Key Points to Consider

- Definition: Payday loan fee prediction tools are software applications designed to estimate fees for payday loans.

- Functionality: These tools analyze various factors to generate accurate fee predictions, aiding borrowers in making informed decisions.

- Benefits: Utilizing these tools enhances clarity regarding potential costs and allows users to compare multiple loan offers effectively.

- Limitations: Variability in lender policies and data quality can impact the accuracy of predictions from these tools.

Introduction to Payday Loan Fee Prediction Tools

What Are Payday Loan Fee Prediction Tools?

Payday loan fee prediction tools are robust software applications engineered to estimate the fees associated with payday loans. These tools empower borrowers by providing a clearer understanding of potential costs, thereby facilitating informed borrowing decisions. The following key features make these tools indispensable for consumers navigating the often confusing payday loan landscape:

- Fee estimation based on diverse loan parameters.

- User-friendly interfaces that simplify the input process.

- Real-time data integration for accurate predictions.

- Comparative analysis across various lenders.

- Historical data insights to anticipate future charges.

By utilizing these tools, borrowers can easily grasp the implications of their loan choices, leading to more financially sound decisions.

How Payday Loan Fee Prediction Tools Work

These tools function by analyzing a myriad of factors—including loan amount, duration, and specific lender policies—to generate fee predictions. The prediction process is systematic and efficient, ensuring users receive a comprehensive estimate grounded in real-world data and trends. The steps in the prediction process typically include:

- Inputting personal loan parameters such as amount and repayment duration.

- Evaluating lender-specific fee structures and policies.

- Utilizing historical data to inform current predictions.

- Generating a detailed fee estimate based on the computed data.

- Allowing users to modify inputs for scenario analysis.

This structured approach equips borrowers with the knowledge they need to make better financial choices.

Benefits of Using Payday Loan Fee Prediction Tools

Employing payday loan fee prediction tools offers a multitude of significant benefits that ultimately lead to smarter borrowing decisions. Understanding the true cost of loans helps users avoid unanticipated financial pitfalls. Some of the key benefits include:

- Enhanced clarity regarding potential expenses.

- The ability to compare multiple loan offers effectively.

- Insights into historical fee trends for better decision-making.

- Reduction in financial anxiety by knowing what to expect.

By leveraging these tools, borrowers can navigate the payday loan landscape with much more confidence.

Key Features of Payday Loan Fee Prediction Tools

Customizable Loan Scenarios

One of the standout features of payday loan fee prediction tools is the ability to customize loan scenarios. Users can easily input various loan amounts and durations to observe how fees might fluctuate. This flexible approach allows for better planning and decision-making. Typical scenarios that users can customize include:

- Different loan amounts ranging from a few hundred to several thousand dollars.

- Varying repayment durations, from a week to several months.

- Comparisons based on different lender policies.

- Scenarios reflecting changes in borrower credit status.

Such customization helps users understand how different choices can affect their overall financial obligations.

Real-Time Fee Estimates

The accuracy of payday loan fee predictions hinges significantly on real-time data. These tools are designed to provide up-to-date fee estimates based on the latest information from lenders, ensuring that users receive the most accurate insights available. Typically, these estimates are updated frequently—often on a daily basis—to reflect:

- Changes in lender fee structures.

- Market trends affecting interest rates and fees.

- Consumer demand fluctuations that can affect loan pricing.

- Regulatory changes impacting lending practices.

By relying on real-time estimates, users can be assured that the predictions they see are current and relevant.

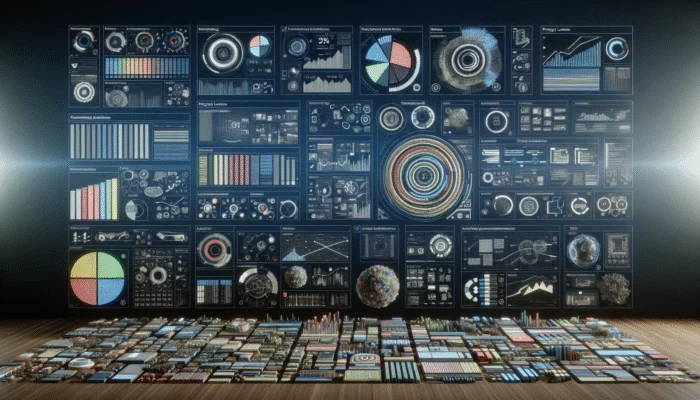

User-Friendly Interfaces

Designed with accessibility in mind, payday loan fee prediction tools often feature intuitive interfaces that cater to users of all experience levels. These user-friendly aspects contribute to the overall effectiveness of the tools. Key factors that make these interfaces easy to use include:

- Simple navigation menus that guide users through the input process.

- Clear, concise instructions that minimize confusion.

- Visual aids, such as graphs and charts, to illustrate fee breakdowns.

- Responsive design that adapts to various devices for on-the-go access.

These elements together create a seamless experience, enabling users to focus on making informed financial decisions rather than struggling with complicated software.

Comparative Analysis Features

An invaluable component of payday loan fee prediction tools is their comparative analysis features. Users can pit fee estimates from different lenders against each other side by side, making it easier to identify the most cost-effective option. Typically, these comparisons include:

- Major national lenders with varying fee structures.

- Local credit unions that might offer competitive rates.

- Online lenders with unique fee arrangements.

- Alternative lending options that may provide better terms.

By facilitating such comparisons, these tools empower borrowers to make choices that align with their financial goals.

Historical Data Insights

The provision of historical data insights is a game-changer for those looking to make informed decisions about payday loans. Understanding past fee trends allows users to anticipate future changes, which is crucial for effective planning. Usually, the historical data offered by these tools can go back several years and includes:

- Annual trends in payday loan fees across various states.

- Shifts in lending practices due to regulatory changes.

- Comparative analysis of fee changes over time for specific lenders.

- Consumer behavior patterns in relation to payday loan uptake.

Such insights enable users to make educated predictions about what they can expect moving forward.

How Accurate Are Payday Loan Fee Prediction Tools?

Factors Affecting Accuracy

The accuracy of payday loan fee prediction tools can be significantly influenced by several key factors. The quality of data, complexity of algorithms used, and how timely the information is play crucial roles in determining the reliability of predictions. Typically, these tools utilize a range of data sources to ensure accuracy, including:

- Direct feeds from lenders’ databases to capture real-time fee information.

- Consumer feedback and historical usage data to assess common trends.

- Market analysis reports that highlight changes in lending practices.

- Regulatory updates that may affect fee structures.

By focusing on these aspects, developers can create more accurate and reliable tools that truly reflect the borrowing landscape.

Comparing Tool Predictions to Actual Fees

To assess the reliability of payday loan fee prediction tools, users should compare the predicted fees with the actual fees charged by lenders. This comparison serves as a vital check on the tool’s performance. Users can verify the accuracy of predictions through:

- Reviewing loan agreements before signing to cross-check predicted fees.

- Consulting with fellow borrowers who have used the same lenders.

- Tracking fees over time to see how predictions align with reality.

- Utilizing online forums and communities for shared experiences.

Such proactive measures can help users better gauge the trustworthiness of the tools they are using.

Improving Prediction Accuracy

Developers of payday loan fee prediction tools are continuously refining their algorithms and data sources to enhance the accuracy of their predictions. Several steps are typically taken to improve accuracy, such as:

- Integrating machine learning algorithms that adapt to new data trends.

- Regularly updating databases to include the latest lender policies.

- Conducting user surveys to gather feedback on tool effectiveness.

- Collaborating with financial institutions for more reliable data access.

These ongoing efforts ensure that users can rely on these tools for the most precise fee predictions possible.

Expert Insights on Payday Loan Fee Prediction Tools

Real-World Applications of Payday Loan Fee Prediction Tools

Experts have documented numerous case studies where payday loan fee prediction tools have significantly aided borrowers in making better financial decisions. For instance, consider a borrower who was contemplating a payday loan but was uncertain about the associated fees. By utilizing a prediction tool, they discovered that a seemingly low-fee loan would result in much higher costs due to hidden charges. This insight empowered them to negotiate better terms with their lender. Other successful examples include:

- Borrowers saving hundreds of dollars by comparing fees across lenders.

- Individuals avoiding loans with hidden or unexpected fees.

- Assistive tools helping users navigate complex financial jargon.

- A case where a borrower adjusted their loan amount after seeing the fee impact.

Such real-world applications demonstrate the tangible benefits of leveraging these predictive tools.

Expert Recommendations for Choosing the Right Tool

When it comes to selecting the most suitable payday loan fee prediction tool, financial experts offer a wealth of advice. Individual needs can vary widely, so it’s crucial to consider various factors. Actionable steps for choosing a tool include:

- Identifying personal loan scenarios to understand necessary features.

- Researching user feedback and expert reviews for different tools.

- Testing free versions or demos to gauge usability before committing.

- Evaluating the tool’s update frequency to ensure data accuracy.

By following these expert recommendations, borrowers can make informed decisions and select tools that genuinely meet their needs.

Future Trends in Payday Loan Fee Prediction

As the payday loan industry continues to evolve, so too will the tools designed to predict fees. Experts predict several upcoming developments that could revolutionize this field. Future trends may include:

- Integration of artificial intelligence for even more precise predictions.

- Increased focus on mobile accessibility to meet user demands.

- Expansion of tools to include alternative financing options.

- Collaboration with credit bureaus to provide comprehensive insights.

Such advancements promise to enhance the functionality and reliability of payday loan fee prediction tools, ultimately leading to better outcomes for borrowers.

What Are the Limitations of Payday Loan Fee Prediction Tools?

Variability in Lender Policies

While payday loan fee prediction tools are incredibly helpful, they do come with limitations. One significant challenge is the variability in lender policies. Various lenders may employ unique fee structures, making it difficult for tools to provide universally accurate predictions. The following factors highlight how different lender policies can affect predictions:

- Diverse fee types, such as origination and late fees, that differ by lender.

- Changes in state regulations that affect loan terms.

- Individual lender practices that may be less known to consumers.

- Market conditions impacting lenders’ willingness to adjust fees.

These variabilities necessitate a degree of caution when using these predictive tools.

Data Limitations

Another limitation of payday loan fee prediction tools is data availability and quality. The accuracy of predictions can be compromised, particularly for less common loan scenarios. Data limitations that impact these tools include:

- Inconsistent data feeds from lenders that may miss critical updates.

- Limited historical data for new lenders entering the market.

- Challenges in gathering real-time data for smaller, local lenders.

- Inadequate user-reported data that could enhance prediction accuracy.

Such factors highlight the importance of using these tools as a guide rather than an absolute resource.

User Error and Misinterpretation

User error can be another constraint affecting the effectiveness of payday loan fee prediction tools. Incorrect input or misunderstanding of the tool’s output can lead to inaccurate fee predictions, resulting in poor decision-making. Some common issues include:

- Providing inaccurate loan amounts or durations.

- Misinterpreting fee structures resulting in unexpected costs.

- Failing to account for additional fees that may not be captured in predictions.

- Overlooking the importance of lender terms and conditions.

To mitigate these risks, users should take care to double-check their inputs and ensure they fully comprehend the outputs.

How Can Payday Loan Fee Prediction Tools Save You Money?

Comparing Different Loan Offers

Utilizing payday loan fee prediction tools can significantly save borrowers money by allowing them to compare fees across multiple loan offers. This competitive analysis is crucial for identifying the most cost-effective option. Key factors to consider when comparing loans include:

- Interest rates and their impact on overall loan costs.

- Fees associated with loan origination and processing.

- Flexibility in repayment terms and potential penalties.

- Reputation of the lender based on user reviews.

By taking these factors into account, borrowers can make educated decisions that align with their financial goals.

Avoiding Hidden Fees

One of the greatest benefits of using payday loan fee prediction tools is their ability to help users identify potential hidden fees. Recognizing these fees allows borrowers to avoid costly surprises and opt for more transparent loan options. Users can spot hidden fees by:

- Thoroughly reviewing lender terms and conditions before applying.

- Utilizing tools that break down fee structures for clarity.

- Consulting user reviews that highlight any hidden charges.

- Asking lenders directly about any fees that may not be initially disclosed.

This proactive approach enables consumers to safeguard themselves against unexpected costs.

Planning Loan Repayments

With accurate fee predictions, borrowers can plan their loan repayments more effectively, ultimately reducing the risk of late fees and penalties. Effective strategies for loan repayment planning include:

- Creating a detailed budget that includes repayment amounts.

- Setting aside funds in advance for upcoming payments.

- Using automated payment options to ensure timely repayments.

- Adjusting loan amounts based on repayment capacity.

By employing these strategies, borrowers can manage their loans with greater ease.

Negotiating Better Loan Terms

Understanding predicted fees empowers borrowers to negotiate better terms with lenders, potentially reducing costs and improving overall loan conditions. Effective negotiation tactics include:

- Presenting alternative offers from competing lenders.

- Highlighting any discrepancies in fee predictions versus actual charges.

- Expressing readiness to switch lenders if terms are not favorable.

- Asking for flexibility based on personal financial situations.

These strategies can lead to more favorable loan agreements.

Choosing the Right Payday Loan Fee Prediction Tool

Evaluating Tool Features

When searching for the right payday loan fee prediction tool, evaluating its features is crucial. A variety of features can enhance user experience and effectiveness. Important features to look for include:

- Customization options for tailoring loan scenarios.

- User support mechanisms for assistance with the tool.

- Integration of real-time data for accurate predictions.

- Comparative analysis capabilities to evaluate different lenders.

By taking these features into account, users can find tools that best align with their borrowing needs.

User Reviews and Ratings

User reviews and ratings serve as critical resources when selecting payday loan fee prediction tools. They provide invaluable insights into a tool’s reliability and user satisfaction. Key aspects of user feedback to consider include:

- Overall satisfaction ratings and common user experiences.

- Specific mentions of accuracy in fee predictions.

- Comments on user interface and ease of use.

- Insights into customer support quality for troubleshooting.

These insights can help prospective users make well-informed decisions.

Cost and Accessibility

Cost considerations play a significant role in choosing the right payday loan fee prediction tool. While some tools are free, others may require a subscription or one-time payment. Factors to weigh include:

- Budget availability for tool subscriptions or fees.

- Evaluating the value based on features offered.

- Exploring free trials to assess usability before committing.

- Considering long-term costs versus immediate financial needs.

These factors can significantly impact the accessibility and value of the tools for users.

What Are the Best Practices for Using Payday Loan Fee Prediction Tools?

Regularly Updating Loan Information

To ensure accurate predictions, it is essential for users to regularly update their loan information within the tools. Consistent updates help capture any changes in lender policies or personal financial situations. Users should update their loan data:

- Whenever they consider a new loan application.

- If there are changes in their financial circumstances.

- To reflect varying loan amounts or terms accurately.

- Periodically, to ensure data remains relevant and accurate.

Such vigilance enhances the reliability of the predictions users receive.

Combining Tools with Financial Planning

Using payday loan fee prediction tools in conjunction with a comprehensive financial plan can maximize their effectiveness. Integrating these tools into a broader financial strategy involves:

- Aligning loan choices with overall budget goals.

- Utilizing predictions for long-term financial forecasting.

- Incorporating insights into debt management strategies.

- Setting specific financial milestones based on predicted fees.

This holistic approach can lead to more sustainable financial outcomes.

Seeking Professional Advice

When in doubt or faced with complex decisions, users should consider consulting with financial advisors to interpret tool outputs accurately. Professional advice is particularly beneficial:

- When navigating complicated loan agreements.

- If users are unsure about their financial capabilities.

- To gain insights into broader financial planning.

- For personalized strategies that align with individual circumstances.

Engaging with professionals can provide the clarity and guidance needed for informed borrowing decisions.

Monitoring Market Trends

Keeping an eye on market trends can greatly influence the effectiveness of payday loan fee prediction tools. Being aware of economic developments allows users to anticipate changes in fees and adjust their predictions accordingly. Users can monitor market trends through:

- News articles and financial reports that focus on lending practices.

- Economic indicators that suggest changes in interest rates.

- Feedback from industry experts and consumer advocacy groups.

- Online forums discussing market dynamics.

Staying informed can help borrowers make better decisions in an ever-evolving financial landscape.

The Impact of Payday Loan Fee Prediction Tools on Borrowing Decisions

Influencing Loan Choices

Payday loan fee prediction tools have a profound impact on the loans borrowers choose. By providing transparent fee information, these tools empower users to make more cost-effective decisions. They influence loan selection by:

- Offering a comprehensive overview of potential expenses associated with different loans.

- Allowing users to identify the most favorable terms based on their financial situations.

- Enabling comparisons that highlight the best options available.

- Assisting borrowers in avoiding pitfalls associated with hidden fees.

This level of transparency enhances the decision-making process.

Reducing Financial Stress

By providing clarity and predictability regarding payday loans, fee prediction tools can significantly reduce the financial stress associated with borrowing. This reduction in stress occurs through:

- Elimination of uncertainty regarding what fees to expect.

- Empowerment of users to take proactive steps in their financial planning.

- Encouragement of responsible borrowing practices.

- Enhancement of overall financial literacy through informed decision-making.

These effects create a more secure borrowing environment for users.

Promoting Responsible Borrowing

Encouraging borrowers to utilize payday loan fee prediction tools can lead to more responsible borrowing practices and better financial outcomes. These tools promote responsible borrowing by:

- Facilitating informed decisions that prioritize financial health.

- Encouraging users to compare different offers before committing.

- Highlighting the importance of understanding loan terms and conditions.

- Empowering consumers to take control of their financial futures.

Ultimately, this leads to healthier financial practices and improved long-term outcomes for borrowers.

FAQs

What is a payday loan fee prediction tool?

A payday loan fee prediction tool is software designed to estimate the fees associated with payday loans, helping borrowers understand potential costs.

How do these tools work?

These tools analyze various factors such as loan amount and lender policies to predict fees, providing estimates based on current data.

What are the benefits of using payday loan fee prediction tools?

Benefits include enhanced clarity on potential expenses, the ability to compare multiple offers, and insights into historical fee trends.

How accurate are payday loan fee prediction tools?

Accuracy can vary based on data quality and lender policies, but regular updates and algorithm improvements enhance reliability.

What limitations do these tools have?

Limitations include variability in lender policies, data quality issues, and the potential for user error in inputting information.

Can these tools help save money?

Yes, they allow borrowers to compare different loan offers and avoid hidden fees, ultimately leading to cost savings.

What features should I look for in a payday loan fee prediction tool?

Look for customization options, real-time data integration, user-friendly interfaces, and comparative analysis capabilities.

How often should I update my loan information in these tools?

Regular updates should be made whenever considering a new loan or if there are changes in financial circumstances.

Should I seek professional advice when using these tools?

Yes, consulting professionals can provide clarity and guidance on interpreting tool outputs and making informed decisions.

How do market trends affect payday loan fee predictions?

Monitoring market trends helps anticipate changes in fees, allowing users to adjust their predictions and choices accordingly.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

Your exploration of payday loan fee prediction tools raises important considerations about both the utility and the limitations of technology in financial decisions. It’s true that these tools can offer a much-needed transparency to borrowers who may otherwise feel overwhelmed by the fine print and varying terms of payday loans. However, I wonder if we might also discuss the broader implications of relying on software for such crucial monetary commitments.

It’s fascinating to see how payday loan fee prediction tools are evolving to support consumers in such a complex financial landscape. The ability to predict fees accurately can genuinely empower borrowers and promote transparency in an often murky market. I appreciate how these tools can facilitate informed decision-making, especially for individuals who might otherwise feel overwhelmed by the options available to them.

Your exploration of payday loan fee prediction tools shines a light on an important aspect of financial literacy that often gets overlooked. As someone who has navigated the landscape of payday loans in the past, I know firsthand how overwhelming it can be to decipher the true costs involved. These tools not only provide much-needed clarity but also empower borrowers to make informed choices in a landscape where fees can spiral out of control.

I found this discussion on payday loan fee prediction tools really interesting and quite relevant, especially considering how many people find themselves in tight financial spots these days. It’s a bit mind-boggling how quickly some can fall into the payday loan cycle; the allure of quick cash can be incredibly tempting. I remember my friend used one of these tools last year when she was in a bind, and it really helped her clarify the potential costs involved. It’s one thing to read those fine print disclosures, but having a tool analyze the numbers made it feel a lot less overwhelming.