually.

What strategies can help in effectively managing payday loans?

Effective management involves creating a budget, exploring alternative financial options, and employing debt management techniques to minimize reliance on payday loans.

What alternatives exist to payday loans?

Yes, alternatives include personal loans from banks, credit unions, community programs, and peer-to-peer lending platforms that often provide more favorable terms.

How do economic shifts affect payday loans?

Economic shifts can influence demand, interest rates, and regulatory changes, impacting the ease with which consumers can obtain payday loans and the terms available.

How can I determine if a payday loan is suitable for me?

Evaluate your financial circumstances, consider the total cost of the loan, and assess your ability to repay it on time. It is crucial to explore alternatives before making a decision.

What steps should I take if I cannot repay a payday loan?

Contact your lender promptly to discuss possible repayment options or extensions. Seeking assistance from a debt counselor can also provide guidance on navigating the situation.

What regulatory measures govern payday loans in Texas?

Texas has specific regulations in place for payday lending, including caps on interest rates and established repayment terms aimed at protecting consumers from exploitative practices.

Where can I find resources for financial education in Texas?

Numerous local non-profits, community centers, and online platforms offer financial education programs designed to help Texans enhance their financial literacy and make informed decisions.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

I appreciate the comprehensive look at payday loans and their role during significant economic shifts. Your insights into the dual nature of these loans—a potential lifeline in times of crisis versus a debt trap due to high interest—strike a chord with many who have faced unexpected financial emergencies.

I’m glad the article resonated with you. It really is a tricky balance with payday loans—on one hand, they can help people out of tight spots, but on the other, the interest can snowball into something overwhelming. I think it’s important to look at the bigger picture, too. Many of these loans serve as a reflection of a larger issue: the instability in income and a lack of access to more affordable credit options.

You’re spot on about the dual nature of payday loans. They can indeed provide a quick fix in an emergency, but the consequences often stretch far beyond what people initially anticipate. It really makes you think about the systemic issues at play, like the instability in income you mentioned.

It’s a real juggling act, isn’t it? Payday loans can feel like that friend who shows up at the party with snacks—real handy when you’re starving, but a bit questionable when you start to realize they’re also the one who drank all your good whiskey.

You know, it’s funny you mention that friend showing up at the party with snacks because I’ve been thinking about this whole payday loan situation in a similar way. They can sneak in all charming and helpful when we’re feeling financially famished. It’s like, “Oh great, someone brought chips! I’m starving!” But as the night rolls on and we dig into those chips, we start noticing the hangover from the whiskey…or in this case, the interest rates.

You’ve really captured the essence of the payday loan debate. It is fascinating how these loans can act as both a crucial resource during unpredictable financial downturns and a potential pitfall due to their steep interest rates. Many people often find themselves in that uncomfortable position where necessity outweighs caution.

Your exploration of payday loans highlights a critical aspect of financial accessibility during turbulent times. I’ve seen firsthand how these short-term solutions, while useful, can easily spiral into a daunting cycle of debt. A close friend of mine fell into this trap when faced with unexpected medical expenses. What started as a seemingly harmless financial breath of fresh air quickly transformed into a struggle as interest piled up, leading her to seek out even more loans just to stay afloat.

It’s striking how quickly a situation can shift from feeling manageable to overwhelming, isn’t it? Your friend’s experience is all too common, and it really underscores the fine line many walk when considering payday loans. They often seem like a helpful solution in urgent moments, but those spiraling interest rates can quickly turn relief into a heavier burden.

This is such an insightful examination of payday loans and their role in times of economic stress. I’ve found that many people often overlook the underlying risks associated with these loans, especially the potential for deepening financial distress due to high-interest rates. I’ve personally seen friends get caught in that debt cycle; they take out a loan to cover an immediate need, only to end up needing another loan soon after to pay off the previous one.

It’s clear from your experience that the cycle of relying on payday loans can quickly become a trap that’s hard to escape. Your observation about high-interest rates is spot on; they create a barrier that often makes it difficult for borrowers to regain their footing. When someone takes out a payday loan, the immediate relief often comes with a ticking clock—those hefty fees can compound rather than provide a solution.

You’ve captured the essence of the payday loan dilemma really well. It’s quite startling how quickly the allure of immediate relief turns into a longer-term financial bind. When I think about high-interest rates, it feels like a sort of paradox where the very solution to a cash flow issue can end up exacerbating the problem. There’s an interesting piece of research that shows how this cycle can affect mental health, as the stress of looming payments can create a constant state of anxiety for many.

You’ve touched on something that really hits home for so many people. The immediate relief that payday loans offer can feel like a lifesaver, but it’s wild how quickly that can flip into a financial nightmare. You’re spot on about the paradox of high-interest rates. It’s almost like they trap you in this vicious cycle where, instead of getting ahead, you end up digging a deeper hole.

You’ve captured the essence of those payday loan cycles really well. It’s interesting how, in desperate moments, they can seem like the only option, but that immediate relief often masks the long-term consequences. For many, the cycle of borrowing can become more about surviving than truly addressing underlying financial issues.

I found an insightful piece that dives deeper into how payday loans particularly affect Texas retirees; it really reinforces the concerns about those overwhelming interest rates and the cycle of debt you mentioned.

‘Payday Loans: Insights on Their Impact for Texas Retirees’

https://southlaketxhomeloans.com/payday-loans-insights-on-their-impact-for-texas-retirees/.

You’ve really highlighted an important issue with payday loans, especially how they can feel like a quick fix during tough times. It’s true that for many, it’s less about making a financial decision and more about surviving an immediate crisis. That pressure can completely obscure the long-term consequences, which often end up compounding the original problem.

You bring up an important point about the potential pitfalls of payday loans, especially during tough times. It’s so easy to think of them as a quick fix when immediate financial needs arise, but the reality can be quite different. I’ve seen the same cycle play out—one loan leads to another, and before you know it, what seemed like a temporary solution turns into a spiraling problem.

You’ve touched on a crucial point about the dangers of payday loans that often go unnoticed until it’s too late. Many individuals enter these agreements with the intention of resolving a short-term financial issue, thinking it’s a quick fix. The reality, as you’ve seen with friends, can spiral into a cycle of debt that feels nearly impossible to escape.

I appreciate how you’ve laid out the realities of payday loans during tough economic times. It’s a topic that often gets swept under the rug, despite how many people find themselves navigating these challenging waters. I’ve had a few friends who’ve turned to payday loans when life threw unexpected curveballs, like sudden car repairs or medical bills. It’s easy to see the appeal — that quick cash can feel like a lifeline when you’re strapped for options.

It’s a relief to see these conversations happening because, as you mentioned, payday loans often slip under the radar. Your friends’ experiences really highlight the precarious balance many people have to strike when unexpected expenses hit. That instant access to cash can definitely feel like a lifeline, but that immediate relief often comes with unseen strings attached. The real kicker is how crippling those loans can become when the cycle of debt begins.

It’s true—payday loans can seem like a quick fix during moments of crisis. Your friends’ experiences highlight how unexpected expenses can put anyone on the back foot. That immediate access to cash can feel like a lifeline, especially when options are limited.

You’ve hit the nail on the head with your thoughts about payday loans! It’s really wild how life can throw curveballs. One minute you’re feeling like a financial wizard, and the next, BOOM—a leaky radiator or an unexpected hospital bill. It’s frustrating, especially when you realize that quick cash feels like the best option—like finding the last slice of pizza at a party.

You’ve touched on a really important and often overlooked aspect of personal finance. I’ve seen firsthand how payday loans can serve as a lifeline for someone facing unexpected expenses. A close friend of mine found herself in a tight spot when her car broke down, and conventional credit options weren’t available. In her case, the payday loan allowed her to get back on the road quickly and continue working without major disruption.

It’s interesting to hear your friend’s experience with payday loans, especially since they often get a bad rap. When someone is in a bind, getting quick access to cash can feel like the only option. But while that immediate relief is a valid point, it’s crucial to weigh the long-term consequences. The high fees and interest rates associated with payday loans can lead to a cycle of debt that’s tough to break out of.

Your exploration of payday loans in the context of economic instability is both timely and necessary. I’ve seen firsthand how these loans can be a lifeline for individuals facing urgent financial challenges, yet I resonate with your caution regarding the potential for debt cycles. A personal anecdote comes to mind: a friend once took out a payday loan to cover an unexpected car repair. While it alleviated their immediate stress, the daunting interest turned what was a short-term fix into a months-long financial struggle.

It’s striking to hear about your friend’s experience with payday loans, especially since it highlights the dual nature of these financial products. They can provide immediate relief in a crisis, but the long-term effects often tell a different story. It’s almost ironic; these loans are marketed as quick solutions but frequently lead to a deeper financial hole.

Your observation about the dual nature of payday loans really captures the essence of the problem. On one hand, they can feel like a lifeline during urgent times—when you need to cover unexpected expenses like car repairs or medical bills. People often think they’re making a rational choice in the heat of the moment, believing they can easily pay back the loan with their next paycheck. But, as you pointed out, that immediate relief can quickly spiral into a much larger issue.

Your friend’s experience sounds all too familiar. It’s like a twisted version of Whac-A-Mole, isn’t it? You make a hit on that immediate problem—say, a busted car—and then, just when you think you’ve got it covered, another mole pops up, this time wearing a sombrero made of interest rates and fees. There’s almost a sick irony in how quickly payday loans can feel like tossing a pebble into a pond, only to realize you’ve stirred up a full-blown tidal wave of financial chaos.

I appreciate this nuanced look at payday loans and their role during economic shifts. It’s so true that in times of turmoil, traditional financial avenues often close off, leaving people scrambling for immediate solutions. I’ve seen friends and family turn to payday loans out of sheer necessity—medical emergencies or unexpected car repairs can quickly derail a budget.

It’s great to hear that the article resonated with you. The reality you described reflects a very human experience. Many people find themselves in difficult binds, and when traditional financial avenues shut down, the pressures can feel overwhelming. Payday loans do fill an immediate gap for many, and your observations about friends and family resorting to them during emergencies highlight a crucial aspect of our financial landscape.

It’s interesting how those unexpected financial crunches can change our perspective on borrowing, isn’t it? When life hits you with a medical bill or car trouble you didn’t see coming, the urgency often overshadows our usual thought processes about money. You’ve probably seen how quickly a balanced budget can flip into chaos, leading many to explore options outside of traditional lenders.

It’s so true how those unexpected financial crunches can really shift our perspective on borrowing. It’s almost surprising how quickly we can go from having our finances in a good place to feeling completely overwhelmed. I remember when I had an unexpected car repair; it caught me off guard, and I suddenly realized how fragile my budget really was. You think you’re prepared, but life has a way of throwing curveballs that make you rethink your financial strategies.

I can really relate to what you’re saying about those unexpected financial crunches. It’s wild how a single event—a medical bill or car trouble—can completely shift our financial landscape and, like you mentioned, our approach to borrowing. It seems like we’re often caught off guard and forced to make decisions quickly, which can lead us down paths we wouldn’t have considered before.

Your exploration of payday loans highlights a vital aspect of our financial landscape, especially during times of economic uncertainty. I completely resonate with the idea that these short-term loans can serve as a lifeline for many individuals caught off guard by sudden expenses. Reflecting on my own experiences, I recall a time when unexpected medical bills forced me to reassess my financial strategies. While I didn’t resort to payday loans, I can understand the allure they hold for those who find themselves in dire straits.

Your experience with unexpected medical bills really highlights how quickly financial challenges can arise. Many people underestimate the impact that sudden expenses can have, especially when they don’t have a safety net. Payday loans appeal to those in immediate need, but it’s crucial to weigh the pros and cons.

You bring up such an important point about the role of payday loans, especially as a reflection of our broader financial landscape. It’s interesting how these short-term solutions can sometimes become a double-edged sword. Your experience with unexpected medical bills really resonates; those sudden expenses can really throw off even the most carefully planned budgets.

Your exploration of payday loans highlights a crucial aspect of personal finance that many still overlook—how economic changes can create a desperate need for quick financial solutions. While you accurately depict payday loans as a short-term financial tool, the real concern lies in the social implications and the cycle of debt they often perpetuate.

You make a solid point about the social implications of payday loans. They often create a cycle that’s tough to escape. It’s not just about the immediate need for cash; it can lead to a long-term struggle that traps people. I’ve seen friends get stuck in that loop where they need to take out another loan just to pay off the previous one.

You bring up an important point regarding the social implications of payday loans. It’s true that while these loans can appear to be a quick fix for immediate financial crunches, they often lead individuals into a cycle that’s hard to escape. Many people facing unexpected expenses may not have the luxury of time to consider alternatives, and payday loans can seem like the only option available.

Your exploration of payday loans during economic changes sheds light on a topic that is often overlooked yet deeply impactful for many individuals. The immediacy of payday loans can be a lifeline in times of urgent need, but as you rightly pointed out, the associated high-interest rates can lead to dire consequences. This dual reality is something I’ve seen firsthand in my community, where friends and family members have relied on these loans only to find themselves in an ever-deepening cycle of debt.

Your exploration of payday loans highlights a critical aspect of financial decision-making that many often overlook. I can relate to the feeling of desperation that can accompany unexpected expenses. However, I’ve seen firsthand how precarious relying on these loans can be. A friend of mine took one out to cover an emergency car repair, but the high-interest rates turned a small debt into a much larger burden over time, making it hard to pay off.

Isn’t it wild how payday loans can feel like the “quick fix” to our financial superheroes right when trouble strikes? But like any good superhero origin story, there’s a catch—those infamous interest rates can turn you from Clark Kent into a financial villain faster than you can say “emergency fund.”

You’ve touched on a really important aspect of how payday loans operate, especially during tough economic times. I’ve personally seen friends get caught in that high-interest trap where what started as a quick fix turns into months of stress and juggling payments. It’s almost like they can become a lifeline that quickly turns into an anchor.