Key Points to Remember

- Definition: Payday loans are short-term, high-interest loans due on the borrower’s next payday.

- Interest Rates: In Texas, payday loans can carry interest rates exceeding 300% APR.

- Alternatives: Options like credit union loans and borrowing from family can provide safer alternatives to payday loans.

- Regulations: Texas laws set limits on certain fees but may not adequately address high interest rates.

Understanding Texas Payday Loans

What Are Payday Loans?

Payday loans are short-term, high-interest loans typically due on the borrower’s next payday. They are designed to offer quick cash for those facing unexpected expenses but can quickly lead to a cycle of debt that is difficult to escape. Borrowers often turn to payday loans for reasons such as covering emergency medical bills, paying utility bills that are due, managing car repairs, funding essential living expenses during a financial shortfall, or dealing with unexpected situations like job loss or urgent travel needs. However, the convenience of quick access to cash comes at a high price, often resulting in exorbitant interest rates and fees that can trap borrowers in a continuous cycle of borrowing.

How Do Payday Loans Work in Texas?

In Texas, payday loans are regulated under state law but still carry exorbitantly high interest rates. The process typically involves borrowers providing a post-dated check or electronic access to their bank accounts. This allows lenders to cash the check or withdraw funds directly from the borrower’s account on the due date, which is often aligned with the borrower’s payday. This method can lead to significant fees if borrowers are unable to repay the loan on time, forcing them to roll over their loans, which incurs additional charges. Understanding this mechanism is crucial for borrowers to navigate the payday loan landscape safely and avoid the pitfalls associated with these financial products.

Legal Regulations in Texas

Texas law outlines specific regulations for payday loans, including caps on certain fees and limits on rollovers. These regulations aim to protect consumers from predatory lending practices. For instance, lenders are prohibited from charging excessive fees beyond the established limits, which helps mitigate some of the risks associated with high-cost loans. However, despite these regulations, many borrowers still find themselves in precarious financial situations due to the high interest rates prevalent in the payday loan industry. Familiarizing oneself with these laws is essential, as it equips borrowers with the knowledge to make informed decisions and seek help if they believe they are being charged unfairly.

Alternatives to Payday Loans in Texas

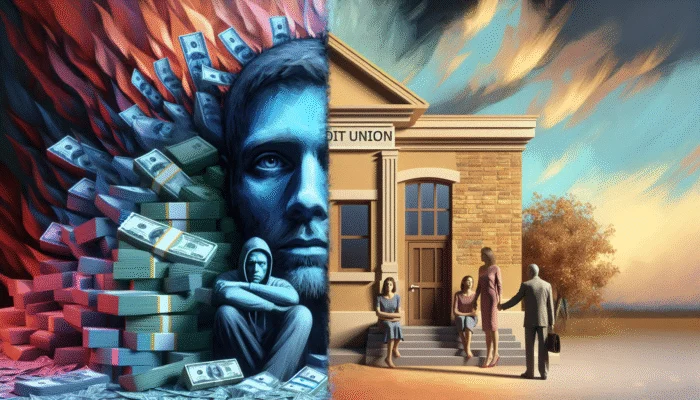

Exploring alternatives to payday loans can significantly reduce financial strain. Numerous options exist that can provide immediate financial relief without the high costs associated with payday lending. Credit union loans often feature lower interest rates and more favorable repayment terms, making them a viable alternative. Additionally, borrowing from family or friends can eliminate interest charges altogether, although it’s important to have clear agreements in place to maintain relationships. Emergency assistance programs offered by local non-profits or government agencies can also help bridge financial gaps without incurring debts. By understanding these alternatives, individuals can craft strategies to avoid the pitfalls associated with payday loans.

Expert Insights on What Are Texas Payday Loan Pitfalls

What Are the Most Common Pitfalls?

The most common pitfalls associated with payday loans include high interest rates, short repayment periods, and the substantial risk of falling into a debt cycle. Borrowers often underestimate the total cost of these loans, which can lead to surprise fees and financial repercussions. For instance, the average payday loan can carry an interest rate upwards of 300% APR, making it incredibly difficult for borrowers to pay off the principal plus interest. Additionally, many borrowers find themselves unable to meet the short repayment deadlines, leading to rollovers that accrue even more fees. To mitigate these pitfalls, borrowers should carefully review the terms before committing to a loan and consider setting up a strict repayment plan that includes a budget to avoid falling into this cycle.

How Can Borrowers Protect Themselves?

Borrowers can take several proactive steps to protect themselves when considering payday loans. First, understanding the full terms of the loan agreement is crucial. This means not only looking at the interest rate but also evaluating any potential fees, the total repayment amount, and the repayment timeline. Shopping around for the best rates can also yield better terms, as different lenders may offer varying conditions. Additionally, establishing a clear repayment plan before taking out a loan can help ensure that the borrower is prepared to meet their obligations. This plan should include setting aside a portion of their income specifically for loan repayment, which can alleviate the stress of trying to find funds at the last minute.

Real-World Examples of Payday Loan Issues

Real-world examples reveal the challenges many Texans face when dealing with payday loans. For instance, one borrower took out a 0 payday loan with a 400% APR, planning to repay it within two weeks. However, due to unforeseen medical expenses, they couldn’t pay on time and were forced to roll over the loan, incurring additional fees that ballooned the total amount owed to over $700. Another example shows a borrower whose reliance on payday loans led to a significant drop in their credit score after multiple defaults, severely impacting their ability to secure future loans. These cases underscore the potential dangers and financial consequences of payday loans, highlighting the need for consumers to approach them with caution and consideration.

How Do State Regulations Impact Payday Loans?

State regulations play a critical role in shaping the payday loan landscape. Texas laws set limits on the fees lenders can charge, which can help protect borrowers from excessive charges. However, these laws often do not adequately address the high-interest rates that can trap borrowers in a cycle of debt. Additionally, regulations on loan rollovers can vary, affecting how many times a loan can be extended before full repayment is required. Understanding these regulations is essential for borrowers, as it can help them navigate their options and seek legal recourse if they suspect that lenders are violating state laws. The impact of state regulations underscores the importance of consumer advocacy and the need for ongoing reforms to better protect borrowers.

What Are Alternatives to Payday Loans?

Alternatives to payday loans offer safer borrowing options that can help individuals avoid high costs and potential debt traps. Personal loans from banks or credit unions typically feature lower interest rates and longer terms, making them more manageable for borrowers. Credit card cash advances can also be a viable option, although they come with their own set of fees and interest rates. Additionally, borrowing from friends or family can provide immediate relief without the burdens of high-interest loans. Each of these alternatives comes with key benefits: personal loans often come with fixed repayment plans, credit card advances can be quick and easy, and family loans can offer interest-free options. Understanding these alternatives empowers borrowers to make better financial decisions and avoid the pitfalls associated with payday loans.

Financial Impact of Payday Loans in Texas

What Are the Costs Associated with Payday Loans?

The costs associated with payday loans can be staggering, often including high interest rates, late payment fees, and potential bank charges if a check bounces. For borrowers, the immediate cash received may seem like a solution, but the reality is that the total repayment can far exceed the initial amount borrowed. Many payday loans can have interest rates exceeding 300%, leading to the potential accumulation of hundreds of dollars in fees over a short period. Understanding these costs is pivotal for making informed borrowing decisions; a clear picture of the total expenses can help borrowers weigh their options and consider less costly alternatives.

Long-Term Effects on Personal Finances

The long-term effects of repeatedly using payday loans can be detrimental to personal finances. Borrowers who rely on these loans often find themselves trapped in a cycle of debt, where they must continuously take out new loans to pay off old ones. This dependency can lead to damaged credit scores, making it difficult for individuals to qualify for traditional loans or secure favorable interest rates in the future. Additionally, the financial strain of managing multiple loans can impede long-term financial goals, such as saving for retirement or purchasing a home. Understanding these long-term effects highlights the importance of seeking alternatives to payday loans and establishing a sound financial strategy that prioritizes stability and growth.

Impact on Credit Scores

Payday loans can have a significant negative impact on credit scores, particularly if borrowers fail to repay their loans on time. Defaults and late payments are reported to credit bureaus and can lower a borrower’s creditworthiness. Furthermore, the reliance on payday loans can lead to an overall decline in financial health, as missed payments may result in collections, further damaging credit scores. For renters or future homebuyers, this can translate to higher security deposits, increased interest rates for loans, or even denial of credit altogether. Being aware of how payday loans can impact credit scores is crucial for borrowers, allowing them to make informed decisions that protect their financial future.

Alternatives to Payday Loans in Texas

What Are Safer Borrowing Options?

Safer borrowing options present viable alternatives to the high costs associated with payday loans. Personal loans from banks or credit unions often come with lower interest rates and more manageable repayment schedules. For instance, personal loans can range from 6% to 36% APR, significantly lower than the average payday loan. Credit card cash advances can be another option, although they typically accrue interest immediately, making it essential to pay them off quickly. Additionally, borrowing from friends or family can eliminate interest costs altogether, although it’s critical to maintain transparent communication to avoid straining relationships. Each alternative has its own benefits:

- Lower interest rates compared to payday loans.

- Longer repayment terms, allowing for manageable payments.

- Potential for no interest if borrowing from friends or family.

- Access to funds typically requires less stringent credit checks.

Exploring these safer options helps borrowers make informed decisions and avoid the pitfalls commonly associated with payday loans.

How to Build an Emergency Fund

Building an emergency fund is a crucial financial practice that can help individuals avoid the need for payday loans in the future. A well-structured emergency fund provides a safety net during unexpected financial hardships, reducing reliance on high-interest loans. Effective strategies for building this fund include setting a realistic savings goal based on monthly expenses and automating savings deposits directly into a dedicated account. This approach not only ensures consistency but also makes saving a priority. Additionally, cutting unnecessary expenses, such as dining out or subscription services, can free up funds to direct toward the emergency fund. Establishing this financial cushion empowers individuals to navigate financial challenges more confidently, reducing the temptation to resort to payday loans.

Community Resources and Assistance Programs

Texas offers a variety of community resources and assistance programs aimed at aiding residents facing financial difficulties. Organizations such as the Texas Workforce Commission provide job placement services and training, while local non-profits often offer emergency financial assistance for utilities, rent, and medical expenses. Food banks and meal programs can help alleviate immediate living costs, allowing individuals to redirect funds towards crucial expenses. Additionally, many communities host financial literacy workshops that educate residents on budgeting and savings strategies. By taking advantage of these resources, individuals can find support without the burden of high-cost payday loans, ultimately fostering long-term financial stability.

Research-Backed Benefits of What Are Texas Payday Loan Pitfalls

Understanding the Cycle of Debt

Research consistently indicates that payday loans can lead to a damaging cycle of debt due to their high interest rates and short repayment periods. This cycle occurs when borrowers are unable to repay their loans on time and are forced to roll them over, incurring additional fees that accumulate quickly. To break this cycle, borrowers must seek alternatives to payday loans and explore effective financial planning strategies. These steps could include creating a realistic budget, prioritizing essential expenses, and considering debt consolidation options that allow for lower interest rates and more manageable repayment plans. Understanding this cycle empowers individuals to take control of their financial situations and seek help before falling deeper into debt.

What Are the Psychological Effects of Payday Loans?

The psychological effects of managing payday loans can be profound. Borrowers often experience heightened stress and anxiety due to the pressure of looming repayment deadlines and the potential consequences of defaulting. This stress can lead to mental health issues, including anxiety disorders and depression, impacting overall well-being. Moreover, the shame associated with financial struggles can further isolate individuals, making them less likely to seek help. To cope with these effects, it’s essential for individuals to engage in self-care practices and seek support from trusted friends or mental health professionals. Building a support system can provide emotional relief and practical advice, helping borrowers navigate their financial challenges more effectively.

Consumer Education and Awareness

Educating consumers about the risks associated with payday loans and the available alternatives can lead to better financial choices. Awareness initiatives, such as community workshops and online resources, offer valuable information on budgeting, savings strategies, and credit management. Real-world examples of successful consumer education programs demonstrate that informed individuals are less likely to fall into the payday loan trap. For instance, programs that provide financial literacy training have shown reduced reliance on payday loans among participants, empowering them to seek safer borrowing options. By fostering a culture of financial education and awareness, communities can help individuals make informed decisions and promote long-term financial health.

Strategies for Managing Payday Loan Debt in Texas

What Are the Best Practices for Repayment?

Implementing best practices for repayment is essential for managing payday loan debt effectively. Prioritizing high-interest loans first can help borrowers save money in the long run. It may be beneficial to establish a repayment plan that outlines specific amounts to be paid each month, allowing borrowers to visualize their progress and stay motivated. Additionally, negotiating with lenders for lower fees or extended repayment terms can ease the financial burden. Borrowers should also explore debt consolidation options, which can allow them to combine multiple high-interest loans into a single loan with a lower rate, simplifying payments and reducing overall costs. By adopting these practices, borrowers can regain control of their finances and work towards eliminating their debt.

How to Negotiate with Payday Lenders

Negotiating with payday lenders can be daunting but is often necessary to achieve more favorable terms. Borrowers should approach negotiations prepared, armed with knowledge of their financial situation and an understanding of what they can afford. It’s crucial to communicate openly with lenders about any difficulties in making payments, as many are willing to work with borrowers to find solutions. Asking for lower fees, extended repayment terms, or settlement options can lead to better outcomes. Keeping detailed records of all communications and agreements can also be beneficial should disputes arise later. By being proactive and assertive in negotiations, borrowers can potentially alleviate some of the financial strain caused by payday loans.

Seeking Professional Help

Seeking professional help from credit counselors or financial advisors can provide invaluable guidance in managing payday loan debt. These professionals can offer personalized plans tailored to individual financial situations, helping borrowers navigate their options more effectively. Credit counselors can assist in creating budgets, establishing repayment plans, and negotiating with lenders. Additionally, they can provide resources for debt relief and financial education. For those overwhelmed with debt, seeking assistance can be a critical step toward regaining financial stability. Accessing professional help empowers individuals to address their financial challenges head-on and work towards long-term solutions.

Exploring Legal Options for Debt Relief

Understanding Texas laws concerning payday loans can open avenues for legal remedies or protections if borrowers find themselves in challenging situations. Legal options may include filing complaints with state regulatory agencies if lenders violate state laws, seeking protection from aggressive collection practices, or exploring bankruptcy as a last resort for overwhelming debt. Many legal aid organizations offer free or low-cost consultations to help individuals assess their situations and outline possible steps forward. By being aware of their legal rights and options, borrowers can potentially reduce the burden of payday loan debt and establish a path toward financial recovery.

FAQs

What is a payday loan?

A payday loan is a short-term, high-interest loan typically due on the borrower’s next payday, designed to cover emergency expenses.

What are the interest rates on payday loans in Texas?

Interest rates on payday loans in Texas can exceed 300% APR, making them one of the most expensive borrowing options available.

How can I avoid payday loan debt?

To avoid payday loan debt, consider building an emergency fund, exploring alternatives like credit union loans, and establishing a strict budget.

What are the risks of payday loans?

Risks of payday loans include high interest rates, potential fees for late payments, and the risk of falling into a cycle of debt.

Can I negotiate payday loan terms?

Yes, borrowers can negotiate terms with payday lenders, including asking for extended repayment periods or lower fees.

What should I do if I can’t repay my payday loan?

If unable to repay a payday loan, consider contacting the lender to discuss payment options and seek financial counseling for managing debts.

What are some alternatives to payday loans?

Alternatives include personal loans from banks, credit union loans, borrowing from family or friends, and emergency assistance programs.

How do payday loans affect my credit score?

Payday loans can negatively impact your credit score if unpaid or defaulted, as lenders may report these actions to credit bureaus.

Are there any legal protections for payday loan borrowers in Texas?

Yes, Texas law regulates payday loans, placing caps on fees and protecting borrowers from predatory practices.

How can I build an emergency fund?

To build an emergency fund, set a savings goal, automate monthly savings, and cut back on non-essential expenses to increase savings potential.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

Ah, payday loans—like that friend who promises to spot you some cash but then disappears right when it’s time to pay them back. I once thought I’d be clever and borrowed one to cover a surprise car repair, and let’s just say my “plan” snowballed faster than I could say “interest rates.”

It’s interesting how payday loans serve as a quick fix for urgent financial needs, but I’ve seen firsthand how they can spiral into deeper debt. A friend of mine got caught in that cycle after taking one out to cover a medical bill. The high interest quickly undid any relief they thought they found, leading to even more financial stress.

It’s definitely a tricky situation, isn’t it? Your friend’s experience highlights a harsh reality that many face with payday loans. They can feel like a lifeline in a moment of crisis, but the high interest rates can quickly turn a small financial fix into a mountain of debt.

The points you’ve outlined about payday loans in Texas really highlight a critical issue that often gets overshadowed by the allure of quick cash. It’s unsettling how easily individuals can find themselves entrapped in a cycle of debt simply because of a momentary financial need. I’ve seen friends and family members turned into reluctant repeat customers of payday lenders, where what initially seemed like a lifebuoy amidst financial strain became a potential anchor pulling them deeper into financial despair.

You’ve touched on a really important point that often goes unnoticed until it’s too late. The way payday loans can quickly turn from a helpful solution to a source of stress is something I’ve witnessed as well. It’s almost like a trap that can ensnare anyone who feels they have no other options. The instant gratification of cash in hand feels like a lifeline, but you’re right—what follows can all too easily become an anchor.