Key Insights on Payday Loans in Beaumont

- Loan Purpose: Payday loans are designed to cover immediate financial needs until the next paycheck.

- Regulatory Framework: In Beaumont, payday loans are subject to Texas regulations that cap loan amounts and interest rates.

- Application Process: Applying for a payday loan is generally straightforward, requiring basic personal information and proof of income.

- Risks Involved: High-interest rates and short repayment terms can lead to a cycle of debt for borrowers.

Understanding Payday Loans in Beaumont

What are Payday Loans?

Payday loans are short-term, high-interest loans that are typically designed to cover immediate financial needs until the borrower receives their next paycheck. These loans are often utilized for urgent expenses, which can include:

- Medical bills

- Car repairs

- Utility bills

- Unexpected travel costs

- Household emergencies

- Groceries or essential living expenses

- Debt consolidation

In Beaumont, many people turn to payday loans as a quick solution for financial shortfalls. The allure of payday loans lies in their accessibility; they often do not require a credit check, making them a viable option for individuals with poor credit histories. However, the convenience comes at a cost, with interest rates that can be significantly higher than those of traditional loans.

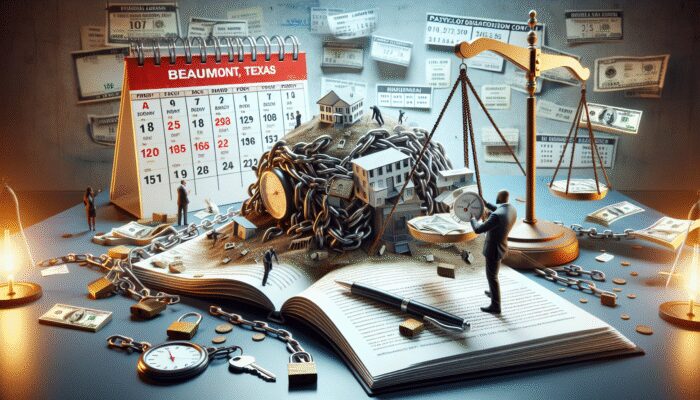

Payday Loan Regulations in Beaumont

Beaumont, located in Texas, adheres to state regulations regarding payday loans. These laws are designed to protect consumers from predatory lending practices. In Texas, payday loans cannot exceed certain amounts, often capped at $1,000, and they typically carry high-interest rates, sometimes exceeding 400% APR. Additionally, the repayment terms are usually short, often forcing borrowers to pay back the loan within two to four weeks. Failure to repay can lead to rollovers, extending the loan but accumulating more interest and fees, which can plunge borrowers into a debt cycle.

Texas law requires that lenders provide clear and transparent information about the loan terms, including the total cost of the loan and the consequences of late payments. Such regulations aim to ensure that borrowers are fully informed before taking on these financial obligations.

How to Apply for a Payday Loan in Beaumont

Applying for a payday loan in Beaumont is designed to be a straightforward process. Typically, interested borrowers can visit a local lender’s branch or apply online. The first step involves filling out an application, which usually requires basic personal information, proof of income, and identification. Most lenders will require proof of employment or a steady income, which demonstrates the borrower’s ability to repay the loan.

The application process is often completed quickly, and many lenders guarantee same-day or next-day funding upon approval. This speed is a significant draw for those facing immediate financial challenges. However, it is crucial for borrowers to ensure they understand the terms and conditions before signing any agreements, as the high-cost structure can lead to severe financial repercussions if not managed properly.

Benefits and Risks of Payday Loans in Beaumont

Payday loans offer several advantages, particularly in terms of speed and convenience. For individuals facing emergency financial situations, the ability to obtain cash almost instantaneously can be a lifesaver. The application process is typically easy to navigate, allowing borrowers to quickly meet their urgent financial needs. However, the risks associated with payday loans are substantial.

High-interest rates can lead borrowers into a cycle of debt, where they find themselves continually borrowing to pay off existing loans. Additionally, failing to repay on time can result in significant fees and damage to credit scores, creating long-term financial challenges. Borrowers must weigh these benefits against the potential pitfalls carefully.

Expert Insights on Payday Loans in Beaumont Options

What Factors Should You Consider Before Taking a Payday Loan?

Before taking on a payday loan, it is essential to consider several critical factors. First, the interest rate is a major consideration, as high rates can drastically increase the total amount repaid. Second, understanding the repayment terms is crucial; knowing how long you have to pay back the loan can help prevent falling into a debt trap. Additionally, assess your current financial situation and your ability to repay the loan on time.

Defaulting on a payday loan can have serious consequences, including escalating fees and damage to your credit score. For instance, some borrowers have found themselves in a cycle where they took out multiple loans, unable to repay their initial loan, leading to a financial crisis. It’s vital to reflect on real-world experiences of others to understand the potential ramifications and to carefully evaluate your circumstances before proceeding.

How to Choose the Right Payday Lender in Beaumont?

Selecting a trustworthy payday lender in Beaumont is crucial for a positive borrowing experience. First, look for lenders that have established a good reputation in the community. Checking online reviews can provide valuable insight into other borrowers’ experiences. Additionally, a reputable lender should be transparent about their terms, ensuring that all fees and interest rates are clearly outlined.

Signs of a trustworthy lender include a physical presence in the community, no upfront fees, and a customer service team willing to answer your questions. To evaluate lenders effectively, borrowers should take actionable steps such as comparing interest rates, reading the fine print in contracts, and seeking recommendations from friends or family who have taken out payday loans. This diligence can protect you from predatory lending practices.

What Are the Alternatives to Payday Loans in Beaumont?

While payday loans are a popular option for short-term financial needs, they are not the only solution available. Alternatives include credit union loans, which often offer lower interest rates and more favorable repayment terms. Additionally, borrowing from friends or family can provide a zero-interest option, though it’s important to manage these relationships carefully to avoid potential strain.

Negotiating payment plans with creditors or utilizing community resources can also be viable alternatives. For instance, some local organizations provide financial assistance or counseling services. Each alternative comes with its pros and cons, and evaluating these options can lead to more sustainable financial health than relying solely on payday loans.

Benefits and Drawbacks of Payday Loans in Beaumont

What Are the Advantages of Payday Loans in Beaumont?

Payday loans present several notable advantages, particularly in times of financial distress. One of the primary benefits is the quick access to cash, often available within hours of application approval. There is typically no credit check required, making it easier for individuals with less-than-perfect credit to obtain funds. Additionally, the application process is generally straightforward, which can be a relief for those in urgent situations. Key benefits include:

- Immediate cash access

- No credit check requirements

- Simplified application process

- Flexibility in use for various needs

For many borrowers, these factors can turn what could be a financial disaster into a manageable short-term solution. However, borrowers should be cautious and ensure that they can meet repayment timelines to avoid falling into a debt cycle.

What Are the Risks Associated with Payday Loans in Beaumont?

Despite their benefits, payday loans carry significant risks. The most notable risk is the high interest rates, which can lead to overwhelming debt if payments are missed. Additionally, borrowers may find themselves caught in a cycle of loans, where they must continually borrow to pay off previous debts. This can lead to a situation where the total amount owed spirals out of control.

To mitigate these risks, borrowers should take proactive steps, such as creating a budget that prioritizes loan repayment, seeking financial advice, and avoiding taking out multiple loans simultaneously. Understanding the potential consequences of late payments is also crucial, as they can severely impact credit scores and result in additional fees. By managing these risks carefully, borrowers can improve their chances of a positive outcome.

How Do Payday Loans Compare to Other Loan Types in Beaumont?

Payday loans differ significantly from other forms of borrowing, such as personal loans, credit cards, and installment loans. Personal loans typically offer lower interest rates and longer repayment periods, making them more manageable for borrowers. Credit cards, while also having high-interest rates, offer revolving credit that can be paid down over time without the immediate repayment pressure that payday loans impose.

Installment loans allow borrowers to pay back the loan in structured payments over a set period, which can alleviate the pressure of a lump-sum repayment. When considering which loan type is best, borrowers should assess their financial needs, repayment capabilities, and the terms associated with each type of loan. Weighing these factors carefully can lead to more informed and sustainable financial decisions.

How to Manage Payday Loan Repayment in Beaumont

What Are the Best Practices for Repaying Payday Loans in Beaumont?

Managing repayment of payday loans demands a thoughtful strategy to avoid falling into further debt. One of the best practices is to create a detailed budget that accounts for the loan repayment. Prioritizing loan payments can help ensure that they are made on time, which is crucial for maintaining financial health. Additionally, borrowers should avoid the temptation to take out multiple loans, as this can complicate repayment efforts.

Late or missed payments can result in serious consequences, including additional fees, collection actions, and damage to credit scores. To effectively manage repayments, borrowers can implement strategies such as setting up reminders for due dates, communicating with lenders if financial difficulties arise, and considering the use of automatic payments to avoid oversight. Adopting these practices can lead to a more responsible repayment process.

How to Handle Payday Loan Debt in Beaumont?

If you find yourself struggling with payday loan debt, several strategies can help manage and alleviate the burden. One option is debt consolidation, which allows you to combine multiple loans into a single payment, ideally at a lower interest rate. This can simplify your financial situation and make it easier to manage repayments. Additionally, negotiating with lenders can sometimes lead to modified payment plans or lower interest rates.

Seeking financial counseling is another effective resource. Many organizations in Beaumont offer counseling services that can help you develop a strategy to manage your debt. By exploring available resources and taking proactive steps, you can work towards alleviating payday loan debt and improving your financial situation.

What Are the Legal Rights of Payday Loan Borrowers in Beaumont?

Borrowers in Beaumont are protected under Texas law regarding payday loans. They have the right to a clear loan agreement that outlines all terms and conditions, including interest rates and repayment requirements. Furthermore, borrowers can dispute any unfair charges or practices and are protected against predatory lending. If a borrower believes their rights have been violated, they can take several steps, including filing a complaint with the Texas Office of Consumer Credit Commissioner.

Understanding these rights is crucial for borrowers to ensure they are treated fairly and to navigate the borrowing process confidently. Knowing your rights can empower you to make informed decisions and seek recourse if needed.

Research-Backed Benefits of Payday Loans in Beaumont Options

How Do Payday Loans Help with Emergency Expenses in Beaumont?

Research indicates that payday loans can be a vital resource for individuals facing unexpected financial challenges. For instance, whether it’s covering an urgent medical bill or addressing unexpected car repairs, payday loans provide immediate access to funds that can alleviate stress during financial emergencies. This immediacy can be crucial when traditional financial resources or savings are unavailable.

Many individuals have shared real-world experiences where payday loans have acted as a saving grace, allowing them to navigate through crises without incurring additional debt from credit cards or other financial products. These loans can bridge the gap between urgent needs and the timing of income, serving as a stopgap measure in financial planning.

What Impact Do Payday Loans Have on Financial Inclusion in Beaumont?

When examining the role of payday loans in financial inclusion, studies suggest that these loans can provide access to credit for underserved populations. Many individuals, particularly those without traditional banking services or with poor credit histories, find payday loans to be one of the few options available to them for obtaining immediate financing. By offering a means to access funds, payday loans can enable individuals to handle emergencies and manage day-to-day expenses effectively.

However, while payday loans can assist in this regard, it is essential to emphasize responsible borrowing. The impact on financial inclusion can be a double-edged sword; while they provide access to cash, the high costs associated with payday loans can exacerbate financial difficulties for those already in precarious situations. Understanding this dynamic is crucial for both borrowers and lenders in Beaumont.

How Can Payday Loans Be Used Responsibly in Beaumont?

Responsible use of payday loans is pivotal for maintaining financial health and avoiding the cycle of debt. First and foremost, borrowers should fully grasp the terms of the loan, including interest rates and repayment timelines, before borrowing. It is advisable only to take out a payday loan for urgent needs and amounts that can be comfortably repaid within the stipulated period.

Best practices for responsible borrowing include creating a financial plan that considers all current obligations and potential income. Additionally, it’s beneficial to explore alternative financial resources before resorting to payday loans. By adhering to these guidelines and being mindful of borrowing habits, individuals can leverage payday loans effectively without compromising their financial well-being.

Trusted Strategies for Payday Loans in Beaumont Options

How to Evaluate Payday Loan Offers in Beaumont?

When comparing payday loan offers in Beaumont, several key factors should be considered to ensure you secure the best deal. Interest rates are the most significant consideration; a lower rate can save you money in the long run. Fees associated with the loan should also be examined, as they can vary greatly among lenders. Additionally, repayment terms should be clearly understood; knowing how long you have to repay the loan can significantly impact your financial planning.

Reputable lenders will provide clear information about all these aspects. It is essential to look for lenders with positive customer reviews and a transparent track record. Real-world comparisons of loan offers can help borrowers identify the most favorable terms suited to their financial situation, making the evaluation process critical to smart borrowing.

What Are the Steps to Secure the Best Payday Loan in Beaumont?

To secure the best payday loan, start by conducting thorough research on multiple lenders. Look for established lenders with good customer feedback and transparent terms. Reading the fine print is crucial; it can reveal hidden fees or unfavorable conditions that could impact your loan experience.

If possible, don’t hesitate to negotiate the terms. Some lenders may be willing to adjust interest rates or fees, particularly if you present a good repayment history. By following these steps and being proactive, borrowers can position themselves to obtain the most favorable payday loan terms available in Beaumont.

How to Avoid Payday Loan Scams in Beaumont?

With the rise of payday loans, scams have unfortunately become more prevalent. Scammers often lure individuals with offers that seem too good to be true, such as loans with no interest or guaranteed approval regardless of credit history. To avoid falling victim to these schemes, be vigilant and watch for red flags, such as lenders who request upfront fees or lack clear contact information.

Legitimate lenders will have a physical presence and clear terms outlined in their agreements. Researching the lender’s reputation and checking for any consumer complaints can also provide additional assurance. Awareness of common scam tactics can empower borrowers to protect themselves effectively.

What Are the Legal Regulations for Payday Loans in Beaumont?

In Beaumont, payday loans are subject to specific legal regulations that are designed to protect consumers. Texas law stipulates maximum loan amounts, interest rate caps, and mandatory disclosures regarding loan terms. These regulations aim to promote fair lending practices and ensure that borrowers are aware of the total costs associated with their loans.

Understanding these legal frameworks is essential for borrowers, as they can help to navigate the lending landscape and ensure compliance with local laws. By being informed about these regulations, borrowers can better protect themselves from predatory lending practices and make informed borrowing decisions.

How to Manage Payday Loan Repayments in Beaumont?

Effective management of payday loan repayments is critical for maintaining financial well-being. Best practices include creating a comprehensive budget that accurately reflects income and expenses, allowing borrowers to allocate funds for loan repayment. Timely payments are essential to avoid additional fees and negative impacts on credit scores.

Open communication with lenders can also play a vital role in managing repayments. If financial difficulties arise, discussing options with lenders may yield alternative arrangements that could alleviate repayment pressures. By employing these strategies, borrowers can minimize the risks associated with payday loans and maintain better control over their financial situations.

Payday Loan Lenders in Beaumont: A Comprehensive Guide

Who Are the Top Payday Loan Lenders in Beaumont?

Beaumont boasts several reputable payday loan lenders, including both national chains and local businesses. Some of the most trusted providers in the area include:

- Cash Store – Known for competitive rates and flexible terms.

- Check Into Cash – Offers a range of financial services beyond payday loans.

- Speedy Cash – Provides fast access to funds with straightforward terms.

- Advance America – A well-established lender with transparent practices.

Each of these lenders has unique features that can cater to different borrowing needs, making it important for potential borrowers to assess their options carefully.

What Services Do Payday Loan Lenders in Beaumont Offer?

In addition to payday loans, many lenders in Beaumont provide additional services that can benefit borrowers. Some lenders offer financial education resources, helping individuals understand managing their finances better and avoiding future debt. Online applications are increasingly common, allowing for a more convenient borrowing process.

Additionally, flexible repayment options can vary from lender to lender. Some institutions might allow for extended repayment plans or lower interest rates for repeat customers. Understanding these services can enhance the borrowing experience and promote better financial management.

How to Contact Payday Loan Lenders in Beaumont?

Contacting payday loan lenders in Beaumont is straightforward. Borrowers can visit local branches in person to discuss options and ask questions directly. Alternatively, many lenders provide customer service lines or online contact forms, making it easy to reach out for information or assistance. Using online resources can often lead to quicker responses, particularly for inquiries regarding loan terms or application processes.

Establishing initial contact can set the tone for your borrowing experience, so be proactive in seeking out the information you need to make informed decisions.

What Are the Eligibility Requirements for Payday Loans in Beaumont?

To qualify for a payday loan in Beaumont, borrowers typically need to meet specific eligibility criteria. Common requirements include being at least 18 years old, having a steady source of income, and providing proof of residency within Texas. Additionally, lenders may ask for identification documents, such as a driver’s license or Social Security card, to verify identity.

Some lenders might have additional requirements, so it’s essential for potential borrowers to check with individual lenders to ensure they meet all necessary criteria before applying for a loan.

How to Compare Payday Loan Lenders in Beaumont?

When comparing payday loan lenders in Beaumont, there are several factors to consider. Interest rates and fees are among the most important elements to examine, as they can significantly impact the overall cost of the loan. Additionally, borrowers should look at repayment terms, including how long they have to repay the loan and any consequences for late payments.

Customer reviews can also offer insights into a lender’s reputation and service quality. Taking the time to compare these factors can help borrowers find the lender that best suits their financial needs and circumstances, ultimately promoting a more positive borrowing experience.

Payday Loans in Beaumont: Frequently Asked Questions

What Are the Eligibility Requirements for Payday Loans in Beaumont?

To qualify for a payday loan in Beaumont, you typically need to be at least 18 years old, have a steady income, and provide proof of identity and residence. Documentation such as a driver’s license and recent pay stubs may be required.

How Quickly Can You Get a Payday Loan in Beaumont?

Payday loans in Beaumont are known for their speed, with many lenders offering same-day or next-day funding. The entire process, from application to receiving funds, can often be completed within a few hours, depending on lender policies.

Can You Renew or Extend a Payday Loan in Beaumont?

In Beaumont, some lenders allow borrowers to renew or extend their payday loans, although this often comes with additional fees and interest. It’s essential to review the terms carefully to understand any implications associated with renewal.

What are the maximum loan amounts for payday loans in Beaumont?

The maximum loan amount for payday loans in Beaumont is typically capped at $1,000 per loan. However, individual lenders may impose their limits based on the borrower’s income and repayment ability.

What happens if you can’t repay your payday loan on time?

If you cannot repay your payday loan on time, you may face additional fees, interest, and potentially, a negative impact on your credit score. It is crucial to communicate with your lender to explore possible options.

Are payday loans a good option for emergencies?

Payday loans can provide quick cash for emergencies, but they come with high interest rates that can lead to financial strain. Assessing your financial situation and exploring alternatives is advisable before proceeding.

How can you avoid falling into a debt cycle with payday loans?

To avoid a debt cycle with payday loans, create a budget, repay loans on time, and avoid taking out multiple loans at once. Seeking alternatives for financial assistance can also help mitigate risks.

Do payday lenders conduct credit checks in Beaumont?

Most payday lenders in Beaumont do not conduct traditional credit checks, making it easier for individuals with poor credit to qualify. However, they may verify income and employment status.

Can payday loans affect your credit score?

Payday loans can affect your credit score if you miss payments or default on the loan. Keeping up with repayments and understanding the terms can help maintain your credit health.

What should you do if you feel you’ve been scammed by a payday lender?

If you believe you’ve been scammed by a payday lender, report the issue to the Texas Office of Consumer Credit Commissioner and consider seeking legal advice to understand your options for recourse.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

I found your insights about payday loans in Beaumont really thought-provoking. It’s crucial that potential borrowers understand not just the mechanics of these loans but also the risks involved. The point about high-interest rates leading to cycles of debt resonates with my own experience. I’ve seen friends struggle to break free from the burden of these loans, often needing to take out another just to pay off the last one.

You hit the nail on the head about those high-interest rates! It’s like running on a treadmill but forgetting to plug it in—lots of effort, but you’re just staying in one place. I often wonder if payday lenders have a secret handshake for their repeat customers.

I appreciate your thoughts on payday loans—it’s such an important topic that often flies under the radar. The way you described the cycle of debt is spot on. I’ve seen similar situations among acquaintances, where they feel trapped, taking out loans just to keep up with previous ones. It’s like they’re caught in a revolving door of financial stress.