Comprehending the Dynamics of Payday Loan Cycles

How Do Payday Loans Function?

Payday loans serve as short-term financial solutions aimed at providing immediate cash flow to individuals until they receive their next paycheck. Borrowers generally seek these loans to address unforeseen expenses such as medical bills, car repairs, or other urgent financial needs. Understanding the operational mechanisms of payday loans is crucial for anyone contemplating or currently juggling multiple payday loans. The typical process involves submitting a loan application, presenting proof of income, and agreeing to repay the loan by the next payday, often accompanied by exorbitant interest rates. Notable features of payday loans include:

- High Interest Rates: These loans frequently carry annual percentage rates (APRs) that can surpass 400%.

- Short Repayment Terms: Loans are usually due in full on the borrower’s next payday, generally within two weeks.

- Minimal Qualification Requirements: Borrowers often only need to present proof of income and maintain a bank account to qualify.

- Quick Access to Funds: Numerous lenders can approve loans and deposit funds into your bank account within hours.

- No Credit Check: Many payday lenders do not perform traditional credit checks, making these loans accessible to individuals with poor credit histories.

- Fees and Penalties: Late payments can result in significant fees and penalties, causing the debt to escalate quickly.

Grasping the mechanics and implications of payday loans can empower borrowers to make informed decisions and manage their debts more efficiently.

The Risks Associated with Loan Rollovers

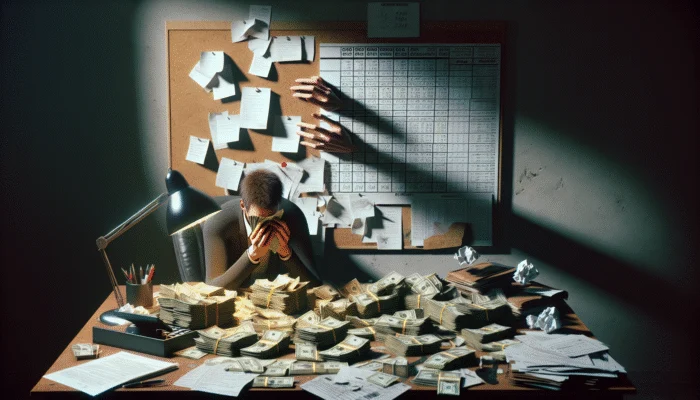

Loan rollovers transpire when a borrower cannot repay a payday loan by the due date and chooses to extend the loan term. Although this may appear to be a convenient solution, it can entrap individuals in a vicious cycle of debt. Each rollover incurs additional fees and inflates the total amount owed, leading to alarming interest compounding. This escalation can result in situations where borrowers end up repaying substantially more than the original loan amount.

For instance, if a borrower secures a $500 payday loan with a two-week term and rolls it over twice, they could end up paying $700 or even more just to extend the loan. This cycle can become overwhelmingly burdensome, inducing financial instability and, in some cases, a dependence on additional loans to manage existing debts. Understanding the ramifications of rollovers is critical; often, it is more advantageous to explore alternatives rather than continue extending payment due dates.

What Are the Consequences of Defaulting on a Payday Loan?

Defaulting on a payday loan can trigger a cascade of serious consequences, adversely impacting both your financial standing and personal life. The immediate repercussions typically involve a significant decline in your credit score, which can impede future borrowing opportunities and escalate costs for loans and credit cards. Beyond the implications for credit, lenders may resort to aggressive collection tactics, including harassment and legal action, to recover the owed amount.

In many instances, lenders may transfer the debt to collections, potentially resulting in lawsuits. If a lender successfully obtains a judgment against you, they may garnish your wages or levy your bank account. Recognizing these potential outcomes underscores the importance of proactively addressing payday loans rather than permitting them to spiral into default.

Expert Recommendations for Managing Multiple Payday Loans

How Can Debt Management Experts Assist You?

Engaging a financial advisor can be a transformative step for individuals grappling with multiple payday loans. These experts can deliver tailored strategies that emphasize financial health and sustainable debt management. For example, an advisor might suggest a comprehensive analysis of your finances, assisting in pinpointing areas for savings or expense reduction, which can facilitate improved repayment plans.

Consider the case of a client who approached a financial advisor overwhelmed by $5,000 in payday loans. The advisor guided the client in formulating a structured payment plan, reallocating funds from discretionary spending, and securing a lower-interest personal loan to eliminate the payday loans. This method not only streamlined the repayment process but also significantly decreased the borrower’s total interest paid. Seeking expert assistance can yield practical solutions for overcoming payday loan burdens.

What Are the Effective Strategies for Loan Consolidation?

Loan consolidation can be a powerful approach for managing multiple payday loans by merging them into a single loan with a potentially lower interest rate. This tactic simplifies repayment and can pave a clearer path to financial recovery. Successful consolidation begins with evaluating your existing loans, determining total amounts owed, and identifying lenders that provide consolidation options.

To effectively consolidate payday loans, consider implementing the following actionable steps:

- Research Consolidation Lenders: Seek out reputable lenders who specialize in debt consolidation and offer favorable terms.

- Compare Interest Rates: Assess the interest rates of the consolidation loan against your current payday loans to ensure savings.

- Check Terms and Fees: Be aware of any associated fees involved in the consolidation process.

- Understand Repayment Terms: Ensure you fully comprehend the repayment terms and how they will fit within your budget.

Consolidating loans is not merely about merging debts; it is about creating a manageable plan that fosters financial stability and mitigates reliance on high-interest loans.

The Importance of Credit Counseling Services

Credit counseling services can act as a lifeline for individuals overwhelmed by payday loan debt. These professionals advocate on behalf of the borrower to negotiate with lenders, frequently resulting in lower interest rates or extended repayment terms. A credit counselor can also aid in devising a personalized debt management plan, which often encompasses budgeting advice and strategies for rebuilding credit.

For instance, a nonprofit credit counseling agency might assist a client with $8,000 in payday loans by negotiating a debt management plan that cuts interest rates by 50%. The agency can also facilitate monthly payments to various lenders, thereby alleviating the burden on the borrower. Credit counseling can significantly enhance the borrower’s financial standing, enabling them to regain control over their finances and strive for a debt-free future.

How Can Effective Budgeting Strategies Mitigate Payday Loan Reliance?

Implementing robust budgeting strategies is essential for anyone aiming to lessen their dependence on payday loans. By acquiring a clear understanding of income and expenses, individuals can prioritize essential spending and allocate funds for debt repayment. Experts recommend several budgeting techniques that can drastically reshape financial habits and diminish reliance on high-interest loans.

Practical approaches include:

- The 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% for savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar a specific purpose, ensuring that income minus expenses equals zero.

- Envelope System: Utilize cash in envelopes for different spending categories to regulate discretionary spending.

- Regular Review: Conduct monthly evaluations of budget performance to identify and eliminate unnecessary expenses.

By employing these strategies, individuals can transform their financial landscape, reduce their reliance on payday loans, and achieve enhanced financial security.

Your Legal Rights and Protections as a Borrower

What Rights Do Borrowers Hold?

As a borrower, understanding your legal rights is vital for protection against unfair lending practices. Federal and state laws offer several safeguards designed to ensure fair treatment and transparency in payday lending. Key borrower rights encompass:

- Right to Clear Information: Lenders are required to disclose the terms, fees, and interest rates associated with the loan.

- Right to Cancel: Borrowers may have the right to cancel a loan agreement within a specified period without incurring penalties.

- Protection Against Harassment: Collection agencies are prohibited from employing abusive methods for debt collection.

- Access to Fair Terms: Lenders cannot impose unfair or deceptive practices concerning loan terms.

Being informed about your rights empowers you to advocate for fair treatment and take action against any unfair practices you may encounter in the payday loan industry.

How Should You File a Complaint Against a Lender?

Filing a complaint against a lender can be a crucial step in resolving disputes or reporting unethical practices. The process typically involves contacting state regulatory agencies or the Consumer Financial Protection Bureau (CFPB) to submit a formal complaint. Each state has specific procedures for submitting complaints, but the steps generally include:

1. Collecting relevant documentation, including loan agreements and communication records with the lender.

2. Completing any required forms provided by the regulatory agency.

3. Submitting your complaint through the agency’s online portal, by mail, or via phone.

Being proactive in addressing issues with lenders not only aids you but can also protect other consumers from potential predatory practices. Understanding the complaint process empowers borrowers to take control of their financial situations.

What Are Usury Laws and Why Are They Important?

Usury laws are established to protect borrowers from excessive interest rates that may lead to predatory lending practices. These laws stipulate maximum allowable interest rates that lenders can impose, which can vary significantly by state. Familiarizing yourself with your state’s usury laws is crucial, as it can help you identify unfair loan terms that exceed legal limits.

In numerous states, payday loans are subjected to strict regulations regarding interest rates and fees. For example, some states cap interest rates on payday loans at 36%, while others may lack such protections. If you suspect your lender is violating these laws, you may have grounds to contest the loan terms or seek legal recourse. Understanding usury laws equips borrowers with the knowledge needed to make informed decisions and advocate for fair lending practices.

Effective Budgeting and Financial Planning Techniques

How to Develop a Practical Budget?

Creating a practical budget is a fundamental step in managing finances and prioritizing debt repayment. A well-structured budget enables individuals to comprehend their income, expenses, and available funds for debt repayment. The budgeting process begins with tracking all sources of income, followed by documenting monthly expenses and categorizing them into fixed and variable costs.

Key budgeting tips encompass:

- List All Income Sources: Include wages, side gigs, and any passive income to capture a complete overview of total earnings.

- Track Expenses: Utilize apps or spreadsheets to categorize expenses and identify spending patterns.

- Prioritize Bills: Ensure essential bills are addressed first, leaving room for debt repayment in your budget.

- Adjust as Needed: Regularly revisit and modify your budget to reflect changes in income or expenses.

A practical budget is dynamic and should evolve with your financial situation, ensuring that debt repayment remains a priority while still allowing for necessary living expenses.

Why Is Having an Emergency Fund Crucial?

An emergency fund is a vital element of financial planning. It acts as a financial cushion, assisting in covering unexpected expenses like medical bills or car repairs without resorting to payday loans. Experts advocate saving at least three to six months’ worth of living expenses in an accessible account.

The advantages of having an emergency fund encompass:

1. Reduced Financial Stress: Knowing you have funds available can offer peace of mind during crises.

2. Avoiding High-Interest Debt: An emergency fund can avert the necessity for payday loans, which frequently come with prohibitive interest rates.

3. Increased Financial Security: A substantial emergency fund cultivates resilience against economic downturns, job loss, or other financial challenges.

Building an emergency fund demands discipline and prioritization, but the long-term benefits far outweigh the initial effort.

What Are the Advantages of Financial Education?

Financial education is an invaluable resource that empowers individuals to make informed decisions regarding borrowing, saving, and investing. Familiarity with basic financial principles can assist in avoiding common pitfalls associated with payday loans and other high-interest debts.

Benefits of financial education include:

- Informed Decision-Making: Knowledge about financial products enables borrowers to select the best options for their specific needs.

- Debt Management Skills: Learning how to budget and manage expenses can diminish the likelihood of accumulating debt.

- Increased Savings: Education can foster the habit of saving, leading to a more secure financial future.

- Improved Credit Understanding: Awareness of how credit scores function can help individuals maintain and enhance their credit ratings.

Financial education programs are widely available through community organizations, online courses, and local workshops, providing essential knowledge for achieving long-term financial stability.

Exploring Alternatives to Payday Loans

How Can Personal Loans Serve as an Alternative?

Personal loans can act as a viable alternative to payday loans, usually offering lower interest rates and extended repayment terms. Unlike payday loans, which are often due in full within a matter of weeks, personal loans typically have repayment periods ranging from one to five years, making monthly payments more manageable.

For instance, an individual may qualify for a personal loan with an interest rate of 15% as opposed to the 400% commonly associated with payday loans. This substantial difference can result in significant savings over time. When contemplating personal loans, borrowers should:

- Shop Around: Compare rates and terms from various lenders to uncover the best deal.

- Check Eligibility: Understand the requirements for obtaining a personal loan, including credit score and income verification.

- Consider Loan Purpose: Ensure that the personal loan is designated for necessary expenses rather than discretionary spending.

- Read the Fine Print: Carefully scrutinize the terms and conditions to avoid hidden fees.

By selecting personal loans instead of payday loans, borrowers can steer clear of the debt cycle and work towards a more sustainable financial future.

What Advantages Do Credit Union Loans Offer?

Credit unions frequently present an alternative to payday loans with more favorable lending terms. As member-owned institutions, credit unions typically provide lower interest rates and fewer fees than traditional payday lenders, making them an attractive option for individuals requiring quick cash.

The benefits of obtaining a loan from a credit union include:

1. Lower Interest Rates: Credit unions commonly charge lower interest rates compared to payday loan providers, thereby minimizing overall borrowing costs.

2. Flexible Repayment Terms: Many credit unions offer flexible repayment plans that can better accommodate a borrower’s budget.

3. Member Support: Credit unions often deliver personalized service and financial education resources to assist members in managing their finances.

4. No Hidden Fees: Unlike numerous payday lenders, credit unions are transparent about their fees and terms, reducing the risk of unexpected charges.

Joining a credit union often necessitates meeting specific eligibility criteria, but the long-term benefits can be substantial, leading to healthier financial habits and diminished reliance on high-interest loans.

What Are the Various Alternatives to Payday Loans?

For individuals pursuing alternatives to payday loans, several options can offer financial relief without the encumbrance of high-interest debt. Solutions such as salary advances from employers, community assistance programs, or peer-to-peer lending can provide essential funds while alleviating financial strain.

Potential alternatives include:

- Employer Salary Advances: Some employers provide advances on paychecks, allowing employees to access their earnings prior to the official payday.

- Community Assistance Programs: Local nonprofits and government programs may offer grants or loans to assist with emergency expenses.

- Peer-to-Peer Lending: Online platforms enable individuals to borrow money from other individuals, often at lower rates than payday loans.

- Credit Card Cash Advances: Although typically not recommended due to high fees, cash advances on credit cards can be a more affordable option compared to payday loans.

Exploring these alternatives can empower individuals to tackle financial challenges without succumbing to the pitfalls of payday loans and their burdensome terms.

Effective Strategies for Negotiating with Lenders

How to Approach Lenders for Improved Loan Terms?

Negotiating with lenders can frequently lead to more favorable loan terms, making it easier to manage multiple payday loans. An informed approach is critical for successful negotiations. Borrowers should begin by gathering all pertinent information regarding their loans, including current balances, interest rates, and repayment terms.

Effective negotiation strategies encompass:

- Be Honest: Clearly articulate your financial situation and the challenges you are encountering.

- Know Your Options: Understand the alternatives available to you, which can fortify your bargaining position.

- Propose a Solution: Present a specific, realistic repayment plan or request an extension on the loan.

- Stay Professional: Approach the conversation calmly and respectfully to foster constructive dialogue.

By engaging lenders with a clear strategy and maintaining open communication, borrowers can often secure more manageable terms that help alleviate their financial burdens.

The Significance of Payment Plans in Debt Management

Payment plans can substantially alleviate the burden of managing multiple payday loans by allowing borrowers to distribute their repayments over an extended period. This method can lower monthly payment amounts, making it more feasible for individuals to pay off their debts without incurring further loans.

Implementing a payment plan involves:

1. Assessing Current Debt: Comprehending the total amount owed and the interest rates linked to each loan.

2. Negotiating with Lenders: Discussing the possibility of establishing a payment plan that aligns with the borrower’s income and expenses.

3. Setting Up a Schedule: Creating a clear repayment schedule helps ensure timely payments while preventing further debt accumulation.

Payment plans can provide much-needed structure for borrowers, reducing stress and enabling them to concentrate on financial recovery.

What Steps Should You Take If Lenders Refuse to Negotiate?

If initial negotiations with lenders do not yield results, it’s vital to remain proactive in addressing the situation. There are several avenues to explore, starting with investigating other debt relief options. Seeking legal counsel can be advantageous, particularly if lenders are employing aggressive tactics or violating borrower rights.

Steps to consider if negotiations prove unsuccessful include:

- Consult a Financial Advisor: An advisor can provide alternative strategies for effective debt management.

- Explore Debt Relief Programs: Investigate options such as debt management plans or bankruptcy as a last resort.

- Document Everything: Maintain records of all communication with lenders, noting any unethical behavior.

- Contact Regulatory Agencies: If lenders refuse to negotiate fairly, reporting them to state regulatory bodies can lead to resolution.

Remaining informed and seeking support is crucial in navigating difficult negotiations and exploring viable solutions to manage payday loan burdens.

When Should You Consider Debt Consolidation?

Debt consolidation can be a valuable strategy for individuals managing multiple payday loans, but it’s essential to evaluate when this option is most beneficial. Consolidation should be considered when borrowers feel overwhelmed by high interest rates and repayment terms that are challenging to manage.

Key factors for pursuing debt consolidation include:

1. High Interest Rates: If payday loans carry exorbitant interest rates, consolidating into a lower-rate loan can result in significant savings.

2. Multiple Payments: If juggling multiple payments proves difficult, consolidation simplifies the repayment process into one manageable monthly payment.

3. Financial Stability: Ensure you possess a stable income to support the new payment terms associated with consolidation.

Conducting thorough research and seeking guidance can help determine if debt consolidation is a prudent choice, enabling borrowers to regain control over their financial circumstances.

Research-Backed Advantages of Managing Excessive Payday Loans

How Does Debt Consolidation Affect Credit Scores?

Consolidating debt can yield varied effects on credit scores, contingent on how it is executed. Initially, acquiring a new loan to consolidate existing debts may result in a temporary dip in your credit score due to a hard inquiry. However, over time, debt consolidation can enhance your credit profile if managed correctly.

Benefits of consolidation for credit scores include:

1. Reduced Credit Utilization: Paying off high credit card balances with a consolidation loan decreases your overall credit utilization ratio, positively affecting your score.

2. Timely Payments: A single payment can foster more consistent on-time payments, crucial for maintaining a healthy credit score.

3. Simplified Management: Fewer accounts to oversee can reduce the risk of missed payments or defaults, further safeguarding your credit score.

Understanding the potential credit implications of debt consolidation can assist borrowers in making informed decisions that bolster their long-term financial health.

The Effectiveness of Debt Management Plans (DMPs)

Debt management plans (DMPs) can be an effective means of reducing the amount owed on payday loans. These plans entail collaborating with a credit counseling agency to negotiate lower interest rates and establish a structured repayment schedule. Numerous individuals have experienced success in utilizing DMPs as a method to regain control over their finances.

For example, a borrower with $10,000 in payday loans utilized a DMP to consolidate their debts. The credit counselor negotiated with lenders to lower the total interest rate, enabling the borrower to pay off their debts within three years instead of five, saving thousands in interest.

DMPs can provide a clear roadmap for individuals struggling with multiple loans, empowering them to achieve financial stability and avoid the pitfalls of high-interest borrowing.

What Psychological Benefits Accompany Debt Relief?

Experiencing debt relief can yield significant psychological benefits, transforming the lives of individuals encumbered by financial stress. The emotional toll of managing multiple payday loans can be overwhelming, often leading to anxiety, depression, and feelings of helplessness. However, achieving debt relief can instill a sense of empowerment and renewed hope.

Key psychological advantages include:

- Reduced Stress Levels: Financial freedom alleviates the continual worry associated with debt, promoting better mental health.

- Increased Confidence: Successfully managing debt can enhance self-esteem and confidence in financial decision-making.

- Improved Relationships: Financial stress often spills over into personal relationships; relieving debt can foster healthier interactions.

- Enhanced Focus: With less time spent worrying about debts, individuals can redirect their energy towards personal and professional aspirations.

Understanding these psychological aspects reinforces the importance of seeking solutions to payday loan dependency, highlighting the holistic impact of financial health.

How Can Payday Loan Refinancing Assist in Managing Multiple Loans?

Refinancing payday loans can be an effective method for managing multiple debts by consolidating them into a single, more manageable loan. This process typically involves securing a new loan with better terms to pay off existing payday loans, potentially lowering interest rates and monthly payments.

The benefits of refinancing encompass:

1. Lower Interest Rates: Refinancing can significantly decrease the interest paid over the life of the loan, making it more affordable.

2. Single Payment Schedule: Consolidating multiple loans into one payment simplifies management and reduces the risk of late payments.

3. Flexible Terms: Many refinancing options provide extended repayment periods, easing monthly cash flow pressures.

4. Potential for Credit Improvement: Successfully managing a refinanced loan can positively influence credit scores over time.

However, borrowers should carefully assess the terms of refinancing to ensure it aligns with their long-term financial objectives and does not introduce new fees or costs.

The Role of Financial Education in Preventing Payday Loan Dependency

Financial education plays a pivotal role in averting the need for payday loans by equipping individuals with the knowledge necessary to manage their finances effectively. Understanding money management principles can help individuals evade debt cycles and reliance on high-cost borrowing.

Programs that successfully educate individuals may include:

- Workshops and Seminars: Numerous community organizations offer free financial literacy workshops focusing on budgeting, saving, and debt management.

- Online Courses: Various platforms provide accessible courses on personal finance, often tailoring content to diverse demographics.

- One-on-One Counseling: Personalized financial counseling can assist individuals in developing specific skills related to their financial situations.

- Youth Education Programs: Teaching young people about finance can lay the groundwork for responsible financial behavior in adulthood.

By investing in financial education, individuals can empower themselves to make informed choices that promote long-term financial stability and mitigate the risk of payday loan dependency.

Seeking Professional Guidance for Debt Management

How to Select a Trustworthy Debt Relief Company?

Choosing a reputable debt relief company is a crucial step in seeking assistance with payday loan debt. The right company can offer valuable resources and support, but it’s essential to conduct thorough research to evade scams.

Key criteria to consider when selecting a debt relief service encompass:

- Transparency: Look for companies that clearly outline their fees, services, and expected outcomes.

- Accreditation: Opt for companies certified by recognized organizations such as the National Foundation for Credit Counseling (NFCC).

- Client Reviews: Investigate customer testimonials and reviews to assess the company’s effectiveness and reputation.

- Experience: Consider the company’s longevity and experience in the industry, as established companies may provide more reliable services.

By thoroughly evaluating potential debt relief companies, borrowers can identify trustworthy partners to assist in navigating their financial challenges effectively.

The Essential Role of Non-Profit Organizations in Financial Assistance

Non-profit organizations play a critical role in providing free or low-cost assistance for debt management. Many of these entities focus on financial education and offer resources designed to help individuals regain control over their finances.

Services provided by non-profit organizations may include:

1. Credit Counseling: Offers personalized advice and plans for managing debt and enhancing financial literacy.

2. Budgeting Workshops: Educational sessions that teach effective budgeting skills and strategies to avert debt cycles.

3. Debt Management Plans: Assistance in establishing structured repayment plans to decrease overall debt amounts.

4. Access to Resources: Providing information on community resources, grants, and assistance programs to support individuals in financial distress.

Collaborating with non-profit organizations can empower individuals to tackle their payday loan issues while cultivating healthier financial habits.

What Should You Expect During Bankruptcy Proceedings?

Bankruptcy can serve as a last resort for individuals facing insurmountable debt, including payday loans. While it offers a fresh start, the process comes with significant long-term consequences that must be carefully considered. Two primary types of bankruptcy for individuals are Chapter 7 and Chapter 13.

In Chapter 7 bankruptcy, most unsecured debts, including payday loans, are discharged, offering immediate relief. However, individuals may forfeit non-exempt assets in the process. Conversely, Chapter 13 bankruptcy permits individuals to retain their assets while establishing a repayment plan for debts over three to five years.

Expectations during bankruptcy proceedings may include:

- Mandatory Credit Counseling: Individuals must complete credit counseling before filing for bankruptcy.

- Asset Evaluation: A thorough examination of assets and liabilities to determine the most appropriate course of action.

- Automatic Stay: Filing for bankruptcy triggers an automatic stay, halting collection efforts from creditors.

- Financial Education Course: After filing, individuals must complete a financial education course before debts are discharged.

Grasping the bankruptcy process can aid individuals in making informed decisions about their financial futures while providing a pathway to recovery from payday loan debt.

Strategies for Long-Term Financial Recovery

How to Rebuild Your Credit After Experiencing Payday Loan Debt?

Rebuilding credit following payday loan debt is essential for achieving long-term financial health. A strong credit score is crucial for obtaining favorable loan terms and financial products in the future.

Key steps for rebuilding credit encompass:

- Pay Bills on Time: Consistently making on-time payments is a significant factor affecting credit scores.

- Reduce Debt Utilization: Aim to keep credit card balances below 30% of their limits to improve credit scores.

- Monitor Credit Reports: Regularly reviewing credit reports helps identify errors and track progress.

- Consider Secured Credit Cards: Using secured cards responsibly can assist in rebuilding credit over time.

Rebuilding credit necessitates patience and discipline, but recovery from past financial difficulties and achieving a strong credit profile is entirely feasible.

The Significance of Savings and Investments for Financial Stability

Establishing savings and investments is fundamental for long-term financial stability. Savings provide a safety net for unforeseen expenses, minimizing reliance on payday loans, while investments can promote wealth growth over time.

Benefits of savings and investments encompass:

1. Emergency Preparedness: Having savings enables individuals to address unexpected financial challenges without reverting to high-interest loans.

2. Future Goals: Savings can facilitate the achievement of larger financial aspirations, such as purchasing a home or funding education.

3. Compound Growth: Investments can grow wealth over time through compound interest, offering a pathway to financial independence.

Cultivating a habit of saving and investing can significantly bolster an individual’s financial security and overall well-being.

What Are the Essential Habits for Achieving Financial Stability?

Developing sound financial habits is crucial for attaining long-term financial stability. Consistent practices can help individuals manage their finances effectively and reduce reliance on payday loans.

Key habits to cultivate include:

- Budgeting Regularly: Consistently reviewing and adjusting your budget can maintain financial discipline.

- Saving a Fixed Percentage: Aim to save a designated percentage of income each month, gradually building savings over time.

- Limiting Discretionary Spending: Stay mindful of non-essential purchases to prioritize financial goals.

- Continuous Learning: Invest time in financial education to enhance understanding of money management and investment strategies.

Adopting these habits can lay the groundwork for lasting financial health, reducing the likelihood of falling into debt cycles associated with payday loans.

Frequently Asked Questions (FAQs)

What are payday loans?

Payday loans are short-term, high-interest loans designed to provide quick cash until the borrower receives their next paycheck.

What occurs if I cannot repay a payday loan?

Failure to repay a payday loan can lead to default, damaging credit scores, provoking legal action, and inciting aggressive collection tactics from lenders.

How can I effectively consolidate payday loans?

You can consolidate payday loans by securing a personal loan or collaborating with a credit counseling service to establish a debt management plan.

Are there viable alternatives to payday loans?

Yes, alternatives include personal loans, credit union loans, salary advances, and community assistance programs.

How can a financial advisor assist with managing payday loan debt?

A financial advisor can provide tailored strategies for managing debt, budgeting, and creating a repayment plan to restore financial stability.

What rights do I possess as a borrower?

As a borrower, you have rights that protect you from unfair lending practices, including the right to clear information regarding loan terms and the ability to contest unfair conditions.

What should I do if my lender refuses to negotiate?

If a lender declines to negotiate, consider seeking legal advice, exploring debt relief options, or filing a complaint with regulatory agencies.

Can credit counseling help with payday loans?

Absolutely, credit counseling can aid in negotiating with lenders and establishing a debt management plan to reduce overall debt.

How can I improve my credit score after experiencing payday loan debt?

You can enhance your credit score by making consistent on-time payments, decreasing debt utilization, and monitoring your credit report for errors.

What role does financial education play in avoiding payday loans?

Financial education equips individuals with essential money management skills, enabling them to make informed choices and avoid reliance on high-interest payday loans.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

Reading through your exploration of payday loan cycles, I find it crucial to emphasize not only the immediate implications of accessing such loans but also their broader socio-economic consequences. The appeal of quick cash in times of financial distress is undeniably compelling, especially for those living paycheck to paycheck. However, the high interest rates and short repayment periods often trap borrowers in a cycle of debt that can be incredibly difficult to escape.

The intricacies of payday loans present a challenging dilemma for many individuals facing unexpected financial burdens. Your breakdown of the operational aspects clearly highlights how accessible these loans can seem, yet the accompanying high interest rates create a precarious situation for borrowers. Having worked in personal finance for several years, I’ve seen firsthand the cycle of debt that can ensue when individuals rely on payday loans as a solution for recurring financial issues.

Your exploration of payday loans really brings to light the urgency many people feel in financial crises. It’s interesting to think about the psychological aspect, too—often, these loans create a vicious cycle, where borrowers are continually trapped in debt due to the high interest rates. I’ve seen friends get caught in this cycle, borrowing again just to pay off previous loans, which only adds to their financial burden.