Key Points to Remember

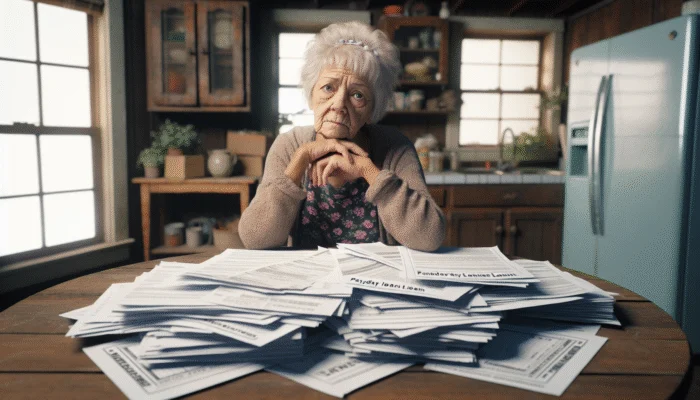

- Loan Types: Payday loans are short-term loans with high-interest rates, often used by Texas seniors for urgent financial needs.

- Application Steps: The application process typically involves researching lenders, gathering documents, and completing a loan application.

- Financial Risks: Seniors face significant risks with payday loans, including high-interest rates and potential cycles of debt.

- Alternatives Available: Options such as personal loans, credit union loans, and assistance programs can provide safer financial solutions.

What Are Payday Loans?

Payday loans are short-term, high-interest loans that provide quick access to cash for individuals facing immediate financial needs. These loans are typically due on the borrower’s next payday, making them a popular option for those who require urgent funds. For Texas seniors, the appeal of payday loans often stems from their accessibility and the speed at which funds can be disbursed. However, the costs associated with these loans can be significant, so understanding their functionality is crucial. Here are some common uses for payday loans among Texas seniors:

- Covering unexpected medical expenses

- Paying for car repairs or urgent maintenance

- Managing utility bills during tight months

- Buying necessary medications not covered by insurance

- Addressing emergency home repairs

- Funding essential travel costs for family emergencies

- Handling overdue property taxes to avoid penalties

As you can see, the situations prompting Texas seniors to consider payday loans can be varied and often revolve around urgent needs that can’t wait until the next month. While these loans can fill a gap, seniors must be aware that the convenience they offer comes with high-interest rates and potentially damaging financial consequences if not managed properly.

What Are the Eligibility and Application Process?

To qualify for payday loans, Texas seniors need to meet specific eligibility criteria. Generally, lenders require proof of income and a valid bank account. The application process is typically straightforward and can be completed online or in-person, which is convenient for seniors who may prefer direct interactions. Here’s a step-by-step guide on how Texas seniors can apply for payday loans:

1. Research Lenders: Begin by researching reputable payday loan lenders in Texas. Look for lenders that are licensed and regulated by the state to ensure that you are working with a trustworthy institution.

2. Gather Necessary Documents: Collect required documentation such as proof of income (e.g., pension statements or bank statements), identification (like a driver’s license), and details of a bank account for fund disbursement.

3. Complete the Application: Fill out the loan application form online or at the lender’s physical location. Be prepared to provide details about your finances, including your income, expenses, and any existing debts.

4. Review Loan Terms: Once your application is approved, carefully review the loan terms, including the interest rates, fees, and repayment schedule. Make sure you fully understand your obligations before signing.

5. Receive Funds: After signing the agreement, funds will be transferred to your bank account, often on the same day or the next business day.

6. Repayment Planning: Develop a repayment plan to ensure you can pay off the loan by the due date, ideally by your next payday.

This process, while relatively simple, emphasizes the importance of understanding loan terms and potential repayment challenges to avoid falling into a cycle of debt.

What Are the Risks and Considerations?

Payday loans, while providing quick cash, come with significant risks that Texas seniors should consider before moving forward. The most pressing concern is the high-interest rates associated with these loans, which can lead to a daunting cycle of debt if loans are not repaid on time. This cycle occurs when borrowers take out new loans to repay old ones, often leading to escalating fees and interest payments.

Another major risk is the potential for financial strain on fixed incomes. Many Texas seniors live on a limited income, such as Social Security or retirement pensions. When unexpected expenses arise, the temptation to seek a payday loan can be overwhelming, but the costs can quickly outweigh the benefits. High fees can result in an inability to pay other essential bills, such as rent or healthcare costs, exacerbating financial instability.

Additionally, payday loans can negatively impact one’s credit score. While payday lenders do not typically report to credit bureaus, failing to repay a payday loan can lead to collections efforts, which will adversely affect credit ratings. Seniors should consider these aspects and assess whether the urgency of their financial needs truly warrants the costs associated with payday loans.

What Are the Alternatives to Payday Loans for Texas Seniors?

Before opting for payday loans, Texas seniors can explore several alternatives that often provide more favorable terms and lower interest rates. These alternatives can help avoid the potential debt trap associated with payday loans, offering safer financial avenues. Below are some viable options:

- Personal Loans: Many banks and credit unions offer personal loans with lower interest rates and longer repayment terms than payday loans. Seniors can consider these options, especially if they have good credit histories.

- Credit Union Loans: Credit unions often have lower fees and interest rates compared to traditional lenders. They may offer small loans or lines of credit aimed at helping members in financial distress.

- Assistance Programs: Various nonprofit organizations and government programs provide financial support for seniors. These programs can assist with medical bills, utility payments, and housing costs.

- Payment Plans with Service Providers: In cases of unexpected bills, seniors might negotiate payment plans directly with service providers, spreading costs over time without incurring interest.

- Community Resources: Local churches or community centers may offer emergency funds or assistance programs for seniors in need, providing financial help without the burden of high-interest loans.

By considering these alternatives, Texas seniors can often find more sustainable financial solutions that protect their long-term financial health while addressing immediate needs. It’s crucial to weigh the potential benefits and drawbacks of each option, ensuring they choose a path that best suits their circumstances.

What Are the Legal Protections and Regulations for Payday Loans in Texas?

Texas has implemented specific laws to regulate payday loans and protect borrowers, including seniors, from predatory lending practices. Understanding these regulations is essential for Texas seniors contemplating a payday loan. The state maintains a set of laws that govern the maximum amount that can be loaned, the fees that lenders can charge, and the terms under which loans must be repaid.

One significant regulation includes the cap on interest rates, which must comply with Texas law to prevent exorbitant fees. Additionally, payday lenders are required to provide clear and transparent loan agreements, detailing all terms, fees, and potential consequences of non-payment. This transparency helps borrowers make informed decisions about whether to proceed with a loan.

Furthermore, Texas law mandates that lenders must not use unfair collection practices, offering seniors legal recourse if they encounter unethical behavior from lenders. These regulations aim to foster a safer lending environment for all borrowers, especially vulnerable populations like seniors who may be more susceptible to predatory practices.

Understanding these protections is crucial for any Texas senior considering a payday loan. It empowers them to seek redress if they feel mistreated and encourages them to make informed financial decisions.

What Expert Insights Are There on How Texas Seniors Use Payday Loans?

Why Do Texas Seniors Turn to Payday Loans?

Many Texas seniors turn to payday loans due to the constraints of living on fixed incomes, often limited to pensions or Social Security. When unexpected expenses arise, such as medical bills or urgent home repairs, the immediate need for cash can push seniors toward these quick loans. Real-world examples illustrate this trend: a senior citizen might face an unexpected medical emergency, such as an illness requiring immediate treatment, which isn’t covered by insurance. In such cases, the high cost of medical care may lead them to seek a payday loan to cover those expenses.

Another common scenario involves car repairs. For many seniors, a reliable vehicle is essential for transportation to appointments, grocery shopping, or social engagements. When a vehicle breaks down unexpectedly, the costs to repair it can be daunting. Consequently, payday loans might be seen as a quick way to address this urgent need, despite their high costs.

However, understanding the reasons behind seeking payday loans is vital for Texas seniors. Many face financial pressures from rising living costs and fixed incomes. Therefore, it’s crucial to offer education on financial management and better alternatives that could alleviate the need for such high-cost loans.

How Can Seniors Manage Payday Loan Debt?

Managing payday loan debt is challenging, especially for Texas seniors who may already be living on tight budgets. However, there are effective strategies to navigate this financial hurdle. Firstly, seniors must prioritize open communication with their lenders. If they anticipate difficulties in repaying on time, contacting the lender to discuss repayment options can often lead to modified payment plans or extensions. This proactive approach can prevent the situation from escalating into more severe financial distress.

Another essential strategy involves creating a repayment budget. Seniors should assess their monthly income and expenses, allocating a portion specifically for loan repayment. By setting aside funds dedicated to repaying the loan, they can avoid falling into the trap of borrowing again to cover previous debts.

Additionally, seeking assistance from financial counselors can provide seniors with critical insights into managing their debts effectively. These professionals can offer personalized strategies and help create a comprehensive financial plan. It is advisable for seniors to explore local community organizations that offer financial literacy workshops or one-on-one counseling tailored to their unique situations.

Finally, seniors should educate themselves about the risks associated with payday loans. Understanding how loans work, including interest compounding and potential penalties, empowers them to make more informed decisions and avoid future reliance on high-cost borrowing.

What Are the Alternatives to Payday Loans for Seniors?

Texas seniors have viable alternatives to payday loans that can provide financial relief without the burdensome costs associated with high-interest borrowing. They can consider personal loans, which often come with competitive interest rates and longer repayment terms. Community banks and credit unions frequently offer lower-cost personal loans tailored to seniors, providing a more manageable solution to financial needs.

Credit union loans represent another excellent option. These institutions typically have lower fees and interest rates compared to traditional banks. Many credit unions also offer small loan products specifically designed for emergencies, which can be a safer choice for seniors facing immediate expenses.

Assistance programs are vital resources as well. Various government and nonprofit organizations provide financial aid for healthcare, utilities, and housing. For example, programs like the Supplemental Nutrition Assistance Program (SNAP) can help alleviate food-related expenses, allowing seniors to allocate funds to other urgent needs.

Lastly, payment plans with service providers can help manage unexpected costs without resorting to payday loans. For instance, if a senior faces significant medical bills, negotiating a payment plan with the provider can make repayment more manageable.

By exploring these alternatives, Texas seniors can find more sustainable financial solutions that help them tackle immediate needs without the long-term consequences of payday loans.

What Are the Risks of Payday Loans for Texas Seniors?

The risks associated with payday loans for Texas seniors are profound and often detrimental. The most significant concern pertains to the high-interest rates charged on these loans. With annual percentage rates (APRs) that can exceed 400%, the costs can quickly spiral out of control. For seniors living on fixed incomes, this burden can lead to overwhelming financial strain.

Another critical risk is the potential for falling into a cycle of debt. Once seniors take out a payday loan, the impending due date can create urgency. If they cannot repay the loan by the deadline, they may resort to taking out another loan to cover the previous one, leading to a perpetuating cycle of borrowing and repayment. This situation can drain savings and lead to further financial instability.

Moreover, the pressure to repay payday loans can affect overall mental health. The stress associated with managing high-interest debt can lead to anxiety and other health issues, further complicating an already challenging situation for seniors.

Lastly, seniors must also be cautious about the potential impact on their credit scores. While payday lenders may not report directly to credit bureaus, missed payments can lead to collections and damage credit ratings, making it challenging to secure future loans or other forms of credit. Awareness of these risks is crucial for Texas seniors considering payday loans, empowering them to make informed decisions about their financial well-being.

How Do Payday Loans Impact Texas Seniors’ Finances?

What Are the Short-Term Financial Effects?

Payday loans can offer immediate financial relief for Texas seniors facing urgent financial emergencies, but the short-term effects must be weighed carefully. When a senior borrows money against their next paycheck, they often gain quick access to cash, which can help them address pressing needs such as medical bills or home repairs. This instant access can alleviate stress and enable seniors to maintain their day-to-day living standards temporarily.

However, the high-interest rates associated with payday loans can lead to significant financial implications shortly after borrowing. When the loan comes due, seniors must ensure they have sufficient funds to pay it back. If the loan is not repaid on time, additional fees and interest charges can accumulate rapidly, straining their already limited financial resources. This situation can lead to a precarious cycle of borrowing, where seniors find themselves re-borrowing to pay off previous loans, creating a continuous financial burden.

Furthermore, the impact on budgeting cannot be underestimated. When a portion of a senior’s income is siphoned off to repay a payday loan, it can create gaps in their monthly budget for essential expenses such as groceries, medication, and utilities. As a result, while payday loans may provide short-term relief, they can also set the stage for long-term financial challenges if not managed carefully.

Long-Term Financial Consequences

The long-term use of payday loans can impose severe financial consequences on Texas seniors, often resulting in a cycle of debt that’s difficult to escape. As seniors rely on these high-interest loans to meet their ongoing financial obligations, they may find themselves deeply entrenched in debt, adversely affecting their overall financial health. This dependence can lead to a significant impact on their credit scores, hindering their ability to obtain conventional loans or credit in the future.

Moreover, the cumulative effect of high-interest payments can deplete savings and other financial resources. Many seniors rely on limited income sources, such as Social Security, which makes maintaining financial stability challenging. When a large portion of this income is directed toward repaying payday loans, it reduces the ability to save for emergencies or future needs, ultimately leading to increased vulnerability in times of financial distress.

Additionally, long-term reliance on payday loans can have implications for overall well-being. The stress associated with ongoing debt can lead to anxiety and depression, impacting mental health and quality of life. The inability to meet financial obligations can also lead to strained relationships with family members and friends, exacerbating feelings of isolation and sadness.

To break the cycle of debt and avoid these long-term consequences, Texas seniors must explore sustainable financial alternatives and develop strategies that promote sound financial management, enabling them to regain control of their finances and improve their overall quality of life.

Strategies for Financial Recovery

For Texas seniors who have taken out payday loans and found themselves in challenging financial situations, various strategies can facilitate recovery. The path to financial stability begins with seeking professional guidance. Many nonprofits and community organizations offer free or low-cost financial counseling services specifically tailored to seniors. These professionals can assist in developing personalized plans to manage debt, create budgets, and improve financial literacy.

Another valuable strategy is to focus on creating a budget that prioritizes essential expenses. Seniors should assess their monthly income and allocate funds for necessary costs, ensuring that they can meet their obligations while gradually paying down any existing loans. A well-structured budget can help prevent future reliance on payday loans, fostering better financial habits.

Additionally, exploring alternative income sources may provide much-needed relief. Seniors can consider part-time work, freelancing, or leveraging hobbies and skills to generate additional income. Even small additional earnings can make a significant difference in financial stability.

Finally, building an emergency fund is crucial. While it may seem challenging to save on a fixed income, even setting aside a small amount each month can create a safety net. This fund can help seniors manage unexpected expenses without resorting to payday loans in the future.

By employing these strategies, Texas seniors can regain control of their finances, reduce the burden of debt, and work towards achieving long-term financial health.

What Are the Legal Protections for Texas Seniors Using Payday Loans?

What Are Texas Payday Loan Regulations?

Texas has established a framework of regulations governing payday loans to protect borrowers, including vulnerable populations like seniors. These regulations aim to prevent predatory lending practices and ensure responsible borrowing. One of the key aspects of Texas law is the cap on the amount of interest and fees that payday lenders can charge. This cap exists to ensure that loans remain manageable and do not lead to overwhelming debt.

Additionally, Texas requires lenders to provide borrowers with clear and concise loan agreements. These agreements must detail all terms and conditions, including the total cost of the loan, repayment schedule, and potential penalties for late payments. This transparency is designed to empower borrowers by allowing them to make informed decisions based on a complete understanding of their obligations.

Furthermore, Texas law prohibits lenders from using deceptive practices or pressuring borrowers. This legal protection is essential for seniors, who may be particularly vulnerable to aggressive sales tactics or misinformation. By enforcing these regulations, Texas aims to create a safer lending environment for all citizens, ensuring that seniors can access financial products without fearing exploitation.

Understanding these regulations is vital for seniors considering payday loans. It empowers them to make informed choices and provides reassurance that they have legal protections in place should they encounter unfair treatment from lenders.

How Can Seniors Report Unfair Lending Practices?

If Texas seniors encounter unfair lending practices related to payday loans, it is important they know how to report these issues effectively. Seniors should first gather all relevant documentation, including loan agreements, payment records, and any correspondence with the lender. This information will help substantiate their claims when reporting unfair practices. Here are steps seniors can follow:

- Contact the Lender: Start by reaching out to the lender to discuss the issue directly. Sometimes, misunderstandings can be resolved through open communication.

- Document Everything: Keep detailed records of all interactions with the lender, including dates, times, and the names of representatives spoken to, as well as the content of conversations.

- File a Complaint with the Texas Office of Consumer Credit Commissioner (OCCC): Visit the OCCC website and submit a complaint online, providing all necessary documentation and details about the unfair practices witnessed.

- Contact the Better Business Bureau (BBB): Reporting the lender to the BBB can help other consumers avoid similar issues and may prompt the company to address shortcomings.

- Seek Legal Advice: If necessary, seniors can consult with legal aid organizations or consumer protection attorneys who specialize in lending practices.

By following these steps, Texas seniors can take action against unfair practices, advocating for their rights and contributing to a safer lending environment for others.

How Can Seniors Seek Legal Assistance?

Texas seniors who face legal issues related to payday loans may benefit significantly from seeking legal assistance. Various resources are available for seniors to explore their rights and obtain support. Local legal aid organizations often provide free or low-cost legal services tailored to seniors, assisting with issues related to consumer protection, debt relief, and unfair lending practices.

When seeking assistance, seniors should first identify the specific legal aid organization that serves their area. Many legal aid offices have staff who specialize in consumer law and can offer targeted support for seniors dealing with payday loan issues. These professionals can help seniors understand their rights, evaluate their financial situations, and determine the best course of action.

Moreover, seniors should not hesitate to reach out to relevant consumer protection agencies. These organizations can provide additional guidance, resources, and advocacy for seniors facing unfair lending practices. They may also help seniors understand their options for disputing unfair charges or negotiating with lenders.

By leveraging these resources, Texas seniors can navigate the complexities of payday loans and protect their rights, ensuring they receive the support they need to resolve their financial challenges.

How Can Seniors Understand Payday Loan Contracts?

Before signing any payday loan contract, Texas seniors should take the time to thoroughly review the terms and conditions. Understanding the nuances of loan agreements is crucial to avoiding pitfalls associated with payday loans. Seniors should pay close attention to several key components of the contract:

1. Interest Rates and Fees: Review the stated interest rates and any additional fees associated with the loan. Understanding how these charges will affect the total cost is essential.

2. Repayment Schedule: Analyze the repayment timeline. Seniors should be clear about when the payment is due and how much needs to be paid each time.

3. Penalties: Look for any penalties associated with late payments. Knowing the potential consequences of missing a payment can help seniors plan effectively.

4. Loan Amount: Ensure clarity on the total loan amount being borrowed, as well as any restrictions or conditions tied to the loan.

If there is anything that is unclear, seniors should not hesitate to ask questions of the lender or seek guidance from a trusted financial advisor. Taking the time to understand the loan contract can help Texas seniors make informed decisions and protect their financial well-being.

What Trusted Strategies Do Texas Seniors Use for Payday Loans?

How Can Seniors Budget Before Taking Out a Loan?

Before considering a payday loan, Texas seniors should engage in thorough budgeting to assess their financial situation and determine if they can afford the loan and its repayment. A well-planned budget can help seniors avoid unnecessary borrowing and highlight areas where they might cut costs or save. Here are some expert techniques for effective budgeting:

1. Track Income and Expenses: Seniors should start by listing all sources of income, including pensions, Social Security, and any part-time work. Next, they should track monthly expenses, categorizing them into essential (e.g., housing, utilities, groceries) and non-essential (e.g., entertainment, dining out) costs. This process helps identify spending patterns and potential savings opportunities.

2. Prioritize Essential Expenses: Once seniors have a clear picture of their finances, they should prioritize essential expenses in their budgets. This prioritization ensures that necessary costs are covered first, allowing for a more manageable approach to any remaining funds.

3. Set a Savings Goal: Even if the goal is modest, setting aside a small amount each month for savings can help create a buffer against future emergencies. This emergency fund can reduce the reliance on payday loans for unexpected expenses.

4. Reassess Regularly: Budgets should not be static. Seniors should review their budgets regularly, adjusting them as necessary based on changes in income, expenses, or financial goals. This adaptability ensures they remain on track and aware of their financial health.

By engaging in these budgeting practices, Texas seniors can make informed financial decisions, reducing the need for payday loans while fostering long-term financial stability.

What Should Seniors Do If They Can’t Repay on Time?

If Texas seniors find themselves unable to repay their payday loans on time, the first step is to communicate with their lender. Open and honest communication can lead to understanding and potential options for extending the loan or negotiating a modified repayment plan. Most lenders prefer to work with borrowers who proactively address repayment challenges rather than risk default.

Seniors should also explore options for temporary financial relief. This might involve reaching out to family members for assistance, utilizing emergency savings, or seeking help from community organizations that offer support in financial emergencies. Sourcing alternative funds can mitigate the immediate pressure of repayment while allowing seniors time to regroup and strategize.

Additionally, seniors must assess their overall financial health during this time. Reviewing their budget, identifying areas where expenses can be reduced, and creating a repayment plan can help ease the burden. If they find themselves consistently unable to manage loan repayments, seeking assistance from financial counseling services can provide valuable insights into better financial management.

Ultimately, the key for Texas seniors is to remain proactive and seek solutions before the situation escalates. By taking these steps, they can work towards resolving their payday loan debts without compromising their financial stability.

How Can Seniors Build a Financial Safety Net?

To minimize reliance on payday loans, Texas seniors should focus on building a financial safety net. Establishing an emergency fund is a critical step toward financial resilience, providing a buffer against unexpected expenses that might otherwise lead to high-interest borrowing. Here are some actionable steps seniors can take to start building their financial safety net:

1. Set a Savings Goal: Begin by determining a realistic savings goal based on monthly income and expenses. Even saving a small amount each month can accumulate over time and provide crucial financial support when needed.

2. Automate Savings: Seniors should consider setting up automatic transfers from their checking account to a savings account. Automation takes the effort out of saving and ensures that funds are consistently set aside for emergencies.

3. Cut Unnecessary Expenses: Reviewing and reducing non-essential spending can free up additional funds for savings. Seniors can assess their budget and identify areas where they can cut back, such as dining out less frequently or canceling unused subscriptions.

4. Take Advantage of Assistance Programs: Seniors can explore community resources or government programs that offer financial assistance. These programs can help alleviate immediate financial burdens, allowing them to redirect funds into savings.

5. Educate Themselves: Learning about personal finance through workshops or online courses can provide valuable insights into budgeting, saving, and responsible borrowing. Increased financial literacy empowers seniors to make informed decisions.

By taking these proactive steps, Texas seniors can establish a solid financial foundation, reducing their reliance on payday loans and enhancing their overall financial security.

How Can Seniors Evaluate Payday Loan Alternatives?

Before resorting to payday loans, Texas seniors should carefully evaluate alternative financial options to determine the best fit for their needs. While payday loans can seem appealing due to their quick cash access, numerous alternatives offer lower costs and more manageable repayment terms.

One prominent option is personal loans from banks or credit unions. These loans typically come with lower interest rates compared to payday loans and longer repayment terms, allowing seniors to manage their debts more effectively. It’s advisable to compare various lenders and their terms to find the most favorable option.

Credit unions represent another excellent alternative. Many credit unions offer specialized loans for their members, often featuring lower fees and rates than traditional lenders. Membership requirements are generally lenient, making credit unions accessible for most seniors seeking financial solutions.

Assistance programs are also worth considering. Numerous nonprofit organizations and government initiatives provide financial aid specifically for seniors, covering essential expenses such as healthcare, utility bills, or housing costs. Seniors should research resources in their communities to tap into these support systems.

Lastly, payment plans with service providers can help avert the need for payday loans. Many businesses are willing to negotiate payment terms that suit the financial situation of seniors, allowing them to pay bills over time without incurring high-interest debt.

By evaluating these alternatives, Texas seniors can find more sustainable financial solutions that align with their needs, ultimately improving their financial health and well-being.

How Can Seniors Understand Payday Loan Regulations?

For Texas seniors considering payday loans, being aware of state regulations is paramount. Texas has laws in place that govern payday lending practices, designed to protect borrowers from predatory lending and ensure fair treatment. Understanding these regulations can empower seniors to make informed choices.

One key regulation is the cap on interest rates, which limits how much lenders can charge on payday loans. Texas law prohibits lenders from imposing excessive fees, ensuring that loans remain manageable for borrowers. This safeguard is particularly important for seniors who may struggle with fixed incomes and rising living costs.

Additionally, Texas requires lenders to provide transparent loan agreements that clearly outline the terms and conditions of the loan. This transparency ensures that seniors can fully comprehend their obligations, including repayment schedules and potential penalties for non-payment.

The state also mandates that lenders must not engage in deceptive collection practices. Seniors who feel they have been treated unfairly have the right to report these behaviors to the Texas Office of Consumer Credit Commissioner (OCCC), which can investigate complaints and take appropriate action.

Familiarizing themselves with these regulations enables Texas seniors to navigate the payday loan landscape more confidently, ensuring they are aware of their rights and protections as borrowers.

What Resources and Support Are Available for Texas Seniors?

Where Can Seniors Find Financial Education?

Financial education is vital for Texas seniors looking to enhance their financial literacy and make informed decisions about loans, budgeting, and saving. Various resources are available throughout Texas to help seniors improve their understanding of personal finance. Community centers, libraries, and local nonprofit organizations often host workshops and seminars focused on financial literacy topics, providing valuable knowledge and skills.

Online platforms also offer a wealth of information. Websites dedicated to financial education often provide free courses, webinars, and articles tailored to seniors. Topics covered may include budgeting, retirement planning, debt management, and understanding credit.

Additionally, many credit unions and banks offer financial education resources specifically designed for seniors. These institutions may provide tools and workshops that cater to the unique financial needs and challenges faced by older adults.

Lastly, organizations such as the AARP offer resources and programs aimed at helping seniors navigate their financial lives, including tools for budgeting, saving, and understanding loans. By taking advantage of these educational opportunities, Texas seniors can equip themselves with essential financial knowledge and improve their financial decision-making.

What Government Programs Are Available?

Numerous government programs are available to assist Texas seniors with financial needs, providing crucial support for managing living expenses. One of the most well-known programs is the Supplemental Nutrition Assistance Program (SNAP), which helps seniors afford food by providing monthly benefits on an EBT card.

Housing assistance programs, such as Section 8 or public housing programs, can provide affordable housing options for low-income seniors, helping them maintain stable living conditions. The Low-Income Home Energy Assistance Program (LIHEAP) offers assistance with heating and cooling costs, which can be particularly beneficial for seniors facing high utility bills.

Additionally, Medicare provides essential healthcare coverage for seniors, ensuring they have access to necessary medical services without incurring overwhelming costs. Some states also offer programs to assist with prescription drug costs, further alleviating financial burdens associated with healthcare.

Lastly, the Texas Department of Aging and Disability Services offers various resources and support services for seniors, including information on benefits, health programs, and financial assistance. By exploring these programs, Texas seniors can access the support they need to enhance their financial stability.

What Non-Profit Organizations Are Offering Help?

Several non-profit organizations in Texas provide critical support for seniors facing financial challenges. These organizations often focus on financial counseling, debt management, and emergency assistance, helping seniors navigate their financial situations effectively.

For instance, organizations like the Texas Association of Community Action Agencies (TACAA) offer various programs aimed at assisting low-income residents, including seniors. They provide access to emergency financial assistance, energy assistance, and food programs.

Another notable organization is the United Way of Texas, which connects seniors with local resources and services that can aid in financial emergencies. Their network often includes food banks, housing assistance, and financial literacy workshops.

The National Council on Aging (NCOA) is another valuable resource, offering tools and information to help seniors manage their finances, access benefits, and connect with local services. They provide educational materials on budgeting, managing debt, and planning for retirement.

Furthermore, local community centers often partner with non-profits to provide senior-focused financial counseling services, ensuring that seniors have access to the support they need to navigate complex financial challenges. By leveraging these resources, Texas seniors can find the assistance necessary to enhance their financial well-being.

FAQs

What is a payday loan?

A payday loan is a short-term, high-interest loan intended to provide quick cash to borrowers, typically due on their next payday.

How can Texas seniors qualify for payday loans?

Texas seniors must provide proof of income, have a valid bank account, and meet the lender’s specific criteria to qualify for payday loans.

What are the risks of payday loans for seniors?

The risks include high-interest rates, potential debt cycles, negative impacts on credit scores, and financial strain on fixed incomes.

What alternatives do seniors have to payday loans?

Alternatives include personal loans, credit union loans, assistance programs, and negotiating payment plans with service providers.

How can seniors manage payday loan debt?

Seniors can manage debt by communicating with lenders, creating a repayment budget, seeking financial counseling, and exploring additional income sources.

What legal protections do Texas seniors have when using payday loans?

Texas regulations limit interest rates, require clear loan agreements, and prohibit deceptive practices, offering protection to seniors.

How can seniors report unfair lending practices?

Seniors can report unfair practices by contacting the lender, documenting issues, and filing complaints with the Texas Office of Consumer Credit Commissioner.

What resources are available for financial education for seniors?

Seniors can access workshops, online courses, and community programs that focus on personal finance, budgeting, and debt management.

What government programs assist Texas seniors financially?

Government programs such as SNAP and housing assistance provide vital support for low-income seniors, helping with food and housing costs.

What non-profit organizations help Texas seniors with financial challenges?

Organizations like TACAA and the United Way offer financial counseling, emergency assistance, and access to local resources for seniors facing financial difficulties.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

Ah, payday loans—the financial equivalent of a late-night infomercial promising miracle solutions in mere seconds, right? It’s funny (not in the haha kind of way, more like the “wow, isn’t that a little scary” kind) how these high-interest loans seem so inviting when you’re in a jam, especially for seniors in Texas. I can picture someone saying, “It’s just a small loan until my next payday!” and poof! Next thing you know, you’re in a spiral more dizzying than a Texas two-step on a dance floor.

You’ve painted quite the vivid picture there with your comparison to late-night infomercials. It really emphasizes how payday loans can easily trap folks in a cycle that’s hard to escape, especially for seniors in Texas who might feel they have limited options. The “just until my next payday” mentality can feel like a rational choice in the moment, but as you pointed out, it often leads to a much bigger issue.

It’s wild how payday loans can seem like a quick fix when you’re in a pinch, but digging into this guide really shines a light on the ins and outs, especially for folks navigating inflation in Texas.

‘Payday Loans: Your Guide During Texas Inflation’

https://southlaketxhomeloans.com/payday-loans-your-guide-during-texas-inflation/.

Your analysis of payday loans highlights critical concerns, particularly regarding their impact on Texas seniors. This demographic often finds themselves in precarious financial situations, and it’s important to consider the societal factors that lead to such reliance on high-interest loans.

This is such an important topic, especially for seniors who might not be aware of the potential pitfalls of payday loans. It’s easy to see why they might consider them—they offer quick cash in urgent situations—but the risks, particularly the high-interest rates, can quickly lead to a downward spiral. I’ve seen friends get trapped in cycles of debt because they took out these loans without fully understanding how they work.