Key Highlights

- Definition: Payday loans are short-term loans due on the borrower’s next payday, offering quick cash for urgent financial needs.

- Debt Cycle: Many borrowers fall into a cycle of debt due to high interest rates and fees, often needing to take out additional loans to repay the original amount.

- Success: Individuals like Maria and James have successfully managed their payday loan challenges through financial counseling and education.

- Regulations: Texas regulations aim to protect borrowers, yet high interest rates remain a critical issue impacting many residents.

Introduction to Payday Loan Turnarounds in Texas

What Are Payday Loans?

Payday loans are short-term, high-interest loans that are typically due on the borrower’s next payday. These loans are often utilized by individuals facing immediate financial needs, providing quick access to cash but at a cost. Common uses for payday loans include:

- Covering unexpected medical expenses

- Paying utility bills to avoid disconnection

- Addressing car repairs necessary for commuting

- Financing essential household purchases

- Bridging the gap between paychecks for essential living expenses

- Managing overdue rent payments

While these loans provide immediate relief, they can lead to significant financial challenges due to their high-interest rates and fees.

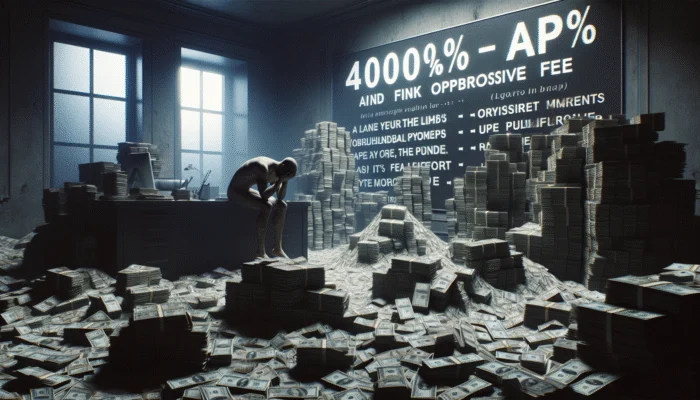

The Cycle of Debt

Many borrowers find themselves trapped in a cycle of debt due to the high interest rates and fees associated with payday loans. The cycle often begins with an urgent need for cash, compelling individuals to take out these loans. Once the repayment date arrives, many borrowers struggle to repay the loan fully, leading them to roll over the loan or take out another payday loan to cover the initial payment. This cycle can create a snowball effect, where individuals accrue more debt, additional fees, and increased stress. The financial strain impacts not just their wallets but also their mental health, relationships, and overall quality of life, making it a significant issue for many Texas residents.

Success Stories from Texas

Despite the challenges, there are numerous success stories from Texas individuals who have managed to break free from the payday loan cycle. Take the story of Maria, a single mother from Austin, who found herself overwhelmed by multiple payday loans. After seeking help from a local financial counseling program, she learned to negotiate her repayment terms and prioritize her bills. With a clear budget and dedication, Maria paid off her debts within six months, leading to a renewed sense of financial stability and confidence. Similarly, James from Houston shared how he transformed his financial habits by enrolling in a credit education course. This knowledge empowered him to avoid future payday loans and save for emergencies instead. These personal anecdotes highlight not just the struggles but also the resilience and resourcefulness of Texans in overcoming payday loan challenges.

How Do Payday Loans Work in Texas?

Loan Application Process

The process of applying for a payday loan in Texas involves several straightforward steps. Applicants must fill out an application form, typically available online or in-store, where they provide personal details and financial information. Additionally, borrowers need to present proof of income, such as pay stubs or bank statements, to demonstrate their ability to repay the loan. The steps in the application process include:

- Researching lenders and their terms

- Filling out the application form

- Providing necessary documentation (proof of income, identification)

- Reviewing loan terms and conditions

- Accepting the loan offer and signing the agreement

- Receiving funds, usually within 24 hours

Understanding these steps helps potential borrowers prepare adequately, ensuring they know what to expect as they navigate the loan application process.

What Are the Interest Rates and Fees?

Payday loans in Texas come with notoriously high interest rates and various fees that can dramatically inflate the cost of borrowing. On average, borrowers may encounter interest rates ranging from 400% to 600% APR, depending on the lender and the loan amount. This exorbitant cost can lead to significant financial strain. In addition to high interest rates, borrowers may face fees such as:

- Application or processing fees

- Loan rollover fees if the loan is extended

- Non-sufficient funds (NSF) fees for bounced payments

- Late payment fees

Understanding these costs is crucial for borrowers to make informed decisions and recognize the potential long-term implications of taking out a payday loan.

Repayment Terms and Options

Understanding the repayment terms is crucial for borrowers engaging with payday loans. Typically, payday loans in Texas require repayment within two to four weeks. However, many lenders offer options for extending or restructuring the loans, often for an additional fee. Borrowers need to be aware of these repayment terms to avoid falling deeper into debt. Options may include:

- Loan extensions, which may incur new fees

- Setting up a payment plan with the lender

- Seeking assistance from credit counseling services

- Refinancing the loan through another lender

Being proactive and informed about repayment options can provide borrowers with alternative pathways to manage their loans effectively.

Expert Insights on Payday Loan Turnaround Stories in Texas

What Strategies Have Proven Effective?

Experts have identified several strategies that have helped individuals in Texas successfully manage and pay off their payday loans. One effective approach is creating a detailed budget that accounts for all monthly expenses and income. This practice allows borrowers to see where they can cut costs and allocate funds toward debt repayment. Real-world examples show how individuals have utilized budgeting apps and financial planning tools to manage their finances better. Another helpful strategy is to prioritize high-interest debts, paying them off first to reduce the overall financial burden. For instance, a borrower may choose to channel any extra income, such as tax refunds or bonuses, directly into paying off payday loans. This focused method can foster a sense of control and accomplishment.

How Can Borrowers Access Support?

Various support systems are available in Texas for those struggling with payday loan debt. Local organizations and non-profits offer resources tailored to assisting individuals in financial distress. Some notable resources include:

- credit counseling services, providing personalized financial advice

- Debt management programs that negotiate with lenders on behalf of the borrower

- Local community organizations offering workshops and educational resources

- Financial literacy programs aimed at enhancing money management skills

Accessing these resources can equip borrowers with the knowledge and tools needed to regain control of their financial situations and avoid payday loans in the future.

What Role Do Financial Education Programs Play?

Financial education programs can be instrumental in helping borrowers understand and manage their finances better. In Texas, these programs often focus on budgeting, saving, and responsible borrowing practices. Many participants report a significant shift in their financial perspectives, gaining the confidence to make informed decisions. For instance, a participant in a financial literacy workshop may learn about the true costs of payday loans and the importance of building an emergency fund. Such knowledge empowers individuals to avoid falling into payday loan traps. By enhancing financial literacy, these programs not only aid in immediate situations but also promote long-term financial stability and independence.

What Are the Common Challenges Faced by Borrowers?

Texas borrowers encounter several typical obstacles when trying to turn around their payday loan situations. One common challenge is the overwhelming burden of high-interest rates, which can make it difficult to pay off loans without resorting to additional borrowing. Additionally, many borrowers might lack access to alternative financial resources, leaving them with few options. The stigma surrounding payday loans can also compound the issue, discouraging individuals from seeking help due to fear of judgment. Experts recommend building a support network, whether through friends, family, or financial counselors, to overcome these hurdles. Sharing experiences and strategies can provide the emotional and practical support needed to navigate the complexities of payday loan debt.

How Do Regulatory Changes Impact Payday Loan Turnarounds?

Recent legislative changes in Texas have started to affect the ability of individuals to manage and pay off their payday loans. While some regulations aim to protect consumers by limiting interest rates or requiring clearer disclosure of loan terms, others may inadvertently create barriers. For instance, new regulations could restrict access to payday loans for certain individuals, potentially pushing them towards less favorable options. Expert analysis suggests that while regulation is essential for consumer protection, it’s crucial to balance these measures with access to necessary financial resources. Ongoing discussions about regulatory frameworks will likely shape the future landscape of payday lending in Texas, emphasizing the need for informed policy-making that prioritizes borrower welfare.

The Impact of Payday Loan Regulations in Texas

What Are the Current Regulations?

Texas has specific regulations governing payday loans aimed at protecting consumers while allowing lenders to operate. Key regulations include mandatory disclosures regarding loan terms, the total cost of borrowing, and the repayment schedule. Additionally, lenders are prohibited from using certain aggressive collection practices, ensuring that borrowers have some protections against harassment. However, the high-interest rates remain a contentious issue, as Texas does not impose a cap on interest rates for payday loans. Understanding these regulations is vital for borrowers to navigate the lending landscape effectively and advocate for their rights.

How Have Regulations Evolved?

The history and evolution of payday loan regulations in Texas reflect ongoing battles between consumer advocacy groups and lenders. Over the years, various legislative efforts have aimed at increasing transparency and reducing predatory lending practices. For instance, in recent years, Texas lawmakers have introduced bills to require lenders to offer more favorable repayment terms and to provide clearer information on the total cost of loans. However, pushback from the payday lending industry has significantly influenced the pace and extent of regulatory changes. Analyzing these developments offers insights into how ongoing advocacy and public sentiment can shape the future of payday loan regulations in Texas.

What Is the Future of Payday Loan Regulation?

Potential future changes to payday loan regulations in Texas could lead to significant shifts in the industry and borrower experiences. Discussions around capping interest rates and expanding consumer protections are gaining traction among advocacy groups. Experts predict that if such regulations are implemented, they could provide much-needed relief for borrowers and create a more equitable lending environment. However, the industry’s response to these changes remains a key factor. As regulations evolve, it is essential for Texans to stay informed and engaged in advocacy efforts to ensure their financial rights are protected.

What Are the Alternatives to Payday Loans in Texas?

Personal Loans from Banks or Credit Unions

Personal loans from banks or credit unions often offer lower interest rates and more favorable terms than payday loans. These institutions typically provide loans with fixed interest rates and structured repayment plans, making them a more sustainable option for borrowers. When compared to payday loans, personal loans can be much more manageable. For individuals considering alternatives, it’s essential to evaluate:

- Loan amounts and terms offered by banks or credit unions

- Credit score requirements and how they affect eligibility

- The overall cost of borrowing, including interest rates and fees

- The processing time and funds availability

By exploring these alternatives, borrowers can find more affordable options that better suit their financial needs.

Credit Counseling and Debt Management Plans

Credit counseling services can be invaluable for individuals managing debt and seeking to avoid payday loans in the future. These services typically involve working with a certified credit counselor to develop a personalized debt management plan. A typical program may include steps such as:

- Assessing the individual’s financial situation

- Creating a budget that accounts for income and expenses

- Negotiating lower interest rates with creditors

- Establishing a repayment plan that prioritizes debts

These structured programs not only help individuals pay off their debts but also equip them with essential financial skills to prevent future financial crises.

Emergency Savings and Budgeting

Building an emergency fund and adhering to a budget can significantly reduce the need for payday loans. Establishing a savings cushion allows individuals to cover unexpected expenses without resorting to high-interest borrowing. To start and maintain healthy financial practices, consider these tips:

- Set a savings goal, even a modest one, to create a sense of achievement

- Automate savings by setting up direct deposits into a designated savings account

- Track expenses meticulously to identify areas for potential savings

- Prioritize needs over wants in budgeting to create financial flexibility

By cultivating these habits, individuals can develop a more secure financial future and reduce their reliance on payday loans.

Trusted Strategies for Payday Loan Turnaround Stories in Texas

How Can Borrowers Negotiate with Lenders?

Negotiating with lenders can sometimes lead to more manageable repayment terms. Open communication is key; borrowers should initiate discussions with lenders as soon as they foresee difficulties in meeting repayment deadlines. Effective negotiation strategies include:

- Being honest about the financial situation and specific challenges

- Requesting a lower interest rate or a longer repayment period

- Inquiring about any available hardship programs

- Documenting all agreements in writing to ensure clarity and accountability

These actionable steps empower borrowers to advocate for themselves and potentially secure terms that better align with their financial capabilities.

What Are the Best Practices for Debt Repayment?

The most effective strategies for paying off payday loan debt involve prioritizing high-interest loans and seeking additional income sources. One approach is the “debt snowball” method, where borrowers pay off smaller debts first to gain momentum. This method fosters motivation as individuals see their debts decreasing. Additionally, exploring side gigs or freelance opportunities can boost income, allowing for more rapid debt repayment. Maintaining open communication with lenders about repayment struggles can also lead to more favorable outcomes. By employing these strategies, borrowers can effectively tackle their payday loan debt and regain financial control.

How Can Borrowers Build a Stronger Financial Future?

After overcoming payday loan debt, it’s crucial to focus on building a stronger financial foundation. Establishing and maintaining healthy financial habits is essential for long-term stability. Here are some key practices:

- Continuing to budget effectively and adjust as necessary

- Consistently contributing to an emergency savings fund

- Improving credit scores by making timely payments on bills and loans

- Educating oneself on personal finance through books, courses, or workshops

Implementing these strategies fosters resilience against future financial challenges and empowers individuals to pursue their financial goals confidently.

Case Studies of Payday Loan Turnarounds in Texas

Profiles of Successful Turnarounds

Detailed profiles of individuals who successfully turned around their payday loan situations in Texas highlight the diverse paths to financial recovery. For example, Linda, a young professional in Dallas, found herself in debt after a series of unexpected expenses. By reaching out to a local credit counseling service, she learned to create a strict budget and identify unnecessary spending. Within a year, she became debt-free and now shares her journey as a motivational speaker. Another case is that of David, a veteran who utilized financial education programs offered in his community. Through diligent budgeting and strategic debt repayment, he eliminated his payday loan debt in nine months. These personal stories serve as powerful reminders that with the right strategies and support, financial recovery is possible.

What Lessons Can Be Learned?

Analyzing the common themes and lessons from successful payday loan turnarounds in Texas reveals several critical insights. First, the importance of seeking help early cannot be overstated; individuals who reached out for support sooner often fared better than those who waited. Additionally, embracing a growth mindset and being open to learning about personal finance played a pivotal role in many success stories. Commitment to change and persistence in implementing new financial strategies emerged as consistent factors among those who achieved stability. These lessons can inform others facing similar challenges, instilling hope and motivating proactive measures.

How Have These Stories Impacted Policy?

Individual success stories have influenced policy discussions and potential changes in payday loan regulations in Texas. As advocates highlight personal experiences of overcoming payday loan debt, legislators may be encouraged to consider reforms that prioritize consumer protection. Success stories showcase the resilience of individuals and can serve as compelling evidence for the need for more sustainable lending practices. This interplay between personal narratives and legislative advocacy emphasizes the potential for meaningful change driven by community efforts and informed voices calling for reform.

Strategies for Implementing Successful Turnarounds

Practical advice and strategies derived from successful cases can help others in Texas effectively manage and overcome payday loan challenges. First, recognizing the need for change and taking proactive steps toward financial education is paramount. This can involve enrolling in workshops or seeking one-on-one counseling. Additionally, cultivating a support system, whether through family, friends, or community resources, can provide the encouragement and accountability needed to stay on track. Leveraging budgeting tools and apps can also aid in maintaining financial discipline. Ultimately, learning from those who have successfully navigated similar challenges can empower individuals to adopt effective strategies and achieve their goals.

Conclusion: The Path Forward for Payday Loan Turnarounds in Texas

The Importance of Awareness and Education

Raising awareness and providing education are key to helping more people avoid or overcome payday loan debt. In Texas, ongoing efforts focus on promoting financial literacy through community workshops and school programs. Initiatives aimed at informing potential borrowers about the true costs of payday loans and available alternatives can significantly impact overall financial health. Moreover, engaging community leaders and advocates in these efforts enhances the reach and effectiveness of educational programs, fostering a culture of informed financial decision-making.

The Role of Community and Support Systems

Community support and resources play a vital role in helping individuals navigate payday loan debt. Successful community initiatives, such as local financial empowerment workshops and peer support groups, demonstrate the power of collective action in addressing financial challenges. Collaborations between non-profits, financial institutions, and community organizations can create a robust support network that empowers individuals. These initiatives not only provide practical assistance but also foster a sense of belonging and encouragement, essential for those facing financial hardships.

What Can Borrowers Do to Stay Out of Debt?

Providing practical advice for borrowers in Texas to avoid falling back into the payday loan cycle is crucial. Effective preventive measures include:

- Establishing a comprehensive budget to track income and expenses

- Building an emergency savings fund to cover unexpected expenses

- Seeking financial education resources to enhance money management skills

- Exploring alternative lending options with more favorable terms

By adopting these practices, borrowers can protect themselves from the pitfalls of payday loans and cultivate a healthier financial future.

FAQs

What is a payday loan?

A payday loan is a short-term, high-interest loan typically due on the borrower’s next payday, often used to cover urgent financial needs.

What is the average interest rate for payday loans in Texas?

In Texas, payday loans can have average interest rates ranging from 400% to 600% APR, depending on the lender and loan amount.

How can I break the cycle of payday loans?

To break the cycle, consider creating a budget, seeking financial counseling, and exploring alternative lending options with lower interest rates.

Are there any regulations on payday loans in Texas?

Yes, Texas has regulations requiring clear disclosures of loan terms and prohibits certain aggressive collection practices, but does not cap interest rates.

What support resources are available for payday loan borrowers in Texas?

Resources include Credit counseling services, debt management programs, financial literacy workshops, and local community organizations.

How can I negotiate with my payday lender?

Be honest about your financial situation, request lower interest rates or adjusted repayment terms, and document any agreements in writing.

What are some alternatives to payday loans?

Alternatives include personal loans from banks or credit unions, credit counseling services, and establishing emergency savings.

How can financial literacy programs help?

Financial literacy programs educate individuals on budgeting, saving, and responsible borrowing, empowering them to make informed financial decisions.

What should I do if I can’t repay my payday loan?

Contact your lender to discuss your situation, explore options for restructuring the loan, or seek assistance from a credit counseling service.

How can I build an emergency savings fund?

Start by setting a savings goal, automate deposits into a savings account, and prioritize saving as part of your monthly budget.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

The exploration of payday loans in Texas certainly sheds light on a critical issue that many individuals face in times of financial distress. The mention of the debt cycle is particularly poignant, as it highlights a systemic problem that extends beyond personal financial management. Many people may initially see payday loans as a quick fix, but the subsequent burden of exorbitant interest rates can create a trap that is difficult to escape.

Ah, payday loans—the financial equivalent of a thrill ride that promises a quick rush but often leaves you feeling nauseous by the end. It’s like being on a Ferris wheel: the initial climb to “Woohoo! I can pay my bills!” feels exhilarating, but that drop back into the reality of towering interest rates is enough to make anyone reconsider their life choices!

Your succinct definition of payday loans perfectly captures their immediacy and urgency in times of financial distress. However, the challenges surrounding these loans, particularly the debt cycle, cannot be overstated. Many individuals find themselves in a precarious position, where the need for quick cash blinds them to the long-term implications of high-interest debts.

The discussion surrounding payday loans, particularly in Texas, highlights a significant financial dilemma faced by many individuals. The urgent need for quick cash often leads people to opt for these short-term loans, which can inadvertently trap them in a cycle of debt due to the burdensome interest rates and fees. Your focus on the debt cycle is particularly pertinent, as it mirrors broader issues in financial literacy and access to more sustainable financial products.

I appreciate your insights on payday loans and the intricacies involved. It’s striking how many individuals find themselves ensnared in a cycle of debt due to the allure of quick cash. I have a friend who once relied on payday loans to cover unexpected car repairs, only to find herself in a deeper financial hole because of the high interest. It really underscores the importance of exploring alternative options, like building an emergency fund or looking into community programs that offer interest-free loans for those in need.