Comprehensive Insights into Payday Loan Regulations in Texas

Navigating the intricate landscape of finance reveals that few topics stir as much controversy as payday loans, especially when considering what payday loan fines cost in Texas. Gaining a thorough understanding of the regulatory framework governing these loans is crucial for both borrowers and lenders. While federal regulations establish a foundational standard throughout the United States, Texas introduces its own specific legalities that dictate how payday loans function within its borders. The mechanisms of compliance and enforcement in Texas further ensure that these regulations are followed, crafting an environment that not only safeguards consumers but also places responsibilities on lenders to operate ethically and transparently.

Navigating Federal Regulations on Payday Loans

Federal regulations aim to create a unified standard that governs payday loan practices across the nation. The Consumer Financial Protection Bureau (CFPB) has been instrumental in enforcing rules designed to shield borrowers from predatory lending practices. These regulations mandate that lenders perform comprehensive assessments to confirm that borrowers possess the means to repay their loans, thereby avoiding a debilitating cycle of debt. Key components of this regulatory framework include restrictions on the number of concurrent loans a borrower can secure, as well as obligatory disclosures concerning the total borrowing costs, fostering a more transparent lending environment.

In states such as Texas, federal regulations serve as a minimum benchmark, yet the local laws frequently surpass these standards, resulting in a distinctive lending climate. It is essential for Texans to familiarize themselves with these federal guidelines, as they interact with lenders who must comply with both federal and state regulations. For instance, lenders are obligated to clearly disclose the Annual Percentage Rate (APR) and overall repayment responsibilities, including any potential fines for non-compliance. This level of transparency is vital for borrowers, enabling them to make well-informed choices regarding the costs associated with payday loans.

Exploring Texas State-Specific Payday Loan Regulations

Texas boasts a set of unique regulations concerning payday loans, carefully crafted to safeguard consumer interests while allowing lenders a degree of flexibility. The Texas Office of Consumer Credit Commissioner oversees these regulations, which stipulate limitations on maximum loan amounts and impose interest rate ceilings. Although Texas does not enforce a statewide cap on payday loan interest rates, lenders are required to adhere to guidelines that prevent exploitative lending practices from taking root.

A noteworthy aspect of Texas law is the stipulation that lenders must present a written agreement detailing the loan’s terms, including repayment schedules and associated fees. This written document is crucial for borrowers, as it clarifies their obligations and potential repercussions for late payments. Furthermore, Texas law mandates a “cooling-off period” following a loan issuance, during which borrowers cannot take out another loan. This provision is designed to protect borrowers from becoming ensnared in a cycle of accumulating payday loans, which can exacerbate their financial challenges.

The Role of Compliance and Enforcement in Lending Practices

The enforcement of payday loan regulations in Texas is thorough and primarily managed by the Texas Office of Consumer Credit Commissioner. This office conducts regular audits and investigations to ensure that lenders remain compliant with state laws. Non-compliance can result in severe penalties, including substantial fines, revocation of lending licenses, or even criminal charges for unscrupulous lenders attempting to exploit consumers.

For borrowers, understanding the compliance and enforcement landscape can empower them to challenge unfair practices. If lenders impose exorbitant fines or fail to meet legal standards, borrowers have the right to lodge complaints with the regulatory body. This process is fundamental in upholding a fair lending ecosystem and ensuring that lenders are held accountable for their operations.

Identifying Different Types of Payday Loan Fines

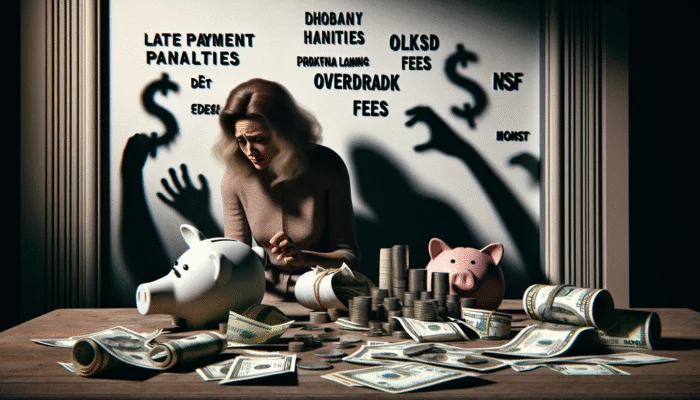

Understanding the various types of fines linked to payday loans is essential for Texas borrowers. Being aware of these potential costs can help consumers avoid falling into a debt cycle commonly associated with payday lending. The most prevalent types of fines include late payment penalties, overdraft fees, and non-sufficient funds (NSF) fees. Each of these charges can significantly influence the overall cost of borrowing and contribute to the financial strain faced by many individuals.

Understanding Late Payment Penalties

Late payment penalties are among the most immediate and tangible costs linked to payday loans. In Texas, lenders can impose severe fines on borrowers who miss their payment deadlines. These penalties can vary significantly, typically falling within the range of $15 to $30 for each late payment, contingent on the lender’s specific policies. Given the steep interest rates associated with payday loans, late fees can accumulate rapidly, exacerbating the financial burden on borrowers.

Additionally, although many lenders may offer grace periods, these are frequently brief, providing borrowers with limited opportunities to catch up on their payments. Understanding the repayment timeline and the associated penalties is crucial for borrowers. This knowledge enables them to devise effective repayment strategies, ensuring they avoid unnecessary fines which can escalate their debt into an unmanageable crisis. Ultimately, late payment penalties can transform a straightforward loan into a financial emergency if borrowers are not vigilant and well-informed.

Evaluating Overdraft Fees

Overdraft fees present another significant concern for borrowers of payday loans. When a borrower’s bank account lacks sufficient funds to cover a payday loan repayment, the institution typically imposes an overdraft fee. In Texas, these fees can reach as high as $35 per incident. For borrowers already grappling with financial strain, this additional cost can trigger a chain reaction of financial issues.

This scenario often occurs when borrowers miscalculate their account balances or face unexpected expenses. Many payday loan borrowers operate on tight budgets, making the impact of overdraft fees even more severe. To mitigate this risk, borrowers should maintain a close watch on their bank accounts, ensuring they have adequate funds available to cover upcoming loan payments and avoid the financial strain that accompanies overdraft charges.

Understanding Non-Sufficient Funds Fees

Non-sufficient funds (NSF) fees arise when a borrower’s payment attempt is declined due to an insufficient account balance. In Texas, these fees can also range from about $30 to $40, further adding to the overall financial burden of payday loans. Borrowers who encounter multiple NSF fees due to recurring loan obligations can find themselves in a precarious situation, leading to heightened stress and financial instability.

To prevent the accumulation of NSF fees, borrowers should consider strategies such as setting up automatic payments judiciously or arranging alternative payment methods, like cash or money orders. Understanding the implications of NSF fees empowers borrowers to make informed decisions, minimizing the likelihood of incurring additional fines and enhancing their overall financial well-being.

Calculating the Costs Associated with Payday Loan Fines

To comprehend what payday loan fines cost in Texas, it is essential to understand the factors that contribute to the accumulation of these costs over time. Both interest rates and additional fees can have a substantial effect on the total amount a borrower pays throughout the lifespan of a payday loan. By evaluating interest rates, extra charges, and the cumulative impact of these costs, borrowers can gain valuable insight into their potential financial obligations.

Assessing Interest Rates and APR

Interest rates and Annual Percentage Rates (APR) are fundamental elements in calculating the total expenses associated with payday loans. In Texas, payday lenders often impose APRs that can soar to as much as 500%, depending on the specific loan agreement. Such exorbitant interest rates can create precarious financial situations for borrowers, particularly if they are unable to promptly repay their loans.

For instance, a borrower who takes out a $500 payday loan with a 500% APR and fails to repay it within a month could see the total repayment amount balloon to an overwhelming sum. By examining the APR and grasping the implications of interest rates, borrowers can better evaluate the affordability of payday loans and make informed decisions regarding their borrowing needs.

Considering Additional Fees and Charges

Beyond interest rates, borrowers in Texas should be cognizant of the various additional fees that can accrue during the loan term. These may encompass application fees, processing fees, and late payment penalties. Each of these charges can compound the financial stress linked to payday loans, pushing borrowers further into debt.

Being aware of these additional fees is essential for borrowers. A transparent understanding of all charges related to a payday loan can empower individuals to negotiate better terms or explore alternatives. For example, if lenders are unwilling to waive certain fees, borrowers can weigh the cost of continuing with the loan against other financial options, such as personal loans or credit lines with more favorable interest rates.

Calculating the Overall Cost of Fines Over Time

The cumulative effect of fines over time paints a stark picture of the true cost of payday loans. When borrowers neglect to factor in the total costs associated with late payments, overdraft fees, and high-interest rates, they may inadvertently find themselves ensnared in a cycle of debt. It is essential to calculate the total amount one would pay throughout the loan duration, considering all potential fines and charges.

For example, a borrower might initially perceive a payday loan as a short-term remedy for a financial challenge, only to discover that the total cost has surpassed their expectations due to accumulating fines. By proactively understanding the financial implications and calculating the total cost of fines, borrowers can equip themselves with the knowledge necessary to navigate the payday loan landscape responsibly and effectively.

Understanding the Impact of Fines on Borrowers’ Financial Health

The financial ramifications of payday loan fines extend beyond mere monetary costs; they can profoundly influence a borrower’s overall financial wellbeing. As fines accumulate, borrowers frequently experience heightened financial stress, implications for their credit scores, and long-lasting effects on their financial stability. Recognizing these impacts is vital for anyone contemplating a payday loan.

Addressing Financial Stress and the Debt Cycle

The consequences of fines stemming from payday loans can lead to significant financial stress and an ongoing debt cycle. For many borrowers, the initial loan may seem like a quick fix for an urgent financial requirement, but late payment penalties and additional fees can escalate the total debt rapidly. This can create a vicious cycle, where borrowers continuously secure new loans to pay off existing debts, leading to a phenomenon known as a “debt trap.”

This cycle can result in emotional and psychological repercussions, as borrowers confront mounting pressures from lenders and a constant anxiety about financial instability. As fines increase, so does the burden of repayment, which often culminates in heightened anxiety and a reduced quality of life. By recognizing this cycle, borrowers can adopt a more cautious approach to borrowing and seek alternatives that contribute to financial health instead of exacerbating their struggles.

Understanding Credit Score Implications

Payday loan fines can adversely affect a borrower’s credit score. Numerous lenders report late payments and defaults to credit reporting agencies, which can lead to a significant decrease in a borrower’s credit score. A diminished credit score may restrict future borrowing opportunities, complicating the acquisition of loans or credit cards with favorable terms.

In Texas, maintaining a strong credit score is crucial for accessing affordable financing options in the future. Awareness of how payday loan fines can damage credit scores is imperative for borrowers. Proactive measures, such as making timely repayments or seeking guidance from financial advisors, can help mitigate these adverse effects and safeguard one’s credit standing.

Assessing Long-Term Financial Health Consequences

The long-term repercussions of payday loan fines extend well beyond immediate financial stress. Borrowers who struggle to repay payday loans may confront enduring challenges in their financial health. High levels of debt can lead to severe issues such as bankruptcy, foreclosure, or an inability to secure housing or employment in the future.

Moreover, a history of reliance on payday loans can perpetuate a cycle of financial dependency, making it increasingly difficult for borrowers to extricate themselves from predatory lending practices. To protect long-term financial health, it is essential for borrowers to pursue education on financial literacy, utilize budgeting tools, and consider alternatives to payday loans that foster sustainable financial wellbeing.

Exploring Legal Recourse for Borrowers

For borrowers confronting unfair fines or predatory lending practices, understanding available legal recourse is vital. Texas has established mechanisms that enable borrowers to file complaints, seek legal assistance, and comprehend their rights concerning payday loan fines. Empowering consumers with this knowledge can cultivate a healthier lending environment and encourage responsible lending practices.

Filing Complaints with Regulatory Bodies

If borrowers suspect they have been subjected to unfair practices or excessive fines, they can file complaints with the Texas Office of Consumer Credit Commissioner. This regulatory authority oversees payday lending practices in the state and investigates consumer complaints. Filing a complaint is a critical step in holding lenders accountable for their actions and ensuring adherence to state laws.

The complaint process typically involves submitting a detailed account of the issue, supplemented by relevant documentation such as loan agreements and payment records. By providing clear evidence of unfair practices, borrowers can facilitate a thorough investigation and potentially attain restitution for excessive fines. Understanding this process empowers borrowers to advocate for their rights and seek justice in instances of predatory lending.

Seeking Legal Assistance for Complex Situations

In cases where borrowers encounter excessive fines or potentially unlawful practices, obtaining legal assistance can be a prudent course of action. Various organizations and legal aid clinics specialize in consumer protection and can offer valuable guidance on navigating the complexities of payday loan regulations. Legal assistance can aid borrowers in understanding their rights, negotiating with lenders, or even pursuing litigation if necessary.

Moreover, attorneys specializing in consumer finance can provide essential insights into the potential legal remedies available to borrowers. Whether through mediation, settlement negotiations, or court actions, legal professionals can advocate on behalf of borrowers, working to alleviate financial burdens imposed by unfair lending practices.

Understanding Borrower Rights in Texas

In Texas, borrowers possess specific rights concerning payday loans that shield them from predatory practices. These rights encompass the right to clear and transparent loan agreements, protection against lender harassment, and the ability to report unfair practices without fear of retaliation. Familiarity with these rights is crucial for borrowers seeking to navigate the payday loan landscape with confidence.

Additionally, borrowers should be aware of their right to receive assistance in comprehending the terms of their loans. Lenders are obligated to furnish borrowers with information regarding their rights and responsibilities, ensuring they can make well-informed financial decisions. By knowing their rights, borrowers can better safeguard themselves and advocate for equitable treatment in their interactions with payday lenders.

Effective Strategies to Avoid Payday Loan Fines

Preventing payday loan fines necessitates proactive strategies that promote financial wellness and responsible borrowing practices. By implementing effective budgeting strategies, timely repayment practices, and exploring alternative financial solutions, borrowers can reduce the likelihood of resorting to payday loans and incurring the associated fines.

Implementing Budgeting and Financial Planning Techniques

Effective budgeting forms the bedrock of financial management, aiding individuals in averting the pitfalls of payday loans and associated fines. By crafting a comprehensive budget that incorporates all expenses, income, and savings objectives, borrowers can adeptly navigate their financial landscapes. This approach allows individuals to anticipate potential financial shortfalls and plan accordingly.

For instance, budgeting can help individuals allocate funds for essential expenses while providing a buffer for unexpected costs. This foresight can significantly diminish the necessity for payday loans in the first place. Moreover, utilizing budgeting applications can assist individuals in monitoring spending habits, enhancing financial awareness, and fostering improved decision-making. Ultimately, a robust budgeting strategy can empower borrowers to liberate themselves from dependence on payday loans and enhance their overall financial health.

Establishing Timely Repayment Practices

Implementing best practices for timely repayment can markedly reduce the risk of incurring payday loan fines. Borrowers should prioritize developing a repayment schedule that aligns with their income cycles, ensuring they can meet their obligations without falling behind. Setting reminders or utilizing automatic payment features can also aid in maintaining punctual payments, thereby reducing the chances of late fees.

Furthermore, borrowers should communicate proactively with lenders if they foresee difficulty in fulfilling a payment. Often, lenders are amenable to collaborating with borrowers to formulate manageable repayment plans, thus helping to avoid fines and fostering a more positive lender-borrower relationship. By prioritizing timely repayment practices, borrowers can alleviate the financial strain associated with payday loans.

Exploring Alternative Financial Solutions to Avoid Payday Loans

When confronted with financial needs, investigating alternative solutions can help borrowers sidestep the pitfalls associated with payday loans altogether. Options such as credit unions, personal loans from reputable lenders, or borrowing from family or friends can frequently provide more advantageous terms without the burden of exorbitant fines.

Many local nonprofits and community organizations offer financial assistance or low-interest loans, presenting borrowers with superior alternatives to payday loans. By exploring these avenues, individuals can secure the funds they require without incurring the high costs typically associated with payday loans. Understanding the spectrum of available alternatives is vital to fostering responsible borrowing habits and diminishing reliance on high-cost financial products.

Case Studies Highlighting Payday Loan Fines

Real-life examples of borrowers navigating the challenges associated with payday loan fines can yield valuable insights into the consequences of these financial products. Through case studies, we can delve into the experiences of individuals affected by payday loan fines, the lessons they learned, and the strategies they employed for recovery.

Examining Real-Life Examples from Texas

Numerous Texans have encountered the repercussions of payday loans, resulting in substantial financial stress and hardship. For instance, one borrower secured a $300 payday loan with the belief that they could repay it within two weeks. However, due to unforeseen medical expenses, they were unable to meet the payment deadline. The ensuing late fees and additional fines quickly escalated the total repayment amount, plunging them into a cycle of borrowing that spiraled out of control.

These narratives underscore the potential pitfalls of payday loans and the necessity of understanding the full scope of financial responsibilities involved. By examining real-life experiences, borrowers can gain perspective on the risks associated with payday loans and develop strategies to avoid similar traps.

Lessons Learned from Case Studies of Borrowers

Case studies of borrowers grappling with payday loan fines often impart critical lessons regarding financial management and decision-making. A recurring theme is the importance of thoroughly assessing one’s financial situation prior to incurring debt. Many individuals come to realize that payday loans should not be viewed as quick fixes, but rather as last-resort options when other avenues are unavailable.

Another valuable lesson is the significance of transparency in communication with lenders. Many borrowers learn that proactive dialogue can lead to more favorable outcomes, such as renegotiating loan terms or securing extensions. By understanding the lessons gleaned from the experiences of others, prospective borrowers can make informed decisions and evade the costly mistakes often associated with payday loans.

Identifying Strategies for Financial Recovery

For those who have endured the financial strain of payday loan fines, recovery is achievable through the right strategies. Many individuals have successfully extricated themselves from debt by implementing structured repayment plans and seeking assistance from financial counselors. These professionals can provide guidance on budgeting, debt management, and alternative financial solutions.

In addition, cultivating a support network of family and friends can be advantageous for emotional support during the recovery journey. By sharing their experiences and soliciting advice, borrowers can find encouragement and practical solutions to overcome financial challenges. Ultimately, recovering from payday loan fines may require time and effort, but proactive strategies can lead to a healthier financial future.

Understanding Legal Actions and Their Outcomes

Over the years, numerous lawsuits have been initiated against payday lenders in Texas for engaging in unfair practices, resulting in significant fines or settlements. These legal actions often address issues such as excessive fees, misleading advertising, and predatory lending practices. By analyzing the outcomes of these lawsuits, borrowers can gain insights into their rights and the importance of holding lenders accountable.

Legal actions can serve as a powerful tool for consumers seeking justice and restitution. Many borrowers have successfully obtained compensation for excessive fines through class-action lawsuits and settlements. Understanding the potential for legal recourse can empower borrowers to assert their rights against unfair practices and pursue the justice they deserve.

Forecasting the Future of Payday Loan Regulations

As the payday lending landscape continues to evolve, potential changes in Texas legislation and federal regulatory trends loom on the horizon. By remaining informed about these developments, borrowers can better navigate the complexities of payday loans and advocate for fair lending practices.

Anticipating Changes in Texas Legislation

Texas lawmakers continually assess the efficacy of payday loan regulations, and prospective legislative changes may be forthcoming. There is increasing advocacy for stricter caps on interest rates and fees, aimed at curbing predatory lending practices. This movement reflects a broader initiative to protect consumers from high-cost loans that frequently lead to financial devastation.

Additionally, proposed legislation may seek to enhance borrower protections, including mandates for clearer disclosures and enforced penalties for non-compliant lenders. By actively participating in the legislative process, consumers can express their concerns and advocate for policies that promote responsible lending practices.

Evaluating the Impact of Regulatory Changes

Potential changes to payday loan regulations could profoundly affect both borrowers and lenders. Stricter regulations may result in reduced access to payday loans, compelling individuals to explore alternative financial solutions. While such changes may present challenges for some borrowers, they could also cultivate a healthier lending environment that prioritizes consumer protection and financial well-being.

Moreover, borrowers may benefit from enhanced transparency and clarity in loan agreements, minimizing the risk of falling victim to predatory lending practices. Ultimately, the future of payday loan regulations will play a pivotal role in shaping the lending landscape in Texas and beyond.

Analyzing Federal Regulatory Trends

In addition to state-level changes, federal regulatory trends are also shaping payday lending practices across the country. The CFPB continues to evaluate and propose new regulations that can impact payday loan operations, particularly concerning interest rates and borrower protections. Heightened scrutiny of payday lenders at the federal level could pave the way for more comprehensive reforms aimed at safeguarding consumers from predatory practices.

As these regulatory trends unfold, borrowers must remain engaged and informed. Understanding the overarching federal landscape can empower consumers to advocate for fair lending practices and ensure their voices resonate in the ongoing dialogue surrounding payday loans and financial responsibility.

Frequently Asked Questions about Payday Loans

What are the different types of payday loan fines in Texas?

Payday loan fines in Texas encompass additional costs incurred when borrowers fail to make timely payments. These include late fees, overdraft fees, and non-sufficient funds fees.

How much can I be fined for late payments on payday loans in Texas?

Late payment penalties in Texas can range from $15 to $30 for each missed payment, depending on the lender’s specific policies.

What is the average interest rate for payday loans in Texas?

The average interest rate for payday loans in Texas can reach up to 500% APR, significantly increasing the total repayment amount for borrowers.

Can payday loan fines affect my credit score?

Yes, payday loan fines can negatively impact your credit score, as lenders may report late payments or defaults to credit reporting agencies.

What should I do if I can’t repay my payday loan on time?

If you’re unable to repay your payday loan on time, contact your lender immediately to discuss your options, such as payment extensions or restructuring the loan.

Are there legal protections for payday loan borrowers in Texas?

Yes, borrowers in Texas possess specific rights regarding payday loans, including the right to transparent loan agreements and protection against harassment by lenders.

How can I file a complaint against a payday lender in Texas?

You can file a complaint with the Texas Office of Consumer Credit Commissioner by providing a detailed account of the issue, along with relevant documentation.

What financial alternatives exist to payday loans?

Alternatives to payday loans include credit unions, personal loans from banks, borrowing from family or friends, and seeking assistance from local nonprofit organizations.

How can budgeting help avoid payday loan fines?

Budgeting helps you manage your finances effectively, ensuring you can cover expenses without resorting to payday loans, thereby avoiding associated fines and fees.

What strategies can help in recovering from payday loan fines?

Strategies for recovery include creating structured repayment plans, seeking financial counseling, and exploring community resources for financial assistance.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

It’s interesting to see how payday loan regulations can vary so widely from one state to another. In Texas, the unique legal landscape definitely shapes how borrowers and lenders interact. I’ve been following the payday loan debate for a while, and one thing that often gets overlooked is the impact these loans have on financial literacy. Many borrowers don’t fully understand the terms or the long-term consequences of taking out these loans, which can lead to a cycle of debt that’s hard to break.

You raise a really important point about the relationship between payday loans and financial literacy. It’s so true that many borrowers jump into these agreements without fully grasping the fine print. The way payday loans are set up can be a trap, especially when the terms are designed to promote quick access to cash but often lead to longer-term financial struggles.

It’s really interesting to dive into the complexities surrounding payday loans, especially in a state like Texas where the regulations seem to take on a life of their own compared to the federal standards. I think many people, including myself, often underestimate the challenges that come with these loans until they find themselves in that precarious situation of needing quick cash. It’s fascinating yet disheartening to realize how such loans can put borrowers in a deeper financial hole if they’re not careful.

It’s fascinating to reflect on the complex dynamics that payday loans present, particularly within the context of Texas regulations. As I read your insights, I couldn’t help but think about the broader implications of these lending practices on community wellbeing. Many people often turn to payday loans as a quick solution to financial stress, but the long-term repercussions can be quite severe.