Key Economic Influences on the Demand for Payday Loans

The Impact of Unemployment Rates on Loan Demand

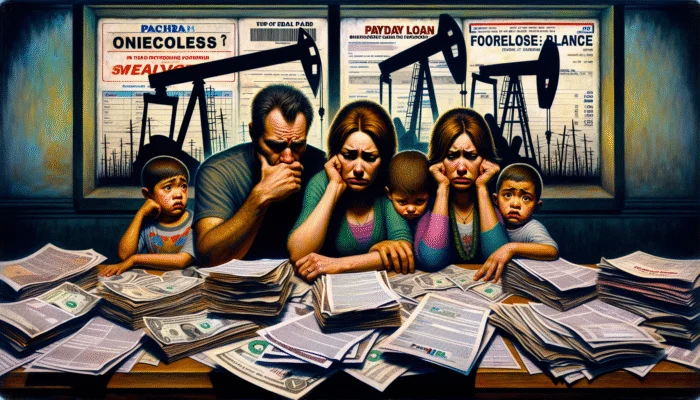

Historically, the demand for payday loans in Texas has shown a strong connection with unemployment rates. A surge in job losses creates immediate financial pressure on households, often leading to an increased need for payday loans as a quick financial fix. In Texas, downturns in vital sectors such as oil and agriculture frequently result in higher unemployment levels, pushing individuals to seek out payday loans to manage essential expenses. For example, during the 2020 pandemic, the unemployment rate soared, prompting numerous Texans to turn to payday loans to cover urgent bills and living costs.

The psychological effects of unemployment are also significant. When individuals lose their steady income, the desperate need for cash tends to overshadow the potential pitfalls of high-interest loans. In these trying times, payday loans often become a crucial lifeline, though this support is typically short-lived. As unemployment rates rise and fall, the demand for payday loans tends to mirror these fluctuations, with noticeable spikes occurring during economic downturns.

Additionally, regions with elevated unemployment rates often experience more pronounced effects. For instance, urban areas like Houston and Dallas, which have diverse employment landscapes, may see a notable increase in payday loan applications during challenging economic times. Understanding the relationship between unemployment and payday loan demand is essential for both lenders and borrowers, as it highlights the financial vulnerabilities of certain demographics during economic fluctuations.

How Holiday Spending Influences Payday Loan Demand

In Texas, the festive season is synonymous with heightened spending, which often leads to an increase in payday loan demand. Americans typically indulge in holiday shopping, travel, and entertainment, all of which can strain finances. For many Texans, the desire to create memorable holiday experiences for family and friends can drive the need for short-term financial relief through payday loans.

As the holidays approach, consumers often feel the pressure of balancing their budgets. The attraction of sales and promotions can obscure their financial realities, causing them to borrow money to maintain their holiday spirit. By the time December rolls around, applications for payday loans frequently surge as individuals seek to cover expenses ranging from gifts to holiday gatherings.

Moreover, the aftermath of the holiday season can leave many individuals facing a financial hangover. In January and February, demand for payday loans often spikes as consumers deal with the repercussions of overspending. This borrowing cycle during the holidays emphasizes the precarious financial positions many individuals find themselves in, making them more vulnerable to high-interest loans.

Understanding Agricultural Cycles and Their Effects on Payday Loan Usage

Texas, known for its extensive agricultural landscape, experiences unique economic cycles that significantly affect payday loan demand. The agricultural calendar, which includes planting, harvesting, and market cycles, directly influences the financial stability of rural communities. During planting and harvest seasons, farmers often encounter cash flow difficulties, resulting in increased dependence on payday loans to cover operational costs and personal expenditures.

For instance, in regions such as the Texas Panhandle, where cotton and cattle farming are prevalent, the cyclical nature of agricultural work can lead to varying income levels. Farmers may need to secure loans to purchase seeds or equipment before they can reap the benefits of their harvest. Thus, the demand for payday loans typically peaks around these critical agricultural periods.

Additionally, the economic well-being of farming communities can impact the broader local economy. When farmers face financial challenges, local businesses may also suffer, leading to an increase in payday loan applications as residents seek quick cash to fill the gaps. Understanding these agricultural cycles is crucial for lenders aiming to effectively support these communities.

The Role of Regulations in Shaping Payday Loan Trends

How State Regulations Affect Payday Loan Accessibility

The regulatory framework governing payday loans in Texas is vital in shaping payday loan trends across the state. Texas has specific regulations that define the terms of payday loans, including maximum loan amounts and interest rates that can fluctuate based on economic conditions and legislative changes throughout the year.

While Texas law permits payday loans, it also enforces limitations designed to protect consumers from predatory lending practices. However, these regulations can differ significantly by region, leading to inconsistencies in loan availability. During high-demand periods, such as holiday seasons or natural disasters, these discrepancies can create a rush for available funds, pushing borrowers toward less regulated alternatives or increasing demand for legally sanctioned loans.

Moreover, the enforcement of these regulations can often be inconsistent, resulting in confusion among borrowers regarding their rights and available options. A comprehensive understanding of state regulations is essential for consumers, enabling them to navigate the payday loan landscape more effectively and make well-informed decisions.

What is the Impact of Federal Oversight on Payday Loans?

Federal policies significantly influence payday loan trends by establishing overarching standards for the financial industry. Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) have introduced measures designed to mitigate risks associated with payday loans, including mandatory assessments of borrowers’ repayment capabilities. These policies not only impact lenders but also shape consumer behavior as financial literacy and awareness increase.

The introduction of federal regulations may lead to a decline in payday loan usage in certain regions, especially as consumers become more informed about alternative options. However, in times of economic hardship, federal protections can inadvertently increase demand for payday loans, as individuals encounter tighter credit restrictions. For example, during economic downturns, credit availability often diminishes, prompting more people to seek short-term loans to address urgent financial needs.

Furthermore, federal oversight can influence seasonal trends by driving changes in lender practices, potentially resulting in more competitive rates during peak demand periods. A nuanced understanding of federal policies can aid consumers in navigating the complexities surrounding payday loans, ensuring that they make informed financial choices.

Why Are Consumer Protection Laws Important in the Payday Loan Landscape?

Consumer protection laws are essential safeguards within the payday loan landscape in Texas. These laws aim to protect borrowers from exploitative lending practices, ensuring fair treatment and access to transparent loan information. For example, regulations requiring clear disclosures about interest rates and fees can empower consumers to make better financial choices.

During peak borrowing seasons, these protections become particularly crucial as lenders may attempt to capitalize on heightened demand. The presence of strong consumer protection laws can alter the dynamics of payday loan usage, potentially reducing reliance on high-cost loans as consumers gain awareness of their rights and available alternatives.

Additionally, local advocacy groups play a pivotal role in educating communities about these laws, fostering a culture of financial literacy. This education can lead to decreased demand for payday loans, especially during periods of financial strain, as individuals become more informed about budgeting and saving strategies.

How Local Ordinances Shape Payday Loan Availability

Local ordinances have a significant impact on payday loan trends in Texas by imposing additional restrictions on lenders, thereby influencing loan availability and terms. These municipal regulations can vary widely across Texas, with some cities enacting stringent measures aimed at curbing predatory lending practices. For instance, cities like San Antonio have established rules limiting the number of payday loan storefronts, which directly affects residents’ access to these services.

Such local regulations can create disparities, where residents in certain areas have greater access to fair lending practices than others. Consequently, during peak financial periods, such as holiday seasons or times of increased unemployment, the availability of payday loans can vary greatly based on local laws. This inconsistency can complicate the decision-making process for consumers in need of funds.

Moreover, local advocacy efforts often complement consumer protection laws, working towards establishing a more equitable lending environment. As communities become more proactive in advocating for their rights, the demand for payday loans may shift, reflecting a growing emphasis on financial education and responsible borrowing.

How Do International Regulations Influence Local Payday Loan Practices?

While payday loan trends in Texas are largely shaped by local and federal regulations, international financial regulations can also have indirect effects. The globalization of finance means that practices from other nations can inform or influence American lending standards. For example, international consumer protection trends may lead to enhanced regulations in the U.S., as policymakers seek to align domestic lending practices with global benchmarks.

These shifts can impact the marketing and utilization of payday loans during high-demand periods. As lenders adapt to evolving regulations, they may modify their offerings to remain compliant and competitive. Additionally, international market conditions—such as economic crises or fluctuations in foreign exchange rates—can indirectly influence the availability and cost of credit.

Understanding the interplay between international and local regulations is vital for consumers navigating the payday loan landscape. As the financial world becomes more interconnected, awareness of these influences can empower borrowers to make well-informed decisions during critical financial periods.

How Demographic Shifts Affect Payday Loan Usage

The Effects of Population Growth on Payday Loan Demand

Texas is witnessing rapid population growth, which significantly impacts payday loan trends in Texas. The influx of new residents, particularly to urban centers like Austin, Dallas, and Houston, alters the financial landscape. As more individuals relocate to these areas in search of jobs and opportunities, the demand for short-term financial solutions, including payday loans, tends to rise.

New residents often face immediate financial pressures as they adjust to new living costs, commuting expenses, and housing challenges. This influx can result in greater reliance on payday loans, especially among those without established credit histories. Additionally, the rapid demographic changes can lead to a diverse population with varying levels of financial literacy, making some groups more susceptible to high-interest lending.

Moreover, the concentration of individuals in urban areas can create distinct borrowing trends. For instance, during peak moving seasons—typically summer and early fall—there may be a noticeable uptick in payday loan applications as newcomers seek to settle in. Gaining insights into these demographic shifts is essential for lenders aiming to cater to evolving market needs while assisting residents in managing their financial challenges responsibly.

Understanding Age Demographics in Payday Loan Borrowing

Different age groups exhibit varying behaviors regarding payday loan trends in Texas, with younger adults being particularly inclined to seek these loans. Millennials and Generation Z, often lacking substantial financial experience, may find themselves turning to payday loans during periods of financial stress, especially during holidays or economic uncertainty.

For younger borrowers, the lure of quick cash can outweigh the risks associated with high-interest loans. Their limited credit histories often restrict their borrowing options, making payday loans an appealing, albeit risky, solution. As they navigate life events such as college expenses or first-time home purchases, they may resort to payday loans to cover short-term deficits, particularly during critical financial times.

Conversely, older demographics may exhibit different borrowing patterns, often relying on payday loans due to unexpected medical expenses or insufficient retirement income. Recognizing these age-specific behaviors is essential for lenders aiming to tailor their products and marketing strategies to effectively address the needs of diverse consumer segments.

The Influence of Income Levels on Payday Loan Demand

Fluctuations in income levels across various demographic groups significantly impact payday loan trends in Texas. Lower-income individuals, who often live paycheck to paycheck, may find themselves more vulnerable to financial emergencies, prompting them to seek payday loans when unexpected expenses arise. This demographic is particularly susceptible during economic stress, such as layoffs or rising living costs.

For instance, in regions where living costs have escalated without a corresponding increase in wages, the demand for payday loans can soar. These loans may serve as a temporary lifeline, enabling individuals to cover essential expenses like rent or utility bills until their next paycheck arrives. However, this borrowing cycle can lead to long-term financial challenges, further entrenching borrowers in debt.

Moreover, seasonal fluctuations in employment—such as holiday hiring spikes in retail—can lead to temporary variations in income levels. Workers may find themselves relying on payday loans to bridge gaps between pay periods, particularly during busy holiday seasons where expenses often exceed income. Grasping the dynamics of income levels and their relationship with payday loans is crucial for both consumers and lenders navigating this complex landscape.

Seasonal Employment Patterns and Their Effects on Payday Loan Demand

The Role of the Tourism Industry in Payday Loan Trends

Texas boasts a vibrant tourism industry, which significantly shapes payday loan trends in Texas. Seasonal employment in this sector can generate unique financial patterns, particularly during peak travel seasons. Workers in hospitality, entertainment, and recreation often rely on temporary positions to meet seasonal demand, resulting in fluctuating incomes.

During high tourism seasons, such as summer and major holidays, employment opportunities increase. However, as these peak seasons conclude, many workers face layoffs or reduced hours, leading to greater reliance on payday loans for financial stability. This cyclical nature of tourism creates distinct borrowing trends, where workers may need to borrow funds to prepare for anticipated income gaps during off-peak periods.

Moreover, the economic health of regions heavily reliant on tourism, such as Austin or San Antonio, can be profoundly affected by external factors, including natural disasters or public health crises. These disruptions can lead to spikes in payday loan demand as workers seek to manage unexpected expenses or bridge income gaps. Understanding the seasonal employment patterns within the tourism industry is crucial for recognizing the financial challenges faced by these workers.

How the Retail Sector Influences Payday Loan Demand

The retail sector in Texas experiences marked seasonal employment fluctuations, especially during the holiday season. As retailers ramp up hiring to accommodate increased demand, many temporary workers find themselves in need of quick cash solutions, leading to heightened payday loan trends in Texas.

During the holidays, retail employees may encounter longer hours, heightened responsibilities, and the pressure to maintain a festive atmosphere for customers. This situation can lead to financial strain, particularly when seasonal workers do not have guaranteed employment beyond the holiday rush. Consequently, many turn to payday loans to manage their finances during this busy yet unpredictable period.

Furthermore, the post-holiday period can intensify the financial challenges faced by retail workers. Following the holiday spending surge, consumers often experience a financial hangover, resulting in a rise in payday loan applications as individuals seek to cover bills and expenses incurred during the festive season. Understanding these dynamics is vital for lenders aiming to support temporary workers in navigating their financial challenges.

Seasonal Employment Dynamics in the Construction Industry

The construction industry also exemplifies seasonal employment patterns that impact payday loan trends in Texas. Construction work often sees fluctuations in project availability, leading to periods of rapid hiring followed by layoffs. Consequently, construction workers may frequently seek short-term loans to manage cash flow during slower periods.

During peak construction seasons—typically in spring and summer—the demand for labor surges, resulting in increased employment opportunities. However, once the seasons change, many workers face uncertainty and may experience job loss, prompting an increase in payday loan applications. This cycle can lead to financial instability for workers who rely solely on construction jobs for their livelihoods.

Additionally, the construction industry is vulnerable to external factors such as weather and economic conditions, which can create unexpected disruptions. When projects are delayed due to adverse weather or economic downturns, many construction workers may feel the financial repercussions acutely, leading them to seek payday loans to cover living expenses. Understanding these seasonal employment patterns is essential for both workers and lenders navigating the complexities of payday loan dependency.

The Effects of Natural Disasters on Payday Loan Demand

Understanding the Impact of Hurricane Season

Texas is prone to hurricanes, and the impact of these natural disasters on payday loan trends in Texas is significant. Each hurricane season carries the potential for widespread destruction, resulting in increased financial strain for affected communities. The immediate aftermath typically sees a rise in payday loan applications as residents scramble to cover unexpected costs associated with recovery and rebuilding efforts.

As evacuation orders and damage assessments unfold, many individuals find themselves without income or access to funds. During these critical moments, payday loans can offer a temporary solution for urgent financial needs, such as emergency repairs or basic living expenses. However, this dependency can lead to long-term financial challenges, as high-interest rates may exacerbate the debt cycle for those already in precarious financial situations.

Furthermore, the economic recovery following a natural disaster can take months or even years. Throughout this period, demand for payday loans may remain elevated as individuals continue to navigate the financial repercussions of hurricanes. A comprehensive understanding of the cyclical nature of hurricane seasons and their effects on payday loan demand is crucial for both lenders and consumers.

Flooding Events and Their Influence on Payday Loan Demand

Flooding poses another critical concern in Texas, particularly in low-lying areas vulnerable to heavy rains. The financial ramifications of flooding can be devastating, leading to increased payday loan demand as residents seek immediate financial relief to recover from their losses. As floodwaters rise, many individuals face unexpected expenses, ranging from home repairs to temporary relocations.

Following flooding events, the demand for payday loans typically surges as residents attempt to cover urgent costs. The urgency of the situation often prompts individuals to seek quick cash solutions, despite the inherent risks associated with high-interest loans. This reliance can create a perilous cycle, as those struggling to recover from flooding may find themselves ensnared in a cycle of debt.

Moreover, the long-term effects of flooding can profoundly impact local economies. Businesses may close, either temporarily or permanently, leading to job losses and increased reliance on payday loans among affected communities. The intersection of flooding events and payday loan usage underscores the necessity for financial preparedness and community support during such crises.

How Wildfire Incidents Affect Payday Loan Demand

Wildfires in Texas can have devastating consequences, both in terms of property damage and financial strain. The aftermath of a wildfire often sees an increase in payday loan demand as affected individuals seek quick financial assistance for recovery efforts. The immediate need for funds to replace lost belongings or cover emergency relocation expenses can drive many to consider payday loans as a viable option.

In areas heavily impacted by wildfires, the economic repercussions can be profound and enduring. As residents grapple with the aftermath of destruction, the demand for payday loans may remain elevated for extended periods. The psychological toll of losing a home or business can lead individuals to prioritize immediate financial relief, often overlooking the long-term financial implications of high-interest loans.

Additionally, wildfire incidents can disrupt local economies by displacing workers and damaging businesses. The interconnected nature of these factors highlights the urgent need for financial education and assistance for communities affected by natural disasters. Understanding the relationship between wildfires and payday loan usage is crucial for both consumers and lenders seeking to navigate this complex financial landscape.

Innovative Payday Loan Marketing Strategies

Leveraging Seasonal Promotions to Drive Loan Applications

Lenders frequently capitalize on the distinct borrowing patterns associated with payday loan trends in Texas by implementing targeted seasonal promotions. During peak demand periods, such as the holiday season, lenders may offer special rates or terms designed to attract borrowers. These promotions might include lower interest rates for first-time borrowers or extended repayment terms aimed at alleviating financial burdens during high-spending times.

Such marketing strategies can significantly influence consumer behavior, enticing individuals to view payday loans as a feasible option when facing financial difficulties. However, the effectiveness of these promotions depends on the timing and messaging employed in marketing campaigns. Understanding the psychological triggers associated with seasonal borrowing can assist lenders in tailoring their promotions for maximum impact.

Moreover, competition among lenders intensifies during peak borrowing seasons, prompting many to innovate their offerings. This competitive environment can lead to more favorable terms for consumers, although it is crucial for borrowers to remain vigilant and compare options to ensure informed decision-making. By leveraging seasonal promotions to foster engagement, lenders can align their services with the financial needs of consumers effectively.

Utilizing Targeted Advertising to Reach Potential Borrowers

Advertising campaigns tailored to payday loan trends in Texas play a vital role in influencing consumer borrowing patterns. As lenders strive to capture the attention of prospective borrowers, targeted advertising can effectively reach specific demographics during peak demand periods. For instance, social media platforms enable lenders to segment audiences based on factors such as age, location, and financial behavior, facilitating more personalized messaging.

During crucial financial times, such as the holiday season or post-natural disaster recovery, targeted advertising can highlight the availability of payday loans as a quick remedy for immediate financial needs. However, the messaging must strike a balance between urgency and responsibility, ensuring that consumers are fully aware of the implications of borrowing.

Additionally, leveraging data analytics can enhance the effectiveness of targeted advertising initiatives. By analyzing consumer behavior and preferences, lenders can refine their strategies to resonate with their audience’s needs and concerns. This data-driven approach can lead to more successful campaigns, ultimately resulting in higher engagement and loan applications.

Comparing Online vs. In-Store Payday Loan Services

The choice between online and in-store payday loan services can significantly influence payday loan trends in Texas. As consumers become increasingly comfortable with digital platforms, many opt for online applications due to their convenience and speed. Online payday loans often appeal to a tech-savvy demographic seeking immediate financial relief without the necessity of visiting a physical location.

However, during certain peak seasons, in-store services may still attract those who prefer face-to-face interactions. Factors such as trust, transparency, and the urgency of financial needs can sway the choice between online and in-store services. For example, during the holiday season, consumers may gravitate towards brick-and-mortar locations for quick cash solutions, seeking the reassurance of personal interactions amid the busyness of holiday shopping.

Understanding the dynamics between online and in-store services is crucial for lenders aiming to optimize their offerings. By providing a seamless borrowing experience across both channels, lenders can effectively cater to the diverse preferences of consumers, ultimately driving higher engagement and loan applications.

Promoting Financial Education and Awareness

How Community Workshops Can Reduce Payday Loan Dependency

Community workshops focused on financial education can substantially decrease reliance on payday loan trends in Texas. These workshops, often organized by non-profit organizations or local governments, offer invaluable resources to empower individuals with the knowledge necessary to manage their finances effectively. By providing information on budgeting, saving strategies, and responsible borrowing, these initiatives can help residents make informed financial decisions.

As communities become more financially literate, the demand for payday loans may diminish, particularly during peak borrowing seasons. Individuals equipped with practical financial skills are more likely to explore alternative options, such as personal savings or community assistance programs, rather than resorting to high-cost loans.

Moreover, financial education programs can cultivate a culture of responsible borrowing, encouraging individuals to consider the long-term implications of their financial choices. By investing in community education, local organizations can play a pivotal role in shaping financial behaviors, ultimately reducing the prevalence of payday loans among vulnerable populations.

Integrating Financial Literacy into School Programs

Incorporating financial literacy education into school curricula can have a lasting impact on payday loan trends in Texas. By teaching students the fundamentals of personal finance, budgeting, and responsible borrowing from an early age, schools can help cultivate a generation of financially savvy individuals. These educational programs empower students to make informed decisions about money, decreasing the likelihood of future reliance on payday loans.

As students learn to navigate financial concepts, they become better prepared to handle their financial futures. This foundational knowledge can significantly influence their borrowing behaviors as they transition into adulthood, fostering a culture of financial responsibility. Programs emphasizing practical applications, such as managing student loans or understanding credit scores, can further enhance students’ preparedness for real-world financial challenges.

Collaboration with local organizations and financial institutions can aid schools in developing comprehensive financial literacy programs. By investing in the financial education of future generations, communities can strive towards reducing the demand for payday loans, ultimately promoting long-term economic stability.

Enhancing Financial Literacy Through Online Resources

Access to online financial education resources can significantly affect payday loan trends in Texas by improving financial literacy among consumers. The digital age has made a wealth of information readily available, allowing individuals to explore topics such as budgeting, debt management, and responsible borrowing. Online platforms, blogs, and webinars can serve as valuable tools for consumers seeking to strengthen their financial knowledge.

As awareness of these resources spreads, individuals may become more inclined to investigate alternative financial solutions rather than depending on payday loans. For instance, learning about budgeting techniques can empower consumers to manage their cash flow more effectively, reducing the likelihood of financial emergencies that necessitate borrowing.

Moreover, online resources can provide insights into the risks associated with payday loans, enabling individuals to make informed decisions. By fostering a culture of financial literacy, communities can work towards decreasing the prevalence of payday loans, ultimately promoting economic resilience.

The Role of Technological Advances in Payday Loans

How Digital Platforms Transform the Payday Loan Experience

The emergence of digital platforms has transformed the manner in which consumers access payday loan trends in Texas. Online applications have streamlined the borrowing process, allowing individuals to secure funds quickly and conveniently. This shift has made payday loans more accessible, particularly for those who may struggle to visit physical locations due to time constraints or mobility challenges.

With the advent of digital lending, consumers can now complete applications in mere minutes, often receiving approvals within hours. This speed and efficiency have contributed to increased demand for payday loans, particularly during periods of financial stress. However, this ease of access raises concerns regarding responsible borrowing, as individuals may be tempted to take out loans without fully understanding the implications of high-interest rates.

Additionally, digital platforms frequently provide borrowers with enhanced transparency regarding loan terms and fees, thereby increasing consumer awareness. As technology continues to shape the payday loan landscape, it is imperative for consumers to stay informed about their options and the potential risks involved in borrowing.

Blockchain Technology and Its Impact on Payday Loan Security

Blockchain technology has the potential to revolutionize the payday loan industry by enhancing security and transparency within transactions. As concerns about fraud and data breaches grow, the integration of blockchain into payday loan processes can establish a level of trust that was previously unattainable. By creating immutable records of transactions, blockchain ensures that both lenders and borrowers have access to accurate and secure information.

For consumers, this heightened security can foster greater confidence in using payday loans, especially for those who are wary of traditional lending practices. The transparency offered by blockchain can also aid consumers in making informed decisions by providing clear insights into loan terms and potential risks.

Furthermore, as the payday loan landscape evolves, lenders embracing blockchain technology may gain a competitive edge, attracting more borrowers who seek secure and reliable options. The intersection of technology and payday lending emphasizes the importance of innovation in addressing the evolving needs of consumers in Texas.

FAQs About Payday Loans

What are payday loans?

Payday loans are short-term, high-interest loans typically used to cover urgent expenses until the borrower’s next paycheck arrives.

How do seasonal trends affect payday loans in Texas?

Seasonal trends, such as holiday spending and economic fluctuations, can lead to increased demand for payday loans, particularly during financial crises or high-stress periods.

What regulations govern payday loans in Texas?

Texas has specific regulations that dictate the terms and availability of payday loans, including limits on interest rates and loan amounts.

How can financial education reduce reliance on payday loans?

Financial education can empower individuals with budgeting and saving skills, reducing the likelihood of resorting to payday loans during financial hardships.

What role do demographic shifts play in payday loan usage?

Demographic shifts, such as population growth and changes in age demographics, can influence the demand for payday loans based on varying financial needs.

How do natural disasters impact payday loan demand?

Natural disasters like hurricanes and floods can lead to increased financial strain, prompting more individuals to seek payday loans for recovery expenses.

What marketing strategies do payday lenders use?

Payday lenders often use seasonal promotions, targeted advertising, and digital platforms to attract borrowers during peak demand periods.

How can technology improve the payday loan process?

Technology, such as digital platforms and blockchain, can enhance the accessibility, security, and transparency of payday loan transactions.

Are there alternatives to payday loans?

Yes, alternatives include personal loans, credit unions, and community assistance programs designed to offer more favorable terms.

How can I avoid payday loan debt traps?

To avoid payday loan debt traps, individuals should prioritize budgeting, seek financial education, and consider alternatives before borrowing.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

I found your analysis of the relationship between unemployment rates and the demand for payday loans in Texas to be quite illuminating. The connection you draw between economic downturns and the increased reliance on these high-interest loans highlights a critical issue that many people face, particularly in times of crisis. The pandemic indeed magnified these struggles, revealing how vulnerable many households are when unexpected financial hardships arise.

You raise an important point about the interplay between unemployment and the demand for payday loans in Texas. The reliance on these high-interest solutions during times of economic strain underscores the urgent need for alternative financial resources. I’ve seen firsthand how quickly financial stability can unravel; during the pandemic, friends and family members were drawn into a cycle of debt simply because they felt they had no other options.

You’ve hit on a crucial aspect of the broader financial landscape in Texas. It’s disheartening how quickly people can be pulled into that cycle of debt, especially when more traditional safety nets seem to vanish under pressure. The story of your friends and family is likely echoed in many households. When the pandemic hit, it wasn’t just a health crisis; it became a financial one, revealing how fragile so many people’s savings or support systems really are.

Your experience highlights the harsh reality many face during tough economic times. The reliance on payday loans often feels like the only option available, and as you’ve seen, that can lead to a trap that’s hard to escape.

Your insights on the link between unemployment rates and the demand for payday loans shed light on a crucial aspect of financial behavior. It’s fascinating how economic downturns, particularly in key industries like oil and agriculture in Texas, can lead not only to increased loan demand but also to the psychological toll of financial instability. I’ve seen firsthand how these pressures can push individuals to make hasty financial decisions, often overlooking the long-term consequences of high-interest loans.