Key Insights

- Usage: Approximately 1.3 million Texans rely on payday loans annually.

- Regulations: The Texas Finance Code outlines specific interest rate caps and fees for lenders.

- Demographics: Borrowers aged 25-34 make up nearly 35% of payday loan users in Texas.

- Future Trends: Economic conditions and technological advances are likely to shape the payday loan market in the coming years.

Current State of Payday Loans in Texas

Statistics on Payday Loan Usage

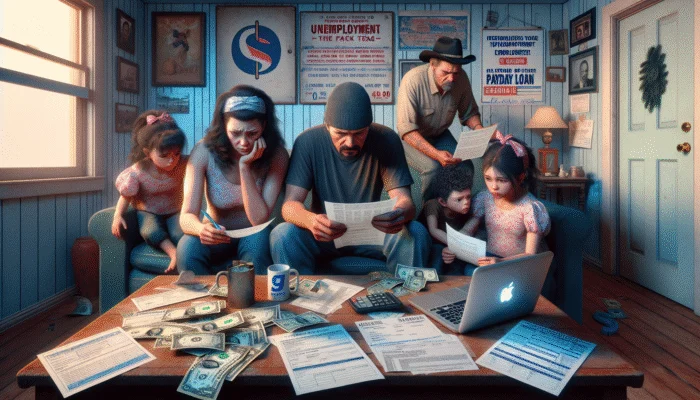

Current data indicates that payday loans remain a vital financial resource for many Texans. These short-term loans often serve as a lifeline for individuals facing unexpected expenses. Key statistics illustrate the significant reliance on payday loans in the state:

- Approximately 1.3 million Texans utilize payday loans each year.

- The average payday loan amount in Texas is around $400.

- More than 60% of borrowers take out multiple loans within a year.

- Over 90% of payday loan borrowers in Texas report using loans for essential expenses such as medical bills and rent.

- Texas has one of the highest payday loan usage rates in the nation, with significant growth noted in urban areas.

The prevalence of payday loans underscores a broader trend of financial instability faced by many households in Texas. Understanding these statistics is crucial for evaluating the future landscape of payday lending in the state.

Regulatory Environment for Payday Loans

Texas has established a framework of laws that govern payday loan practices to safeguard consumers from exploitative lending practices. The Texas Finance Code delineates specific interest rate caps and fees that lenders must adhere to, promoting transparency and fairness.

For instance, payday lenders in Texas can charge an average annual percentage rate (APR) of up to 662%, which leads to ongoing debates about the need for more stringent regulations. The state does require lenders to provide clear disclosures regarding the terms of loans, ensuring that borrowers are aware of their obligations.

Moreover, recent discussions among lawmakers suggest a potential shift towards enhancing protections for consumers, especially as the number of complaints regarding predatory lending continues to rise. The ongoing dialogue indicates that while the current regulatory environment aims to protect borrowers, there may be a need for adjustments to foster greater financial security for consumers.

Consumer Demographics and Payday Loan Usage

Understanding the demographics of payday loan users in Texas can illuminate patterns and forecasts for future trends. Demographers have identified specific characteristics of typical borrowers, revealing that they often include younger adults, individuals with lower income levels, and those experiencing unstable employment.

Data indicates that borrowers aged 25-34 constitute the largest group, representing nearly 35% of payday loan users. Furthermore, around 30% of borrowers have annual incomes below $30,000, highlighting the economic challenges many face. Many borrowers rely on these loans due to a lack of access to traditional banking services or credit.

The growing reliance on payday loans among diverse demographics indicates that as economic conditions fluctuate, borrowing behaviors may continue to evolve. It emphasizes the need for both lenders and policymakers to remain aware of these dynamics to better serve and protect consumers.

Impact of Payday Loans on Borrowers’ Financial Health

Research has shown that while payday loans can provide immediate financial relief, they often result in a detrimental cycle of debt for many borrowers. Those who frequently utilize these loans may find themselves caught in a never-ending loop of borrowing, which adversely affects their long-term financial health and creditworthiness.

One of the primary issues is that payday loans typically come with high fees and interest rates, leading to challenges in repayment. The cycle of borrowing often forces individuals to take out new loans to repay old ones, exacerbating their financial situations. This can lead to significant negative impacts on credit scores, making it more challenging to access affordable credit in the future.

Moreover, studies suggest that excess reliance on payday loans can contribute to heightened stress and anxiety around financial matters, further destabilizing borrowers’ overall well-being. It becomes essential for consumers to weigh the short-term benefits against the potential long-term consequences when considering payday loans.

Expert Insights on Payday Loan Outlook for Texas in 2025

Economic Factors Influencing Payday Loan Demand

The demand for payday loans in Texas is closely tied to various economic factors such as unemployment rates, inflation, and overall economic stability. When the economy faces downturns, or unemployment rates rise, individuals often turn to payday loans for immediate cash flow solutions. For instance, during the economic challenges posed by the COVID-19 pandemic, many Texans found themselves with reduced incomes or job losses, leading to increased reliance on payday lending services.

Historically, economic shifts have demonstrated a clear correlation with payday loan usage. For example, following the 2008 financial crisis, there was a notable surge in payday loan demand as many struggled to meet basic living expenses. Such patterns highlight the sensitivity of payday loan usage to broader economic conditions.

Looking ahead to 2025, economists predict that ongoing inflation and potential increases in living costs may further drive the demand for payday loans. As wages may not keep pace with rising expenses, consumers may increasingly rely on these loans as a stopgap, reinforcing the need for lenders to adapt their services to meet changing consumer needs.

Technological Advances in Payday Lending

With the advent of new technologies, the landscape of payday lending in Texas is evolving. Online applications and mobile apps have transformed how borrowers access loans, making the process more streamlined and accessible. Lenders who embrace these technologies can significantly enhance their customer experience and operational efficiency.

For lenders looking to adapt, it’s crucial to invest in robust online platforms that offer easy application processes, quick approval times, and transparent loan terms. Moreover, integrating technology can facilitate better risk assessment through AI-driven analytics, helping lenders make more informed lending decisions.

To remain competitive in this rapidly changing environment, lenders should consider the following actionable strategies:

- Implement mobile-friendly platforms for loan applications.

- Utilize AI to assess borrower risk more accurately.

- Offer educational resources through digital channels to foster borrower understanding.

- Enhance customer service through chatbots and online support systems.

By adopting these technological advancements, lenders in Texas can create a more efficient and user-friendly experience that meets the evolving demands of borrowers.

Predictions from Industry Experts

Insights from industry experts provide valuable foresight into the future of the payday loan market in Texas. Experts anticipate that as consumer behavior shifts and regulatory environments change, the payday lending landscape will undergo significant transformations by 2025.

One primary prediction is that lenders will face increased competition from alternative financial services, such as credit unions and peer-to-peer lending platforms. These alternatives may offer more favorable terms and attract borrowers who are cautious of traditional payday loans.

Moreover, experts suggest that there may be a move towards more ethical lending practices, with a focus on consumer welfare and responsible lending. This shift could lead to a decrease in the rates charged by lenders, promoting healthier financial habits among consumers.

As the industry evolves, staying ahead of trends and consumer expectations will be essential for lenders. This foresight can shape marketing strategies, product offerings, and overall approaches to customer engagement moving into 2025.

How Will Regulatory Changes Impact Payday Loans?

Potential New Legislation in Texas

As discussions surrounding payday loan regulations intensify, various proposals have emerged that could drastically reshape the lending landscape in Texas. Potential new legislation could introduce significant changes, such as stricter caps on interest rates, enhanced borrower protections, and more transparent disclosure requirements.

For instance, proposed changes might include:

- Reducing the maximum allowable APR for payday loans to curb excessive fees.

- Implementing mandatory financial education programs for borrowers seeking loans.

- Strengthening oversight and compliance requirements for lenders to ensure ethical practices.

- Introducing penalties for lenders that engage in predatory practices.

These legislative reforms aim to create a more equitable lending environment while protecting vulnerable borrowers from falling into deep debt. Lenders must proactively prepare for these changes to comply and maintain their operational viability.

Impact on Lenders and Borrowers

The introduction of new regulations will have profound implications for both lenders and borrowers in Texas. For lenders, adapting to stricter regulations may necessitate significant operational changes, including revising loan terms and adjusting pricing structures.

This shift may lead to a decrease in profit margins for lenders, compelling them to find innovative ways to maintain profitability while adhering to new rules. For instance, lenders might need to explore diversifying their product offerings or implementing technology solutions to reduce operational costs.

For borrowers, the impact could be positive, as stricter regulations may enhance their protection against predatory lending practices. Clearer terms and lower interest rates would likely lead to healthier borrowing experiences and better financial outcomes for consumers navigating these loans.

Overall, the regulatory landscape is poised for transformation that may ultimately benefit both lenders and borrowers in Texas.

Enforcement and Compliance Challenges

As Texas moves toward potential regulatory changes in payday lending, compliance and enforcement present significant challenges for lenders. Ensuring adherence to new laws will require careful monitoring and robust internal processes.

To navigate these challenges, lenders should consider the following strategies:

- Implementing comprehensive training programs for staff on regulatory compliance.

- Utilizing technology to automate compliance monitoring and reporting.

- Establishing clear policies and procedures for loan approvals and disclosures.

- Engaging with legal experts to stay informed on regulatory changes.

By prioritizing compliance, lenders can mitigate risks associated with regulatory violations and foster trust with consumers. Transparency and accountability will be key in maintaining positive reputations within the community.

Consumer Protection Measures

Enhanced consumer protection measures are likely to accompany new payday lending regulations in Texas. These measures may include stricter requirements for loan disclosures, ensuring that borrowers fully understand the terms and implications of their loans.

For instance, regulations could mandate that lenders provide clearer explanations of fees, payment schedules, and potential penalties. This transparency empowers borrowers to make informed decisions, reducing the likelihood of misunderstanding or mismanagement of loan obligations.

Additionally, new consumer protection laws may introduce stronger penalties for non-compliance among lenders, further incentivizing ethical lending practices. By prioritizing consumer protection, Texas can shape a lending environment that fosters responsible borrowing and promotes financial well-being for all Texans.

Market Growth and Expansion in Payday Loans

Projected Growth Rates for Payday Loans

Analysts project steady growth in the payday loan market in Texas over the next few years. Several factors contribute to this anticipated growth, including demographic trends and economic conditions that influence borrowing behaviors.

As the population continues to expand, especially in urban centers, the demand for short-term financial solutions is likely to rise. Moreover, with ongoing economic fluctuations and increased living costs, Texans may increasingly turn to payday loans as a viable option for managing financial shortfalls.

Market analysts predict a compound annual growth rate (CAGR) of around 5% in the payday loan sector, indicating a robust trajectory for the industry. Lenders who adapt to changing market dynamics and prioritize consumer needs will be well-positioned to capitalize on this growth.

Expansion of Payday Loan Services

In response to evolving consumer demands, lenders are likely to explore expanding their payday loan services. This expansion may include diversifying product offerings to meet various financial needs, such as short-term loans for medical expenses or pay advances for unexpected bills.

Innovative products, such as installment loans or hybrid loan options, may emerge as lenders seek to provide borrowers with more flexible and manageable repayment terms. By tailoring their offerings, lenders can cater to a broader customer base and address the unique challenges faced by different demographics.

Additionally, enhancing customer service through personalized communication and support may further solidify lender-borrower relationships. By investing in customer engagement strategies, payday loan providers can differentiate themselves in a competitive market landscape.

Competition from Alternative Financial Services

As the payday loan market in Texas experiences growth, it will inevitably face competition from alternative financial services. These alternatives, including credit unions, peer-to-peer lending platforms, and other short-term lending options, are gaining traction among consumers seeking more favorable terms.

Credit unions, for example, often offer lower interest rates and more flexible repayment schedules than traditional payday loans. This competitive edge positions them as attractive options for borrowers looking to avoid high fees associated with payday lending.

Moreover, the rise of online lending platforms and fintech companies has increased accessibility to credit, particularly for younger consumers accustomed to digital transactions. As these alternatives gain popularity, payday lenders must adapt their strategies to remain relevant and appealing to potential borrowers.

Ultimately, understanding the competitive landscape will be crucial for payday lenders to identify opportunities and address challenges effectively.

What Are the Consumer Trends in Payday Loan Usage?

Changing Borrower Needs and Preferences

Consumer preferences in the payday loan market continue to evolve, reflecting broader economic and social trends. As financial literacy improves and individuals become more aware of their borrowing options, the types of loans consumers seek are changing.

Borrowers today often prioritize convenience and speed in the loan application process. Services that offer quick approvals and immediate access to funds are likely to attract more customers. Furthermore, as many borrowers seek alternatives to traditional payday loans, lenders must adapt to meet these preferences by considering innovative solutions.

By embracing customer feedback and understanding the underlying motivations behind borrowing, lenders can tailor their offerings to better satisfy the changing needs of consumers. This responsiveness will be crucial in maintaining a competitive edge in the market.

Impact of Financial Education on Loan Usage

Increased financial literacy can significantly influence how consumers approach payday loans. As borrowers gain a better understanding of budgeting, credit scores, and responsible borrowing, their borrowing behaviors may shift toward more prudent financial decisions.

Educational initiatives, such as community workshops and online resources, can empower consumers to make informed choices regarding payday loans. By equipping individuals with knowledge about the implications of borrowing, lenders can help foster a more responsible borrowing culture.

Moreover, borrowers who engage in financial education are more likely to seek loans only when necessary, reducing reliance on payday loans. This shift could lead to healthier financial outcomes and a reduction in the cycle of debt that often characterizes payday borrowing.

Consumer Feedback and Satisfaction Levels

Understanding consumer feedback is paramount for lenders looking to enhance their services in the payday loan market. Gathering insights from borrowers can shed light on their experiences and satisfaction levels, informing improvements in the lending process.

Common consumer concerns often include high-interest rates, hidden fees, and the lack of transparency in loan terms. Addressing these issues is essential for building trust and fostering positive relationships with borrowers.

A summary of common feedback might include:

- High costs associated with loan repayment.

- Lack of clarity regarding loan terms and conditions.

- Desire for more flexible repayment options.

- Concerns over aggressive collection practices.

By actively soliciting and responding to consumer feedback, lenders can enhance satisfaction levels and position themselves as trustworthy partners for borrowers navigating short-term financial needs.

Research-Backed Benefits of Payday Loan Outlook for Texas in 2025

Economic Impact of Payday Loans

The economic implications of payday loans are multifaceted, with both positive and negative effects on consumers and the broader economy. On one hand, payday loans provide immediate access to cash for individuals facing unexpected expenses, thereby supporting local economies.

However, frequent reliance on these loans can lead to long-term financial struggles for borrowers, which ultimately affects their overall economic stability. To maximize the benefits of payday loans while minimizing risks, policymakers can consider implementing programs that promote financial education and responsible lending practices.

By fostering an environment that encourages informed borrowing, Texas can leverage the positive aspects of payday loans while safeguarding consumers against the potential pitfalls associated with high-cost borrowing.

Accessibility and Convenience for Borrowers

One of the notable advantages of payday loans is their accessibility and convenience for those in immediate financial distress. The ability to obtain quick funds can be crucial for individuals facing emergencies, such as medical bills, car repairs, or unexpected housing costs.

To enhance this accessibility, lenders should focus on streamlining their application processes and offering flexible loan products that cater to varying needs. For example, incorporating online applications and mobile-friendly platforms can make it easier for consumers to access funds when they need them most.

Moreover, lenders should consider developing partnerships with local organizations that provide financial assistance to underserved populations, ensuring that those who need access to funds the most can obtain them in a timely and efficient manner.

Financial Inclusion and Payday Loans

Payday loans can play a significant role in promoting financial inclusion for underserved populations in Texas. Many individuals lacking access to traditional banking services may find payday loans to be one of the few available options for obtaining financial support.

Real-world examples illustrate how payday loans have facilitated access to credit for those outside the conventional financial system. By offering loans to individuals with limited credit history or low income, payday lenders can help bridge the gap and enable financial participation.

Nonetheless, it remains crucial for lenders to operate responsibly and ethically, ensuring that they do not exploit vulnerable borrowers. By fostering a culture of financial inclusion while prioritizing consumer well-being, payday lenders can contribute positively to the financial landscape in Texas.

What Are the Challenges Facing Payday Loan Providers?

Managing Risk and Default Rates

High default rates pose a significant challenge for payday loan providers, impacting their profitability and long-term sustainability. Many lenders struggle to manage the risks associated with non-repayment, leading to increased scrutiny from regulators and negative consumer perceptions.

To mitigate these risks, payday lenders can implement strategies such as thorough credit assessments, risk-based pricing, and proactive communication with borrowers regarding repayment options. By adopting a more holistic approach to risk management, lenders can foster healthier lending practices.

Moreover, embracing technology to enhance risk assessment processes can further improve the ability to identify and manage potential defaults. By leveraging data analytics and predictive modeling, lenders can make more informed decisions about loan approvals and terms.

Balancing Profitability and Consumer Protection

Finding the right balance between profitability and consumer protection is a key challenge for payday loan providers. While lenders must maintain profitable operations, they also have an ethical responsibility to safeguard consumers against predatory practices.

One effective strategy for achieving this balance is to develop transparent pricing structures that clearly outline fees and interest rates. By ensuring borrowers understand the costs associated with loans, lenders can foster trust and reduce the likelihood of misunderstandings that may lead to debt cycles.

Additionally, offering flexible repayment options can enhance consumer satisfaction while promoting responsible borrowing. By prioritizing consumer welfare alongside profitability, payday lenders can establish themselves as reputable entities within the financial landscape.

Adapting to Changing Market Conditions

The payday loan market is subject to constant change, requiring lenders to adapt quickly to evolving conditions. Shifts in economic trends, regulatory environments, and consumer preferences necessitate a proactive approach to maintain competitiveness and relevance.

To effectively navigate these changes, lenders should invest in market research to stay informed about emerging trends and consumer needs. This foresight can guide the development of new products and services that align with market demands.

Moreover, fostering a culture of innovation within the organization can empower lenders to explore creative solutions that address evolving challenges. By remaining agile and responsive, payday loan providers can position themselves for success in an ever-changing landscape.

Future Innovations in Payday Loan Services

Integration of AI and Machine Learning

The integration of AI and machine learning technologies is set to revolutionize the payday loan industry. These advancements offer lenders the opportunity to enhance their loan approval processes and improve risk assessment methodologies.

By utilizing AI-driven algorithms, lenders can analyze vast amounts of data to predict borrower behavior and assess creditworthiness more accurately. This capability may lead to more personalized loan offers and better matching of borrowers with appropriate products.

Additionally, AI can streamline operational efficiencies, allowing lenders to automate routine tasks and reduce processing times. By embracing these technologies, payday loan providers can enhance their competitive advantage in the market and respond more effectively to consumer needs.

Development of New Loan Products

As consumer preferences evolve, the development of new loan products will become increasingly important for payday lenders. Innovative offerings that cater to specific financial needs can differentiate lenders in a crowded marketplace.

Potential new products may include installment loans with more manageable repayment terms, or loans specifically designed for medical emergencies or housing costs. By diversifying their product lines, lenders can address various borrower circumstances and increase their appeal to a wider audience.

Moreover, incorporating features such as loyalty programs or interest rate reductions for repeat borrowers can incentivize responsible borrowing and enhance customer relationships.

Enhancing Customer Experience

Improving the customer experience is paramount for payday lenders looking to thrive in a competitive environment. By focusing on providing exceptional service and user-friendly interfaces, lenders can establish strong relationships and foster borrower loyalty.

Strategies to enhance customer experience may include:

- Implementing user-friendly online platforms for easy loan applications.

- Offering responsive customer support via multiple channels, including chat and phone.

- Personalizing communication to enhance borrower engagement.

- Providing educational resources to empower informed borrowing decisions.

By prioritizing customer experience, payday loan providers can position themselves as trusted partners for borrowers navigating short-term financial needs, ultimately leading to long-term success in the industry.

FAQs

What are payday loans?

Payday loans are short-term loans intended to cover immediate expenses, typically due on the borrower’s next payday. They often come with high-interest rates and fees.

How much can I borrow with a payday loan in Texas?

In Texas, payday loans can range from $100 to $1,000, depending on the lender and the borrower’s financial profile.

What are the typical fees for payday loans?

Fees for payday loans in Texas can vary, but they often range from $15 to $30 for every $100 borrowed, leading to high annual percentage rates (APRs).

How long do I have to repay a payday loan?

Repayment terms for payday loans in Texas generally range from two weeks to one month, aligning with the borrower’s next payday.

Can payday loans affect my credit score?

Yes, payday loans can impact your credit score, especially if payments are missed or if the loan is sent to collections. Responsible repayment can help improve your credit over time.

Are payday loans legal in Texas?

Yes, payday loans are legal in Texas; however, they are regulated by the state to protect consumers from predatory lending practices.

What happens if I can’t repay my payday loan on time?

If you cannot repay your payday loan on time, lenders may offer extensions or partial payments, but high fees and interest can accrue, leading to a cycle of debt.

Are there alternatives to payday loans?

Yes, alternatives to payday loans include credit unions, personal loans, and installment loans, which often feature lower interest rates and more favorable repayment terms.

How can I avoid payday loan debt cycles?

To avoid payday loan debt cycles, consider creating a budget, seeking financial counseling, and exploring alternative lending options that offer better terms.

What should I consider before taking a payday loan?

Before taking a payday loan, consider the total cost of borrowing, your ability to repay on time, and whether there are alternative financial solutions that better fit your needs.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

The statistics presented in your post about payday loans in Texas highlight a complex and often troubling aspect of our financial landscape. It’s striking to consider that approximately 1.3 million Texans depend on payday loans annually, reflecting a significant reliance on high-interest, short-term borrowing. The fact that the average loan amount hovers around $400 is noteworthy; many people may not realize how quickly such loans can spiral out of control, particularly given that over 60% of borrowers take out multiple loans within a year.

It’s fascinating to see how deeply payday loans are woven into the fabric of financial life for so many Texans. The statistic that around 1.3 million individuals rely on these loans each year speaks volumes about the pressing need for short-term financial solutions in times of crisis. Many people don’t realize that for some, a payday loan can mean the difference between managing an emergency expense or facing larger financial destabilization.

It’s interesting to see how much dependence there is on payday loans in Texas, especially among younger folks in that 25-34 age range. Just thinking about it, those loans can be such a double-edged sword. They provide quick cash when you really need it, but the fees can spiral out of control if you’re not careful.

It’s really interesting to see the statistics on payday loans in Texas; it highlights just how intertwined these loans have become with people’s financial lives. With around 1.3 million Texans relying on them each year, it raises some serious questions about access to financial literacy and alternate resources. I’ve heard from friends that for many in their 20s and 30s, payday loans seem like the only option when unexpected expenses pop up. It’s like a trap; you take out one loan to cover a bill, and before you know it, you’re in the cycle of borrowing more and more just to keep up.