Exploring the Complex Landscape of Payday Loans in Texas

Payday loans in Texas represent a financial enigma—appealing yet dangerous. They offer a quick influx of cash during critical situations, yet they can thrust borrowers into an ongoing cycle of overwhelming debt. So, what are these payday loans, and why do so many individuals find themselves ensnared by them? Let’s delve into the intricacies of payday loans, their consequences, and the potential solutions for escaping the Texas payday loan debt trap.

Defining Payday Loans: A Closer Look

Payday loans are short-term, high-interest financial products specifically designed to meet urgent monetary requirements. While they are readily available, they come with exorbitant costs. In Texas, the annual percentage rates (APRs) can skyrocket to 400% or even higher! This staggering figure means that borrowing $300 could end up costing you over $1,000, particularly if you extend the loan into another payday cycle, sinking you deeper into the debt abyss.

The allure of these loans often lies in their minimal documentation requirements, making them attractive to those lacking excellent credit or sufficient savings. However, this ease of access may conceal the dangers ahead. Many borrowers find themselves unable to repay the loan promptly, leading to repeated borrowing. This initiates a vicious cycle in which individuals become increasingly reliant on these high-interest loans, ultimately creating a severe financial crisis.

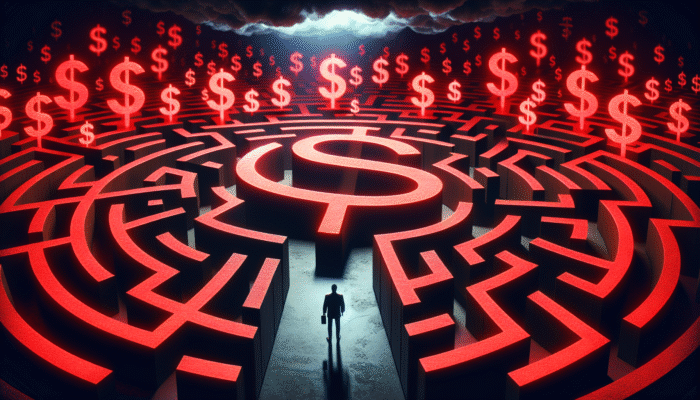

Understanding the Vicious Cycle of Debt

Picture this scenario: you encounter a missed paycheck or an unexpected expense. In a moment of desperation, you opt for a payday loan, believing it to be a temporary solution. Fast-forward to the due date, and suddenly, the interest has ballooned beyond your expectations. Now, you’re not merely repaying the principal amount; you’re also grappling with a mountain of fees. This compels you to borrow again, perpetuating a cycle that becomes increasingly difficult to escape.

Numerous borrowers find themselves rolling over their loans repeatedly, accumulating fees that can nearly double the original sum borrowed. This cycle often leads to a dire situation where financial freedom is shackled by the weight of burdensome debt. Understanding this cycle is crucial for anyone contemplating a payday loan or currently entangled in its web.

Legal Framework Surrounding Payday Loans in Texas

Texas has enacted several legal regulations regarding payday loans to mitigate predatory lending practices. The state requires lenders to furnish clear disclosures detailing the terms of the loan, including the interest rate and total repayment obligations. Nevertheless, many critics argue that these regulations fall short in providing adequate protection for consumers.

A significant concern revolves around the absence of strict caps on interest rates. Unlike many other states that impose hard limits on lender charges, Texas laws permit exorbitant rates, leaving borrowers vulnerable to exploitation. Advocacy organizations are continuously advocating for more stringent regulations to protect consumers from the Texas payday loan debt trap.

Exploring Viable Alternatives to Payday Loans

Fortunately, various alternatives exist to payday loans, offering more sustainable solutions for financial emergencies. Credit unions frequently provide small personal loans with significantly lower interest rates compared to payday lenders. These institutions prioritize community service and the financial well-being of their members over profit, making them an excellent resource for those in need.

Additionally, both local and national emergency assistance programs can intervene to aid individuals facing critical financial challenges. Organizations such as the Salvation Army and various local nonprofits often have designated funds available for emergency assistance.

By considering these alternative options, you can circumvent the pitfalls of payday loans and discover more viable routes to achieving financial stability. It’s all about making informed decisions that prioritize your long-term financial health over immediate, short-term fixes.

Effective Strategies for Escaping the Debt Trap

Breaking free from the clutches of the Texas payday loan debt trap necessitates a proactive approach. It is vital to equip yourself with strategies that can effectively help you liberate yourself from the chains of high-interest borrowing. Let’s explore some actionable tactics to reclaim your financial future.

Mastering Budgeting and Financial Planning

A meticulously crafted budget serves as your fortress against the financial storms life can throw your way! Begin with a comprehensive understanding of your income and expenses. Enumerate all your monthly expenditures, categorize them into essential needs and discretionary wants, and pinpoint areas where you can cut back. By prioritizing your spending, you can redirect funds towards debt repayment instead of reverting to payday loans.

Employing budgeting tools and applications can streamline this process, making it easier to keep track of your financial health. Crafting a budget transcends mere restriction; it embodies empowerment—by comprehending the flow of your money, you can make informed decisions that foster financial growth.

Moreover, forming a financial plan that incorporates savings objectives can ensure you have a safety net for unforeseen expenses in the future. Establishing an emergency fund is a significant step toward avoiding the pitfalls of payday loans again.

Engaging in Negotiation with Lenders

Many borrowers overlook the potential benefits of negotiating with lenders as a viable strategy. If you find yourself behind on payments or enduring financial hardship, do not hesitate to reach out to your lender. Most payday loan companies prefer to negotiate a repayment plan rather than losing you as a customer.

Openly discussing your circumstances and inquiring about more favorable repayment terms or reduced interest rates can yield surprising results. Some lenders may exhibit a surprising degree of flexibility when approached with honesty and transparency. This step can be pivotal in preventing further debt accumulation and enabling you to regain control over your finances.

Additionally, certain lenders may offer hardship programs designed to support borrowers struggling to make payments. Taking the initiative to communicate with your lender can provide essential relief during challenging times.

Seeking Professional Guidance for Financial Relief

When the burden of debt feels insurmountable, seeking professional help can prove transformative. Credit counseling services are specifically designed to assist individuals in effectively managing their debts. These services typically provide personalized financial assessments and develop tailored plans to help you systematically pay off debts.

Certified credit counselors can guide you through the intricate maze of financial options, helping you comprehend your rights as a borrower. They can also negotiate with creditors on your behalf, potentially lowering your interest rates or crafting manageable payment plans.

Taking this step is not a sign of weakness; it represents an act of empowerment. By enlisting the support of professionals, you can carve a path toward financial freedom with confidence and clarity.

Exploring Alternative Financial Solutions

If you find yourself ensnared in the Texas payday loan debt trap, it’s essential to explore alternative financial solutions. Fortunately, various options are available that can provide relief without the crippling interest rates associated with payday loans.

Utilizing Credit Unions for Small Loans

Credit unions are community-oriented financial institutions that frequently offer loans at considerably lower interest rates than payday lenders. They serve as a safe haven for individuals seeking financial assistance without falling victim to predatory lending practices. By becoming a member of your local credit union, you can access small loans that can help you navigate financial emergencies.

In contrast to payday loans, which necessitate quick repayment, many credit unions provide more favorable terms, allowing you to repay the loan over an extended period at a lower interest rate. This reduced financial burden grants you the breathing room needed to regain control of your finances without succumbing to further debt.

Additionally, credit unions often offer financial education resources, empowering you to make informed financial decisions. Engaging with these institutions can lay a solid foundation for your financial future.

Discovering Payday Alternative Loans (PALs)

Certain credit unions offer what are known as Payday Alternative Loans (PALs). These loans are specifically designed to present a more affordable alternative to payday loans, typically featuring lower interest rates and more manageable repayment terms.

PALs often require members to have maintained membership for a specific duration before qualifying, which encourages responsible borrowing habits. By opting for a PAL, you can access the necessary funds without the fear of exorbitant fees and relentless cycles of debt.

It’s critical to research and compare the offerings of various credit unions to identify the most advantageous PAL options available to you. Steering clear of payday lenders and choosing alternatives like PALs can significantly improve your financial well-being.

Leveraging Employer-Sponsored Financial Programs

In an increasingly supportive workplace environment, more employers recognize the financial strains their employees encounter. In response, some companies provide financial assistance programs or payroll advances to help their workforce avoid falling into the payday loan trap.

These programs offer quick access to funds, typically without interest or with minimal fees, allowing employees to effectively manage unexpected expenses. Engaging with your HR department to inquire about available resources can be a proactive step toward achieving financial stability.

Employers that promote financial wellness often observe heightened productivity and decreased employee stress levels. This mutually beneficial relationship underscores the importance of community support in overcoming financial challenges.

Establishing Long-Term Financial Stability

Emerging from the Texas payday loan debt trap is merely the first step. Building a robust financial foundation is critical for ensuring long-term stability and preventing future debt. Here are some strategies to secure your financial future.

Creating an Emergency Savings Fund

An emergency savings fund serves as your safety net during unpredictable times. It provides the necessary financial cushioning to cover unexpected expenses, making it significantly less likely that you’ll need to rely on payday loans in the future. Aim to save at least three to six months’ worth of living expenses, ensuring protection against financial storms.

If necessary, start small—setting aside even a few dollars each week can accumulate over time. Automating your savings can also simplify the process, ensuring that you’re consistently putting money aside without requiring conscious effort.

When the unexpected occurs—be it a car repair or a medical bill—you’ll be prepared to handle it without resorting to high-interest loans. Establishing this fund is a pivotal step that empowers you to take control of your financial destiny.

Enhancing Your Credit Score for Better Opportunities

A healthy credit score opens doors to a wide array of affordable borrowing options and can significantly influence your financial landscape. By implementing strategies to improve your credit score, you can access loans with lower interest rates, making it easier to manage repayments.

Begin by reviewing your credit report for errors or discrepancies and disputing any inaccuracies. Additionally, prioritize paying off existing debts promptly and in full. Keeping your credit utilization below 30% and diversifying your credit mix can also positively impact your score.

By investing time and effort into enhancing your credit, you’re not just striving for better loan options; you’re investing in your financial future. A robust credit score increases your negotiating power, ensuring that you’re never at the mercy of predatory lenders.

Embracing Financial Education for Empowerment

In today’s information age, knowledge serves as your most powerful ally in achieving financial stability. Gaining an understanding of personal finance and money management equips you with the tools necessary to make informed decisions.

Consider enrolling in courses on financial literacy, either online or through local organizations. Grasping concepts such as interest rates, budgeting, and investment strategies can empower you to navigate the financial landscape with confidence.

The more you learn, the better equipped you become to make choices that foster long-term financial health. This knowledge acts as a protective shield against predatory lending practices and arms you with the resources to confront financial challenges head-on.

Accessing Community Resources and Support

When confronting the Texas payday loan debt trap, community resources and support can prove invaluable. Numerous organizations and groups are dedicated to helping individuals regain financial stability, offering a variety of assistance options.

Engaging with Nonprofit Organizations

Many nonprofit organizations across Texas concentrate on financial education and assistance. Entities like the United Way and the Texas Financial Education Coalition provide workshops and one-on-one counseling to aid individuals in managing debt and cultivating sustainable financial habits.

These organizations often offer resources for budgeting, credit counseling, and debt management, empowering individuals to break free from the cycle of payday loans. Many of these services are provided free of charge or at a reduced cost, making them accessible to those in need.

Connecting with a nonprofit can be a transformative step toward reclaiming your financial future. They can guide you through the labyrinth of financial challenges and help you formulate a personalized plan for success.

Exploring Government Assistance Programs

Various government assistance programs are also available to support individuals facing financial hardships. Initiatives at both the state and federal levels provide aid for housing, food, and essential utilities.

For example, the Supplemental Nutrition Assistance Program (SNAP) can help mitigate food costs, while Temporary Assistance for Needy Families (TANF) offers cash assistance to families in need. These programs aim to alleviate financial strain and support individuals in maintaining their well-being.

Exploring these resources can offer vital support during difficult times, reducing the necessity for high-interest loans. Staying informed about the assistance options available in your community is essential.

Joining Local Support Groups for Financial Guidance

Participating in a local support group can offer encouragement and advice for managing finances. Connecting with individuals facing similar challenges fosters a sense of community and accountability. Support groups often share strategies for overcoming debt and provide a safe space to discuss financial struggles.

Consider searching for groups focused on financial wellness or debt management within your area. Engaging with these communities can provide not only practical advice but also emotional support during trying times.

Leveraging Online Financial Communities for Insights

In the digital age, online forums and communities can also serve as valuable resources for those dealing with financial issues. Websites like Reddit and specialized financial forums enable individuals to exchange experiences, strategies, and resources for navigating debt.

Engaging with these communities can provide diverse perspectives and innovative solutions to common financial challenges. Connecting with others facing similar situations can help foster a sense of solidarity and empowerment.

The journey toward financial stability is often more manageable with community support. Don’t hesitate to reach out and connect with others who share your goals.

Advocacy and Legislative Efforts for Reform

Addressing the Texas payday loan debt trap necessitates not only individual action but also collective efforts to reform lending practices. Advocating for stricter regulations and consumer protection laws plays a crucial role in safeguarding borrowers.

Advocating for Stricter Regulations on Lending Practices

Advocacy groups throughout Texas are actively campaigning for stricter regulations concerning payday lending practices. These initiatives often target interest rate caps and the enforcement of transparency in loan agreements.

By rallying community support and engaging policymakers, these groups aim to cultivate a safer lending environment for consumers. Participation in local advocacy efforts can amplify your voice and contribute to meaningful change.

Furthermore, public awareness campaigns can educate citizens about their rights and the risks associated with payday loans. Informed consumers are empowered consumers, and advocacy efforts can help foster a culture of financial literacy.

Supporting Consumer Protection Legislation

Consumer protection laws are essential for preventing predatory lending practices. Advocates tirelessly work to promote legislation that shields borrowers from exploitative interest rates and deceptive practices.

Laws mandating clear disclosures regarding loan terms and protecting borrowers from harassment during collections are pivotal steps toward creating a fairer lending landscape. Supporting these laws can facilitate a more equitable system and assist individuals in breaking free from the debt cycle.

Remaining informed about legislative changes and engaging with advocacy groups can enhance your capacity to influence policy decisions that impact your financial well-being.

Educating Policymakers on the Consequences of Payday Loans

Educating policymakers about the ramifications of payday loans on individuals and communities is a vital facet of advocacy. By sharing personal stories and data on the consequences of payday lending, advocates can influence public policy.

Engaging in community meetings, composing letters, and participating in public forums can help amplify this message. It’s crucial to convey the urgency of implementing reforms to protect vulnerable populations from the pitfalls of high-interest loans.

Through persistent advocacy efforts, communities can collaborate to create a safer financial environment and ensure that payday loans do not lead to lifelong debt spirals.

Frequently Asked Questions (FAQs)

What is the maximum interest rate that payday loans can charge in Texas?

In Texas, payday loans can have annual percentage rates (APRs) that exceed 400%, depending on the lender and specific loan terms.

What steps can I take to avoid needing payday loans?

To steer clear of payday loans, create a budget, build an emergency savings fund, and explore alternative lending options like credit unions or personal loans.

Are there legal protections available for borrowers in Texas?

Texas has implemented certain regulations, but many advocates argue that they are inadequate. Borrowers should be aware of their rights and seek legal assistance when necessary.

What exactly are Payday Alternative Loans (PALs)?

Payday Alternative Loans are offered by some credit unions as a more affordable option compared to payday loans, featuring lower interest rates and better repayment terms.

Do credit counseling services typically charge fees?

Many credit counseling services provide free or low-cost consultations, but it’s essential to inquire about potential fees before engaging their services.

How can I improve my credit score to access better loan options?

To enhance your credit score, ensure timely bill payments, reduce credit card balances, and dispute any inaccuracies on your credit report.

Where can I locate local financial assistance programs?

Local nonprofits, community colleges, and government agencies frequently provide information regarding financial assistance programs available in your area.

Is it possible to negotiate terms with my payday lender?

Yes, many payday lenders are open to negotiation. Communicating your financial situation may lead to more manageable repayment terms.

What should I do if I find myself in a payday loan cycle?

If you’re caught in a payday loan cycle, consider seeking professional help from credit counselors, exploring alternative lending options, and creating a budget to regain control over your finances.

How can community resources assist me in escaping payday loan debt?

Community resources such as nonprofits and support groups can offer education, financial assistance, and emotional support to help individuals escape payday loan debt.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

Your examination of payday loans in Texas really struck a chord with me. It’s a topic that often doesn’t get the attention it deserves, especially considering how many people find themselves caught in this debt cycle. I’ve had friends who turned to payday loans during tough times, thinking they had no other options. Unfortunately, many ended up feeling even more trapped as the debts ballooned.

You hit the nail on the head with your thoughts on payday loans! It’s like a scene straight out of a dark comedy, right? You know, a person feeling cornered, thinking they’ve found the magic bean that’ll fix everything, only to find out they’ve actually just picked up a rather unfriendly gremlin instead.

Your perspective on payday loans really highlights an important issue that often flies under the radar. It’s wild how people can feel like they’re in a financial maze, and payday loans tend to be that shiny, tempting exit sign that leads to a dead end. It makes perfect sense why your friends thought payday loans were their best bet—when you’re facing a financial pinch, the last thing you want is to feel trapped.

You’ve captured the situation perfectly. The allure of payday loans can be incredibly deceptive, almost like a quick fix that feels necessary in moments of urgent need. It’s interesting how people often choose these loans with the hope of a seamless exit from their financial struggles, only to find themselves tangled in a web of escalating debt.

You hit the nail on the head with that analogy about the financial maze. It’s true; payday loans can seem like that quick escape route when you’re desperate. Many folks don’t realize that those “shiny exit signs” often come with high costs and can create a cycle that’s tough to break.

It’s really enlightening to hear your perspective on payday loans. The cycle of debt that can come from these loans is a complicated issue. Many people feel they have no other options, especially when unexpected expenses arise. It’s easy to see why they turn to payday loans; the promise of quick cash during a crisis can be tempting. But, as you pointed out, the reality often leads to a much darker situation.

It’s heartening to see how many people recognize the struggle surrounding payday loans, especially in a state like Texas, where the system seems to take advantage of those who are already vulnerable. You’re right; the cycle of debt is often invisible until someone finds themselves trapped in it.

You’ve pointed out a real and pressing issue with payday loans, especially in Texas. It really is concerning how many people find themselves tangled in a financial web that’s hard to escape. The cycle of debt often goes unnoticed until it becomes overwhelming, and by that time, folks have already felt the weight of high-interest rates and fees.

I really appreciate how you’ve highlighted the double-edged sword of payday loans in Texas. It’s a harsh reality that many people face when they find themselves in need of quick cash. I’ve seen friends get caught in this cycle, initially borrowing just enough to cover an unexpected expense, only to find themselves in a deeper financial hole when the repayment comes due.

You bring up a tough reality that many people face. It’s really easy to fall into that cycle, especially when an unexpected expense pops up. I’ve heard stories similar to what you’ve shared—people thinking they can just cover one payment, only to find the pressure mounts with fees and interest. It makes you wonder how many folks are just trying to make ends meet, only to end up in a deeper hole. A lot of these loans might seem like a quick fix, but the long-term effects can be heavy.

Your exploration of payday loans in Texas truly highlights the precarious balance between immediate financial relief and long-term financial peril. The allure of quick cash, especially in a state where many individuals live paycheck to paycheck, can’t be understated. However, your mention of the staggering APRs is crucial, as they not only reflect the predatory nature of these loans but also spotlight a systemic issue in our financial landscape that seems to be disregarded by those in power.

You’ve hit the nail on the head with your observations about payday loans in Texas. It’s fascinating—and a little disheartening—how enticing quick cash can be when people are already navigating tight budgets. The reality is that many folks feel trapped in a cycle where they turn to these loans out of sheer necessity, only to find themselves in an even tougher spot down the line.

Ah, the infamous payday loan—like a spicy taco at 3 AM, thrilling in the moment, but you often regret it when morning comes. I genuinely appreciate your insights into the complexities of payday loans in Texas. They really are that double-edged sword, aren’t they? A tantalizing quick-fix that can lead to an addiction as sticky as gum on your shoe.

You nailed it with that spicy taco analogy! Payday loans really do have that tempting allure, don’t they? They swoop in like a superhero when funds are low but can leave you with a financial hangover that feels worse than anything after a late-night taco binge.

You hit the nail on the head with that spicy taco analogy. Payday loans can feel like a tempting lifeline when you’re in a pinch, but the aftermath is often messy. Many people don’t realize that these loans can trap you in a cycle that’s tough to escape. The high interest can snowball quickly, pushing you further into financial stress instead of alleviating it.

You’ve nailed it with the spicy taco analogy. It really is fascinating how something that seems like a quick fix can spiral out of control. The allure of payday loans can feel so enticing in a moment of need, but as you pointed out, what often follows is that sticky regret.

If you’re navigating the ups and downs of payday loans, this guide dives into late fee solutions in Texas that might just help you break free from that gum-on-your-shoe feeling.

‘Payday Loan Late Fee Solutions in Texas: A Must-Read Guide’

https://southlaketxhomeloans.com/payday-loan-late-fee-solutions-in-texas-a-must-read-guide/.

It’s great to hear that the spicy taco analogy resonated with you. It really is one of those situations where what might seem like a flavorful choice can leave a bit of an aftertaste, doesn’t it? The immediacy of getting cash through payday loans certainly can feel like a relief in times of stress. Entering that world has a way of pulling you into a cycle that’s hard to escape, especially when the initial relief fades and the reality of fees and mounting interest sets in.

Your discussion on the complexities of payday loans in Texas brings to light an often-overlooked facet of financial desperation. It’s striking how these loans, while seemingly a quick fix, can entrap borrowers in a deep cycle of debt. I find it particularly alarming that the APR can reach 400%, especially when many people are already in vulnerable financial situations.

You’ve highlighted a crucial point about payday loans in Texas. The perception of these loans as quick fixes can be misleading. For many, they turn into a financial spiral that’s incredibly hard to escape. With an APR that can soar to 400%, it becomes clear that the cost of borrowing isn’t just high; it’s overwhelming for someone already struggling.

You’ve highlighted an important aspect of payday loans that often gets lost in the discussion about quick financial solutions. The reality is, while these loans may appear to provide immediate relief, they can create a daunting cycle of debt that traps individuals rather than helping them. The fact that the APR can soar to 400% is not just a statistic; it represents real lives impacted by financial instability.

You’re spot on about the payday loan conundrum. It’s like a financial game show where the house always wins, and the contestants just keep getting deeper into the quicksand. When I read about APRs hitting 400%, I can almost hear the dramatic music from those reality shows kicking in. Talk about a financial cliffhanger, right?

You’ve nailed an important point here. The allure of payday loans can be incredibly deceptive. For someone facing unexpected expenses, the quick cash can feel like a lifeline, but many don’t fully grasp the ramifications until it’s too late. That 400% APR isn’t just a number; it’s a real barrier that keeps people stuck in a cycle of borrowing.

You’ve touched on a crucial point about payday loans in Texas that deserves more attention. The cycle of debt these loans create can often feel like a relentless treadmill for those caught in a financial bind. The promise of quick cash can sound like a lifeline, but the reality is much more complex.

You’re absolutely right; the complexities of payday loans in Texas reveal so much about our financial landscape, especially regarding how vulnerable people can be in dire situations. It makes me think about the broader implications of financial literacy in our society. Many individuals who turn to payday loans often lack access to better resources or understanding of financial health, which keeps them trapped in a cycle that can feel impossible to escape.

You’ve hit the nail on the head there, my friend. The payday loan scene in Texas really is a rollercoaster of twists and turns, and unfortunately, not the fun kind with cotton candy and dizzying heights. It often feels like people are stuck in a loop, kind of like that annoying song that just keeps playing, even when you’re desperate for silence. It’s interesting how the very setup that promises a quick fix tends to entangle so many folks in a web that can feel impossible to get out of.

Your exploration of the complex landscape of payday loans in Texas truly sheds light on an issue that often gets buried under layers of misconceptions. It’s intriguing to consider how these seemingly quick fixes can become financial traps. Personally, I’ve seen friends and family members get caught in this cycle, and it’s alarming how easily those initial financial struggles can escalate into long-term debt.

Your exploration of payday loans in Texas brings to light a critical issue that often gets overshadowed by the immediacy of financial need. It’s heartbreaking to see people driven to these high-interest loans during times of crisis, only to find themselves trapped in a cycle of debt. I’ve seen friends and family members fall into this trap, initially borrowing a small amount to cover an unexpected expense, only to end up struggling with repayments that ballooned into much larger debts.

You’ve hit the nail on the head regarding payday loans in Texas. It’s such a harsh reality that so many people face, and it’s often those unexpected expenses that push them into that tough financial corner. When someone is caught in a moment of crisis, a payday loan can feel like the only lifeline available. But, as you’ve seen in your circle, it can quickly turn into a bigger burden than what was initially borrowed.

It’s really important to highlight the human side of the payday loan situation, isn’t it? It’s easy to throw around numbers and statistics, but at the end of the day, those numbers represent real people facing tough choices. It’s heartbreaking to see how quickly a small financial need can spiral into something much bigger, as you’ve noted with friends and family members.

You’re so right about the human side of payday loans. It’s easy to forget that behind every statistic, there are real people dealing with real struggles. I’ve seen friends get caught up in those situations, thinking it’s just a quick fix for a temporary problem, but it can quickly turn into a cycle that’s hard to escape from.

It’s tough to watch friends and family slip into that kind of situation, isn’t it? The way payday loans can seem like a quick fix in a moment of crisis is both fascinating and frustrating. It’s often the urgency of a sudden expense that leads people to overlook the broader implications.

Your exploration of the payday loan landscape in Texas really sheds light on a predicament that so many face yet few discuss openly. I’ve seen friends get caught in this cycle, starting with a small loan that spirals out of control, impacting their financial health and stress levels. It’s a daunting situation that can lead to deeper financial troubles.

It’s encouraging to see this topic resonate with so many people who experience the real struggles of payday loans firsthand. The cycle you mention can feel almost inescapable, especially when initial intentions are good—just a tiny bridge to get through a rough patch. But as you’ve rightly observed, things can spiral quickly, and the stress that accompanies financial uncertainty is heavy.

Your exploration of payday loans in Texas genuinely highlights a significant and often overlooked issue in our financial landscape. The allure of quick cash, especially in times of need, can be understandably tempting for many individuals. I can personally relate to the financial strain many face during unexpected circumstances. Just a few years ago, I found myself in a position where I considered a payday loan to cover an emergency expense. Although I ultimately chose to seek assistance through community resources, I clearly recall the desperation and urgency that payday loans seem to exploit.

Your experience really underlines a crucial point about the desperation that often leads people to consider payday loans. Many individuals find themselves in a tight spot without the financial cushion to deal with emergencies, and the promise of quick cash can create a sense of urgency that’s hard to ignore.

Your exploration of the payday loan landscape in Texas brings up some crucial points that resonate deeply, especially for those who have found themselves relying on these types of loans during tough times. I’ve seen firsthand how easy it is to fall into that cycle of debt—when I was younger, I took out a payday loan to cover an unexpected car repair. Initially, it seemed like a lifeline, but when I lost track of the repayment terms, I ended up borrowing more just to pay off the first loan. The sinking feeling of being caught in that cycle is something many people can relate to.

Your story really highlights a key aspect of the payday loan experience that often gets overlooked—the emotional toll that can come from these financial decisions. It’s so easy to think of payday loans as just another option in a financial toolbox, but as you pointed out, they can quickly turn into a trap.

Your experience sheds light on a reality many people face, and it’s important to recognize how easily that slippery slope begins. A moment’s financial distress can lead to a decision that shapes your economy for months—or even years. You mentioned the car repair, which I think is significant. Those unexpected expenses can feel like they come out of nowhere, and it’s easy to see how a payday loan can appear as an immediate solution. But soon, that ‘lifeline’ becomes a noose, as the terms can create an illusion of control while, behind the scenes, you’re actually spiraling deeper into debt.

Your exploration of the payday loan landscape in Texas really resonates with me, especially considering how many individuals find themselves grappling with this financial beast. I have seen firsthand the impact that these loans can have not just on people’s finances but on their overall well-being.

Your exploration of payday loans in Texas really captures the precarious balance between immediate financial relief and long-term consequences. Having witnessed friends struggle with the consequences of these loans, it’s astonishing how quickly a seemingly small debt can become a mountain. The staggering APR you mentioned—the 400% or more—truly highlights the predatory nature of these products.

It’s fascinating yet disheartening to think about how a quick fix can lead to such dire financial straits. I’ve seen friends caught in that cycle where a seemingly small loan balloons into insurmountable debt. The way these loans prey on urgent needs really highlights the gaps in financial literacy and support systems in place for many people.

It really is a tough situation, isn’t it? Those quick loans can feel like a lifeline at the moment, but they can spin out of control before anyone realizes it. I’ve noticed that a lot of folks just don’t have the tools to navigate these financial waters. Some might have grown up in environments where money management wasn’t exactly a hot topic.

Ah, the payday loan paradox—like a double espresso on an empty stomach! It gives you that quick jolt when you need cash fast, but the aftermath? Let’s just say we’ve all seen better choices in a 2 AM infomercial. I remember a friend once took out a payday loan for a “slight” emergency; they ended up having to sell a few items on Facebook Marketplace just to pay it off!