Exploring the Essentials of Texas Payday Loans

What Exactly Are Payday Loans?

Payday loans are categorized as short-term, high-interest financial products that aim to provide immediate cash relief to borrowers facing urgent financial challenges. Typically due on the borrower’s next payday, these loans can serve as a crucial financial lifeline during emergencies. However, it’s important to recognize that they come with significant costs and inherent risks. Many individuals turn to payday loans for pressing financial needs, such as medical expenses, auto repairs, unexpected travel costs, utility payments, rent obligations, grocery purchases, emergency home repairs, and debt consolidation. While these loans can offer rapid relief, thorough consideration of their implications is essential to avoid financial pitfalls.

What Regulations Govern Payday Loans in Texas?

Texas has implemented a comprehensive regulatory framework designed to oversee payday loans, with the primary objective of safeguarding consumers from predatory lending practices. Key regulations encompass an interest rate cap, ensuring that lenders are prohibited from charging exorbitant fees. For instance, in Texas, payday lenders are generally restricted from charging more than 20% of the check amount in fees. Additionally, the state mandates that lenders provide a repayment term that exceeds the typical payday cycle, thus affording borrowers adequate time to repay their loans. Familiarizing yourself with these regulations is crucial for making informed and responsible financial decisions.

What Are the Steps Involved in the Payday Loan Application Process?

The application process for securing a payday loan in Texas is relatively straightforward, although it is imperative to approach it with caution. Initially, you will need to complete an application, which can often be submitted online or in person at a lending establishment. Following this, you will be required to furnish proof of income, such as recent pay stubs or bank statements, as lenders need to verify your ability to repay the loan. Upon submitting your application and supporting documentation, you will be required to agree to the repayment terms, which detail the loan amount, associated fees, and due date. Carefully reviewing these terms is vital to avoid unexpected complications later on.

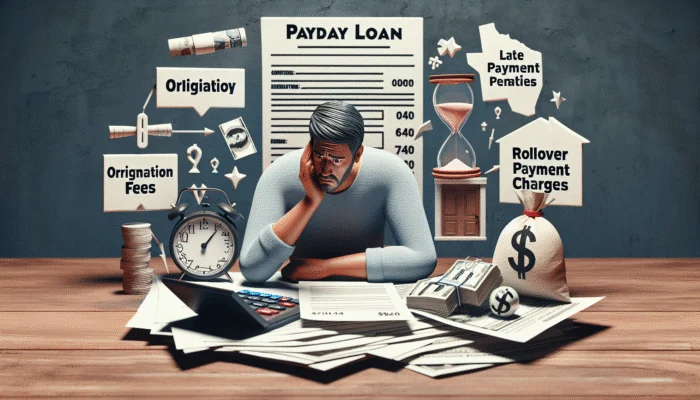

What Are the Costs and Fees Associated with Payday Loans?

Understanding the various costs linked to payday loans in Texas is essential for avoiding unintended financial repercussions. In addition to the principal loan amount, borrowers must be cognizant of several fees, including origination fees that are applied at the outset of the loan and late payment fees incurred if the borrower fails to make timely payments. Furthermore, should a loan be rolled over, additional fees may be added, potentially escalating the total repayment amount substantially. To avert falling into a cycle of debt, it is crucial for prospective borrowers to meticulously calculate the overall cost before entering into any loan agreement.

What Alternatives Exist to Payday Loans?

Although payday loans may appear to be a convenient solution, they frequently come with high costs that can lead to significant financial strain. Fortunately, several alternatives are available to residents of Texas. For example, personal loans obtained from banks or credit unions typically offer lower interest rates and extended repayment periods. Additionally, local emergency assistance programs can provide temporary financial support without the burden of steep fees. Credit unions often implement favorable lending policies, and seeking assistance from friends or family can also be a practical alternative. Exploring these options may lead to more favorable financial outcomes.

Proven Strategies for Navigating Texas Payday Loans Successfully

What Strategies Can Help You Master Payday Loans?

Successfully managing payday loans necessitates a strategic approach and disciplined financial habits. One effective tactic involves creating a detailed budget that clearly outlines all income sources and expenses. This practice allows you to pinpoint areas where spending can be curtailed, thereby freeing up cash for loan repayments. For instance, by closely monitoring my weekly expenditure, I discovered that reallocating funds from discretionary spending, such as dining out, could help meet my loan obligations. It is also essential to make timely repayments, as many lenders provide discounts for early payments or for loyal customers, potentially saving you money on fees. A thorough understanding of the loan terms, including fees and repayment deadlines, is crucial to ensure you never miss a payment.

How Did I Enhance My Knowledge About Payday Loans?

Enhancing my understanding of payday loans was a vital step in taking control of my financial situation. I began by thoroughly researching online resources that explain the implications of payday loans, including their costs and risks. Websites dedicated to consumer financial education frequently offer valuable insights and information. Additionally, I enrolled in financial literacy courses that provided structured education on budgeting and debt management. I also sought advice from financial advisors, who offered personalized guidance tailored to my specific circumstances. These resources not only deepened my understanding but also equipped me with the necessary tools to navigate the complex landscape of payday loans with confidence.

What Resources Were Most Beneficial in My Journey?

Throughout my journey to mastering payday loans, several resources proved to be immensely helpful. Financial blogs dedicated to personal finance offer relatable narratives and actionable advice, making intricate topics more digestible. Government websites, particularly those focused on consumer protection, provide current information on regulations and consumer rights concerning payday loans. Additionally, personal finance books enriched my comprehension, imparting essential skills for managing debt and grasping credit scores. Through these resources, I learned the importance of making informed financial choices, ultimately leading to greater control over my financial destiny.

How Do Texas Payday Loans Influence Your Financial Health?

What Are the Immediate Financial Implications of Payday Loans?

While payday loans can deliver quick cash relief, they also carry significant immediate financial implications. One major concern is the high-interest rates associated with these loans, which can exacerbate debt levels if not managed effectively. Additionally, borrowers may encounter various fees that can swiftly compound their financial responsibilities. The necessity to repay the loan by the next payday can create pressure on budgets, compelling individuals to prioritize loan repayment over other essential expenses. Some of the potential immediate impacts of payday loans include:

- Elevated monthly financial obligations

- Challenges in maintaining regular bill payments

- Increased overall debt burden

- Risk of late fees on other financial commitments

- Feelings of emotional stress and anxiety

Effectively managing these implications requires careful planning and a commitment to making timely repayments to avoid falling into deeper financial trouble.

What Are the Long-Term Financial Risks Associated with Payday Loans?

Consistent reliance on payday loans can result in serious long-term financial repercussions. One of the most significant dangers is becoming trapped in a cycle of debt, where borrowers continuously take out new loans to cover the costs of existing ones, leading to an endless cycle of financial strain. Over time, this behavior can severely damage your credit score, making it increasingly difficult to obtain loans with favorable terms in the future. Moreover, habitual borrowing from payday lenders can deplete savings and contribute to greater financial instability. The long-term effects on financial health underscore the necessity of critically evaluating your borrowing habits and making informed decisions about loans.

Can Payday Loans Be Beneficial or Detrimental to Your Credit Score?

Generally, payday loans do not positively impact your credit score. While obtaining a payday loan may not directly affect your credit, failing to repay the loan certainly will. Non-payment can lead to collections, which can severely impair your credit rating. Conversely, timely payments are often not reported to credit bureaus, meaning payday loans usually do not enhance your credit history. Understanding this relationship is critical when considering payday loans as a financial option, as the potential risks far outweigh any perceived benefits from a credit perspective.

What Alternatives to Payday Loans Should Be Considered?

Exploring alternatives to payday loans can lead to healthier financial choices. Personal loans, especially those sourced from credit unions, often feature lower interest rates and more favorable repayment terms compared to payday loans. Moreover, local emergency assistance programs can offer essential support without the steep costs associated with payday loans. Establishing an emergency savings fund can also act as a financial safety net, reducing the reliance on high-interest borrowing in times of need. Peer-to-peer lending platforms connect borrowers with individual investors, often providing more competitive rates than traditional payday loans. These alternatives present viable options for achieving financial stability while minimizing overall debt.

Reliable Strategies for Successfully Managing Texas Payday Loans

How Can You Create an Effective Budget When Using Payday Loans?

Creating an effective budget is crucial for successfully managing payday loans. Begin by meticulously tracking your monthly expenses, which will help you pinpoint areas where you can reduce spending if needed. Establishing clear repayment priorities is essential; focus on paying off high-interest loans first to minimize cost accumulation. Furthermore, it is advisable to set up a separate savings account specifically for loan repayments, enabling you to build a financial cushion for unforeseen expenses. By allocating a designated portion of your income to this fund each payday, you can resist the temptation to use it for non-essential purchases. Additionally, utilizing budgeting apps can streamline the tracking process and provide reminders for upcoming payments, ensuring you remain on top of your financial commitments.

What Best Practices Should Be Followed for Loan Repayment?

Implementing best practices for loan repayment can significantly alleviate the stress associated with payday loans. One effective strategy is to set up automatic payments, ensuring you never overlook a payment due date. Fully understanding the total cost of your loan—including any associated fees—enables you to budget accurately and avoid falling into a cycle of increasing debt. Moreover, it is vital to steer clear of loan rollovers, as they can dramatically inflate your repayment amount. Regularly reviewing your financial status and engaging with your lender regarding possible repayment adjustments can also provide flexibility in managing your loans. This proactive approach cultivates a healthy repayment routine and facilitates a smoother transition back to financial stability.

How Can You Steer Clear of the Payday Loan Trap?

Avoiding the payday loan trap necessitates a combination of knowledge and self-discipline. First and foremost, ensure you have a complete understanding of the loan terms before signing any agreements. Only borrow what you can realistically afford to repay, taking into account your monthly expenses and any emergency savings you may have. If circumstances arise where borrowing is necessary, consider exploring alternatives first, such as credit unions or personal loans, which often come with more favorable terms. Additionally, establishing a robust budget and adhering to it can prevent the need for payday loans in the future. Cultivating financial literacy and awareness surrounding these products serves as your best defense against falling into the payday loan trap.

What Alternatives to Texas Payday Loans Are Available?

What Are Personal Loans and How Do They Operate?

Personal loans are typically longer-term loans with lower interest rates than payday loans, making them a more appealing option for borrowers seeking financial assistance. These loans can be utilized for various purposes, including debt consolidation or covering larger expenses. Unlike payday loans, which are usually due within weeks, personal loans can offer repayment terms extending from several months to several years. This flexibility enables borrowers to manage their payments more effectively. Lenders typically assess creditworthiness before approval, so maintaining a healthy credit score can help secure more favorable rates. Overall, personal loans provide a viable solution for individuals seeking financial assistance without incurring the excessive costs associated with payday loans.

How Can Credit Unions Provide Assistance?

Credit unions present excellent alternatives to payday lenders, offering a variety of financial products tailored to the needs of their members. Frequently, credit unions extend loans with superior interest rates and terms compared to traditional payday lenders, significantly lowering borrowing costs. Additionally, credit unions usually emphasize community support, making them more inclined to work with individuals facing challenges in repaying loans. They also offer financial education resources, empowering members to enhance their financial literacy and manage their finances more effectively. By becoming a member of a credit union, individuals can access affordable loans while fostering a healthier relationship with their finances.

What Other Financial Assistance Options Are Available?

Beyond personal loans and credit unions, numerous other financial assistance alternatives can help individuals evade payday loans. Many local assistance programs provide financial support for those experiencing emergencies, including grants or low-interest loans. Building an emergency savings fund can create a financial buffer for unexpected expenses, diminishing the necessity for high-interest borrowing. Additionally, borrowing from friends or family can present a practical solution, allowing for flexible repayment terms without added financial pressure. Investigating these options can yield much-needed relief and set the stage for improved financial management.

What Are Peer-to-Peer Lending Platforms and How Do They Work?

Peer-to-peer lending platforms facilitate direct connections between borrowers and investors, often offering more competitive rates than conventional payday loans. This innovative model enables individuals to bypass traditional financial institutions, potentially resulting in lower interest rates and more favorable repayment conditions. Borrowers typically create profiles that outline their financial needs, allowing investors to choose specific loans to fund based on their preferences. This system promotes a community-oriented approach to lending, making financial assistance more accessible. With careful management, peer-to-peer lending can emerge as a valuable alternative for individuals seeking to avoid the pitfalls associated with payday loans.

Real-Life Triumphs in Navigating Texas Payday Loans

How Did I Successfully Overcome Payday Loan Debt?

Successfully overcoming payday loan debt required a combination of discipline, budgeting, and seeking external help. I commenced my journey by establishing a strict budget that prioritized my financial obligations, ensuring that I allocated sufficient funds to cover my loan repayments. I also reached out to my lenders to negotiate manageable payment plans, which alleviated the financial strain during challenging months. Seeking financial counseling proved to be another critical step, as it equipped me with insights into more effective financial management strategies. Through determination and strategic planning, I was able to eliminate my payday loan debt and construct a more secure financial future.

What Valuable Lessons Did I Learn from My Journey?

Throughout my experiences with payday loans, I gleaned several invaluable lessons that have profoundly influenced my approach to financial management. One key takeaway was the importance of thoroughly reading loan terms; I discovered that many loans are laden with hidden fees that can ensnare borrowers in cycles of debt. I recognized that quick fixes often lead to long-term complications, underscoring the necessity for comprehensive financial planning. Additionally, I learned that cultivating an emergency fund and proactively managing expenses can significantly lessen the need for payday loans in the future. These experiences emphasized the value of financial literacy in achieving a secure financial future.

How Can My Experience Serve as Inspiration for Others?

My journey serves as a source of inspiration for others who are grappling with similar challenges involving payday loans. By sharing my story of overcoming debt, I aim to motivate individuals to take charge of their financial circumstances and seek assistance when necessary. Understanding that navigating the complexities of payday loans without succumbing to a cycle of debt is indeed possible is critical. I encourage readers to prioritize financial education, explore alternative options, and adopt a proactive approach to financial planning. The lessons gleaned from my experiences can empower others to make informed decisions and cultivate a more stable financial future.

Frequently Asked Questions about Payday Loans

What is a payday loan?

A payday loan is a short-term, high-interest loan that is typically due on your next payday, designed to provide quick cash to cover emergency expenses.

Are payday loans legal in Texas?

Yes, payday loans are legal in Texas, though they are subject to specific regulations that limit interest rates and repayment terms to protect consumers.

How much can I borrow with a payday loan?

In Texas, payday loans generally range from $100 to $1,500, depending on the lender and your documented income.

What happens if I fail to repay my payday loan?

If you cannot repay your payday loan, you may incur late fees, and the loan may be sent to collections, adversely affecting your credit score.

How can I prevent falling into a payday loan trap?

To avoid the payday loan trap, educate yourself about the loan terms, only borrow what you can afford to repay, and consider alternative financial options.

What alternatives exist to payday loans?

Alternatives to payday loans include personal loans, loans from credit unions, emergency assistance programs, and borrowing from friends or family.

Do payday loans impact my credit score?

While payday loans typically do not enhance your credit score, failure to repay them can lead to significant damage to your credit rating.

Can I negotiate the terms of my payday loan?

Yes, many lenders are open to negotiating repayment terms, especially if you communicate your financial situation in advance.

What steps should I take if I find myself trapped in payday loan debt?

If you are caught in a cycle of payday loan debt, consider creating a strict budget, seeking financial counseling, and exploring options for debt consolidation.

How can credit unions assist me with my financial challenges?

Credit unions can provide loans with lower interest rates and more favorable terms compared to payday lenders, along with access to valuable financial education resources.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

Ah, payday loans—the financial equivalent of a quick snack from the gas station when you’re really on a low-carb diet. Sure, they can fulfill an immediate craving, but oh boy, you might regret that decision when you’re staring down the scale.

Your comparison of payday loans to a quick snack from a gas station is spot on. It captures that moment of temptation when you’re feeling pressed for time and just want to satisfy an immediate need. I think a lot of people have found themselves in that situation—maybe a car repair or an unexpected medical bill shows up suddenly, and a payday loan feels like the easiest way out. But much like those gas station snacks, it’s almost too easy to overlook the long-term impact and costs associated with that quick fix.

Your exploration of payday loans in Texas raises important points about their role in offering immediate financial relief amid pressing needs. However, the mention of “significant costs and inherent risks” cannot be overstated. From my perspective, the high-interest rates associated with these loans often create a cycle of dependency that can ensnare borrowers in a web of continual debt. For instance, if a borrower takes out a payday loan to cover an unexpected car repair, they may find themselves needing another loan to pay back the first, leading to a precarious situation where one emergency leads to another.

Your exploration of payday loans in Texas highlights an important issue that many face during unexpected financial emergencies. It resonates with those who may find themselves in dire situations, needing quick access to cash. I’ve seen friends navigate similar scenarios, where payday loans felt like the only option to cover urgent medical bills or car repairs.

I found your discussion on payday loans in Texas really eye-opening. It’s kind of alarming to think how many people might feel they have no choice but to rely on these high-interest loans. Personally, I’ve seen friends struggle after taking out payday loans—what starts as a quick fix often spirals into a cycle of debt because of the fees and interest rates.