Balancing Payday Loan Costs in Texas: Essential Tips

Key Insights on Payday Loans in Texas Definition: Payday loans are short-term, high-interest loans meant to address immediate financial needs. Regulations: Texas has specific regulations governing payday loans that protect borrowers from excessive fees. Risks: Borrowers face significant risks, including high-interest rates and potential cycles of debt. Alternatives: There are various alternatives to payday loans, […]

Texas Payday Loan Rates: Your Seasonal Guide

Key Insights on Payday Loan Rates in Texas Factors Influencing Rates: Key elements like credit score, loan amount, and lender policies significantly affect payday loan rates. Seasonal Trends: Demand for loans typically peaks during tax season and the holiday season, leading to higher rates. Economic Impact: Inflation and employment rates in Texas directly influence payday […]

Texas Credit Access Business Regulations Explained

Key Highlights Regulations Overview: Texas Credit Access Business Regulations aim to protect consumers by ensuring transparency and fairness in lending practices. Licensing Requirement: Any business providing credit access services in Texas must obtain a state license to operate legally. Compliance Importance: Maintaining compliance with regulations is crucial for credit access businesses to avoid penalties and […]

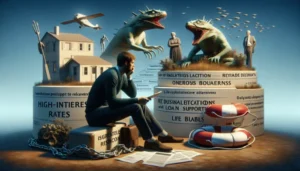

Lower Rate Payday Loan Options in Texas: A Comprehensive Guide

Key Insights on Payday Loan Choices in Texas Definition: Payday loans are short-term loans due on the borrower’s next payday, often used for urgent expenses. Risks: Borrowers may face a cycle of debt due to high interest rates associated with payday loans. Comparisons: Comparing different lenders is crucial to find the best rates and terms […]

Payday Loans: Insights on Their Impact for Texas Retirees

Key Insights on Payday Loans for Texas Retirees Loan Mechanics: Payday loans are high-interest, short-term loans aimed at providing quick cash, often due on the next payday. Eligibility Requirements: Texas retirees must prove a stable income source and have an active bank account to qualify for these loans. Legal Protections: Texas law regulates payday loans, […]

Payday Loan Stories: Inspiring Turnarounds in Texas

Key Highlights Definition: Payday loans are short-term loans due on the borrower’s next payday, offering quick cash for urgent financial needs. Debt Cycle: Many borrowers fall into a cycle of debt due to high interest rates and fees, often needing to take out additional loans to repay the original amount. Success: Individuals like Maria and […]

Payday Loans in Texas: Understanding Their Evolution

Key Insights Origins: The history of payday loans in Texas dates back to the early 20th century, beginning with informal salary loans. Regulations: Legislative changes have shaped the payday lending landscape, focusing on consumer protection and lender accountability. Online Shift: The move to online platforms has made payday loans more accessible, though it raises regulatory […]

Payday Loans: A Guide for Texas City Residents

At a Glance Definition: payday loans are short-term loans due on the borrower’s next payday, often used for urgent financial needs. Regulations: Texas has specific regulations for payday loans, including limits on fees and interest rates. Accessibility: Payday loan stores are prevalent in Texas cities, facilitating quick access to cash for residents. Risks: Borrowers face […]