Mastering Payday Loan Repayment Tools for Financial Success

What Exactly Are Payday Loan Repayment Tools?

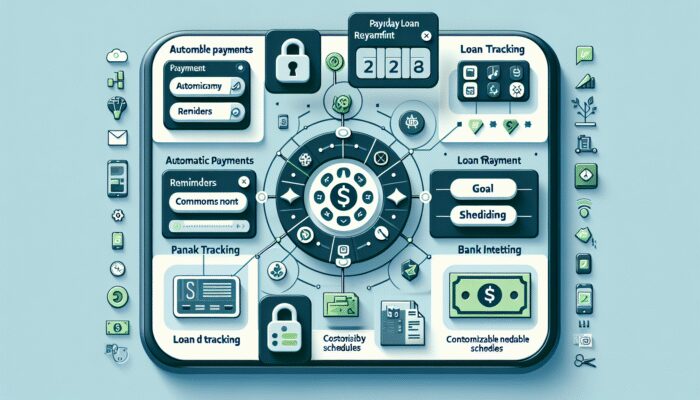

Payday loan repayment tools are specialized applications and software designed to assist borrowers in efficiently managing and repaying their payday loans. These tools aim to simplify the repayment process, reducing stress and confusion for users. Typically, payday loan repayment tools offer a range of features that enhance the user experience, including:

- Automatic payments to guarantee timely loan repayment

- Payment reminders to help avoid late fees

- Budgeting assistance for better financial management

- Loan tracking to keep tabs on outstanding balances

- Customizable payment schedules tailored to individual income

- Financial goal setting for improved loan management

- Integration with bank accounts for seamless transactions

The functionality and user interface of these tools can vary widely, but their primary goal remains the same: to empower borrowers to maintain control over their financial commitments. By providing a detailed overview of repayment schedules and outstanding balances, users can avoid the common pitfalls associated with misunderstanding their loan terms and obligations.

What Are the Advantages of Using Repayment Tools?

Utilizing payday loan repayment tools offers numerous benefits geared toward enhancing the user’s financial health while simplifying the repayment process. One of the most notable advantages is the ability to avoid late fees, which can accumulate quickly and disrupt financial stability. Moreover, repayment tools can positively affect a user’s credit score by ensuring timely payments are consistently made. Key benefits of employing these repayment tools include:

- Reduction of stress related to managing multiple payments

- Increased likelihood of making on-time payments

- Improvement in overall credit health

- Enhanced budgeting capabilities for effective financial management

- Access to historical payment data for informed decision-making

- Customization options tailored to individual financial situations

- Educational resources that improve understanding of loan terms and repayment strategies

By leveraging these advantages, borrowers can transform what is often a daunting repayment experience into a manageable aspect of their financial lives. These tools effectively serve as financial partners, guiding users through each step of their repayment journey.

How Can You Select the Best Tool for Your Needs?

Choosing the right payday loan repayment tool requires thoughtful consideration of various factors to ensure it aligns with your specific financial needs. The first aspect to evaluate is the tool’s ease of use; a user-friendly interface can greatly enhance the overall experience. Additionally, cost is a critical consideration; while some tools offer free services, others may impose fees that could impact your overall savings.

When assessing options, prioritize features such as customizable payment plans that can adapt to your unique income cycle. It’s also wise to determine whether the tool provides integration with your bank account for automatic payments, as this can significantly streamline the repayment process.

Other important factors might include:

- User reviews and testimonials for insights into real-world effectiveness

- Security features to safeguard sensitive financial information

- Customer support for those needing assistance

- Mobile accessibility for managing finances on the go

- Reporting capabilities to analyze payment habits and overall financial health

By focusing on these elements, you can select a repayment tool that not only meets your immediate needs but also supports your long-term financial aspirations.

Expert Perspectives on Navigating Payday Loan Repayment Tools

How Can Financial Experts Assist in Utilizing Repayment Tools?

Experienced professionals in financial management and loan repayment can provide essential guidance in navigating the often intricate landscape of payday loan repayment tools. Their expertise extends beyond merely recommending tools; they can help borrowers grasp the complexities of their loan terms, empowering them to make well-informed decisions.

Moreover, experts can evaluate the effectiveness of various tools based on individual circumstances and recommend those with proven success in improving repayment rates while minimizing the risk of debt traps. For example, they might point to a tool featuring personalized repayment plans that adapt to your financial situation and income cycles, making it easier to stay on top of payments.

Furthermore, their insights can help users formulate effective repayment strategies. This may involve analyzing monthly budgets, pinpointing unnecessary expenses, and cultivating habits that prioritize timely payments. Experts often stress the significance of comprehending the total costs of loans, including interest and fees, and can guide borrowers in utilizing tools that provide clarity in these areas.

What Common Mistakes Should Borrowers Avoid?

When using payday loan repayment tools, borrowers must remain vigilant to avoid certain typical pitfalls that can lead to financial difficulties. A significant concern arises when users do not fully understand a tool’s fee structure, which may include setup fees, transaction fees, or subscription costs that are not immediately apparent. Ignoring these costs can undermine the financial benefits that the tool is designed to provide.

Another frequent mistake is neglecting automatic payment settings. For instance, failing to establish reminders or adjust payment schedules in line with changes in income can result in missed payments and late fees. Users should routinely monitor their accounts to ensure that all settings are correctly configured and that payments are processed as intended.

To steer clear of these pitfalls, consider implementing the following actionable strategies:

- Thoroughly review all fees associated with the tool before making a commitment

- Regularly check automatic payment settings to ensure alignment with your cash flow

- Maintain communication with the lender regarding repayment terms

- Set up alerts or reminders for payment due dates

By proactively addressing these issues, borrowers can significantly enhance their repayment experience and avoid unnecessary financial burdens.

What Are Real-Life Examples of Tool Effectiveness?

Real-world case studies of individuals and families who have successfully utilized payday loan repayment tools illustrate the transformative potential these resources can offer. For instance, consider Jane, a single mother managing multiple payday loans. After conducting thorough research, Jane decided on a repayment tool that provided automatic payment scheduling, reminders, and budgeting features. Within six months, Jane experienced a considerable reduction in her anxiety surrounding payments and was able to pay off one of her loans completely.

Another example features Mark, a recent college graduate who found himself in debt due to a series of unpaid bills and loans. With the guidance of an expert, he selected a repayment tool equipped with loan consolidation features. Mark successfully merged his debts into a single, manageable payment plan, significantly lowering his interest rates and simplifying his financial obligations. Within a year, Mark not only improved his credit score but also gained invaluable skills in budgeting and financial planning.

These stories highlight the importance of choosing a repayment tool that aligns with personal financial situations. With the appropriate tool, borrowers can develop effective repayment strategies, leading to improved financial health and a more secure future.

How Do Payday Loan Repayment Tools Function?

What Key Features Do Repayment Tools Provide?

Payday loan repayment tools typically come equipped with a suite of features designed to facilitate efficient loan management. One of the most notable features is automatic payments, which can significantly mitigate the risk of missed payments and the accompanying late fees. By scheduling payments to coincide with payday cycles, borrowers can ensure that funds are readily available when needed, alleviating financial stress.

Additionally, many tools offer reminders that alert users about upcoming payment dates, reinforcing discipline in repayment habits. Budgeting assistance is another integral component; tools often enable users to track their income and expenses, helping them allocate funds more effectively.

Other noteworthy features include:

- Loan tracking for monitoring outstanding balances

- Financial goal setting to motivate timely repayments

- Customizable payment schedules that adapt to income variations

- Reporting tools for analyzing past payment behaviors

These features work collectively to enhance the user experience, empowering borrowers to manage their loans with greater confidence and efficiency. By understanding how these functionalities interconnect, users can maximize the benefits derived from their repayment tools.

How Do Repayment Tools Integrate with Banking Systems?

The integration with banking systems is a crucial element of payday loan repayment tools, allowing for seamless transactions and effective loan management. Most repayment tools connect directly to users’ bank accounts, enabling automatic withdrawals on designated payment dates. This feature minimizes the risk of late payments, as funds are transferred directly to the lender without the need for manual intervention.

For the integration process, users typically need to consent to securely share their banking information. This ensures that the tool can facilitate automatic payments while adhering to strict security protocols. The benefits of this integration are numerous; it not only streamlines the repayment process but also provides users with real-time insights into their financial situations.

Furthermore, many tools also offer budgeting features that analyze users’ income and expenditures, providing personalized recommendations for managing cash flow. By linking with banking institutions, these tools can track spending habits, allowing users to gain a clearer picture of their financial landscape. This comprehensive approach to financial management ensures that borrowers can remain informed and proactive about their repayment strategies.

Can Repayment Tools Assist with Loan Consolidation?

Many payday loan repayment tools include features specifically designed to assist with loan consolidation, a strategy that can greatly simplify financial management for borrowers with multiple loans. Loan consolidation enables individuals to merge several payday loans into a single payment, often resulting in a lower interest rate and more manageable repayment terms.

Tools that provide this functionality typically assess the total outstanding debts and suggest the best consolidation options based on the user’s financial situation. By consolidating loans, borrowers can reduce the complexity of managing multiple payment schedules and deadlines, leading to a more organized approach to debt repayment.

In addition, the consolidation process often includes features such as:

- Personalized payment plans tailored to individual financial capabilities

- Lower interest rates that can result in substantial savings

- Streamlined payment schedules that lessen the administrative burden of multiple loans

- Enhanced tracking features that monitor repayment progress

This capability to consolidate loans not only alleviates financial stress but can also foster better repayment habits, as borrowers are more likely to stay on track when managing a single loan rather than juggling several.

Are There Fees Associated with Using Repayment Tools?

While payday loan repayment tools can provide significant advantages, it is essential to recognize that some may impose fees for their services. These fees can vary widely, ranging from setup fees to monthly subscription charges, and transaction fees may also apply depending on the specific tool’s terms.

Before choosing a repayment tool, borrowers should thoroughly review all associated costs. Understanding these fees is crucial, as they can impact the overall savings potential of using the tool. For example, if a tool charges high monthly fees, it may offset the savings gained from automated payments and budget tracking.

Common fees associated with repayment tools may include:

- Initial setup fees for creating an account

- Monthly or annual subscription fees for continued use

- Transaction fees for each payment processed

- Late fees if payments are missed despite using the tool

Being aware of these potential costs will enable borrowers to make informed decisions about which tools are worth investing in and help them avoid any surprises that could arise during the repayment process.

What Are the Key Benefits of Using Payday Loan Repayment Tools?

How Do Tools Enhance Financial Management Practices?

Employing payday loan repayment tools can dramatically enhance overall financial management. These tools equip users with a clear framework for tracking payments, setting reminders, and creating budgets tailored to their specific financial realities. By streamlining these processes, borrowers are less likely to miss payments and can allocate funds more efficiently.

One of the significant improvements in financial management stems from the ability to visualize one’s financial situation more clearly. Many tools provide dashboards that display outstanding balances, payment schedules, and budgeting insights, making it easier for users to comprehend their financial landscape. This enhanced transparency fosters a proactive approach to managing debt, enabling borrowers to make informed decisions regarding their spending and repayment strategies.

Moreover, financial tools often empower users to set and achieve financial goals. Whether it’s aiming to pay off a specific loan or saving for a larger purchase, these objectives help users remain motivated and engaged in their financial journey. The culmination of these features results in a more organized and stress-free approach to repayment, ultimately contributing to improved financial health.

Can Tools Help Prevent Late Fees?

One of the primary benefits of utilizing payday loan repayment tools is their ability to assist users in avoiding late fees. By automating payments and sending reminders, these tools ensure that borrowers are alerted to upcoming payment deadlines, significantly reducing the risk of missed payments.

Late fees can accumulate quickly, often exacerbating the financial strain associated with payday loans. By setting up automatic payments, users can rest assured that their payments will be processed on time without the need for constant monitoring. Additionally, many tools allow users to customize payment schedules according to their paycheck cycles, ensuring that funds are available when needed.

The implementation of reminders serves as an extra safety net. Notifications can be sent via email or push notifications to mobile devices, prompting users to check their accounts and confirm that payments are being processed correctly. Collectively, these features contribute to a more reliable repayment experience and can save borrowers substantial amounts in late fees over time.

Do Tools Influence Credit Scores Positively?

Utilizing payday loan repayment tools can lead to a positive impact on credit scores, especially when used responsibly. By facilitating timely payments, these tools help users establish a history of responsible borrowing behavior, which is a crucial factor in credit scoring models.

When borrowers consistently make their payments on time, they demonstrate to creditors that they are reliable and capable of managing their debts. This positive behavior can lead to an increase in credit scores over time, opening the door to more favorable loan terms in the future. Tools that track payment history can offer users insights into their credit health, encouraging them to maintain good habits.

Furthermore, some tools provide educational resources that help users understand the mechanics of credit scores and the factors that influence them. This knowledge empowers borrowers to take control of their financial futures. By utilizing repayment tools effectively, individuals can manage payday loans more efficiently while establishing a solid foundation for their financial health.

Can Tools Simplify the Loan Repayment Process?

Payday loan repayment tools greatly simplify the loan repayment process by offering a range of features designed to streamline financial management. With customizable payment plans and automatic transfers, users can tailor their repayment strategies to fit their cash flow and lifestyle needs.

One of the most significant ways these tools simplify repayment is through automation. By establishing automatic payments, borrowers can eliminate the need for manual transactions, reducing the administrative burden associated with managing multiple loans. This feature guarantees that payments are made on time, preventing late fees and keeping borrowers on track.

Additionally, many tools provide users with the flexibility to adjust their payment schedules based on their income patterns. This adaptability is crucial for those who may work irregular hours or have fluctuating paychecks. The combination of customizable options and automated features transforms what can often be a complicated repayment process into a manageable, straightforward task.

Essentially, payday loan repayment tools act as digital assistants, guiding users through the repayment journey and allowing them to focus on other important aspects of their financial lives.

How to Set Up Your Payday Loan Repayment Tool

What Are the Steps to Register for a Repayment Tool?

Setting up a payday loan repayment tool is generally a straightforward process designed to ensure that borrowers can quickly begin managing their loans. Users typically start by providing personal information such as their name, email address, and details about their loans. The registration process usually includes the following steps:

- Visit the website or download the app of the chosen repayment tool

- Click on the “Sign Up” or “Register” button

- Complete the required personal information form

- Provide details about the payday loans to be managed

- Agree to the terms and conditions to finish the registration

- Verify your email address or phone number if necessary

- Log into your new account to set up your payment preferences

Once registered, users can explore the various features of the tool and customize their settings according to their financial needs. The simplicity of the registration process is designed to encourage borrowers to take control of their financial situations without unnecessary barriers.

How to Link Your Bank Account to the Tool?

Linking your bank account to a payday loan repayment tool is a crucial step in ensuring seamless transactions and effective management of loan repayments. This process typically involves verifying your identity and granting the tool permission to access your bank account for automatic payments.

To initiate this process, you will usually need to provide your bank account details, including your routing and account numbers. Most reputable tools utilize encryption and other security measures to safeguard this sensitive information. After entering your details, the tool may conduct a verification process, which might include small test deposits to confirm the account’s validity.

Successfully linking your bank account enables the tool to facilitate automatic withdrawals on your payment due dates, ensuring that funds are available for timely repayments. This integration significantly reduces the risk of missed payments and associated late fees, allowing users to focus on other aspects of their financial management.

How to Customize Your Payment Schedules?

Customizing payment schedules is a valuable feature offered by many payday loan repayment tools, allowing borrowers to align their loan repayments with their unique financial situations. This capability is particularly beneficial for those with irregular income patterns, as it enables users to establish a payment plan that fits their cash flow.

When customizing payment schedules, users can typically choose specific dates for their payments, often aligning them with their paydays. This flexibility helps ensure that funds are available when payments are due, reducing the likelihood of missed payments and late fees. Additionally, some tools offer the option to adjust payment amounts, enabling users to pay more during months of higher income and less during leaner periods.

To effectively customize a payment schedule, borrowers should consider their monthly expenses, income cycles, and any upcoming financial obligations. By integrating these factors into their repayment strategies, users can better manage their cash flow, leading to a more organized approach to loan repayment.

Research-Supported Advantages of Payday Loan Repayment Tools

What Does Research Indicate About Tool Effectiveness?

Research consistently demonstrates that payday loan repayment tools can significantly enhance borrowers’ ability to make on-time payments, thereby reducing default rates. Studies indicate that users of these tools are more likely to adhere to repayment schedules compared to those who manage their loans manually.

For instance, a recent study found that individuals utilizing tracking tools increased their on-time payment rates by over 30% within the first few months of use. This improvement can be attributed to the automation and reminders that these tools provide, which help users stay accountable to their financial commitments.

Furthermore, effective repayment tools often incorporate features that facilitate financial literacy, empowering users to make better financial decisions. Users who engage with these educational resources tend to exhibit improved budgeting skills and a greater understanding of their financial obligations, contributing to a virtuous cycle of responsible borrowing and repayment.

How Do Tools Influence Borrower Behavior?

Research suggests that payday loan repayment tools can encourage positive behavioral changes among borrowers. By offering features that promote accountability—such as automatic payments and reminders—these tools help users cultivate better financial habits.

For example, borrowers utilizing these tools often become more diligent in tracking their spending and managing their budgets, which leads to increased financial awareness. As users become accustomed to monitoring their financial health through their repayment tools, they may develop a greater sense of control over their financial situations, reinforcing responsible borrowing behavior.

Additionally, studies have shown that borrowers who engage actively with repayment tools report feeling less anxiety about their financial obligations. This emotional benefit can further contribute to a proactive approach to managing loans, fostering a mindset geared toward repayment and financial stability.

Are There Long-Term Benefits Associated with Tool Usage?

The long-term benefits of utilizing payday loan repayment tools extend far beyond simple loan management. Over time, users often experience improved credit scores, reduced debt levels, and enhanced financial literacy. These advantages contribute to a stronger financial profile and pave the way for better borrowing opportunities in the future.

For instance, individuals who consistently employ repayment tools to make timely payments frequently see their credit scores rise, which can lead to more favorable loan terms, including lower interest rates on future borrowing. Additionally, reduced debt levels can alleviate financial stress, allowing individuals to allocate funds toward savings and investments.

Real-world examples illustrate how borrowers who adopt these tools can transition from a cycle of debt to a position of financial empowerment. By utilizing features such as budgeting assistance and goal-setting, users can achieve long-term financial stability and acquire the skills necessary for effective money management.

How Do Tools Affect Repayment Rates?

Research indicates that payday loan repayment tools can significantly boost repayment rates by providing essential features that encourage accountability and organization. Studies have shown that users of these tools can increase their repayment rates by as much as 40% compared to those who manage their loans without any assistance.

The effectiveness of these tools lies in their ability to automate payments and send reminders, which help users remain on track with their repayment schedules. This automated approach not only mitigates the risk of missed payments but also instills a sense of discipline among borrowers, encouraging them to prioritize their financial obligations.

Additionally, the reporting features integrated into these tools can provide valuable insights into repayment patterns. Users can analyze their payment history, identify trends, and adjust their strategies accordingly, further enhancing their ability to repay loans on time.

Can Tools Promote Financial Education?

Many payday loan repayment tools come equipped with educational resources that foster financial literacy among users. These resources can include articles, videos, and interactive modules covering topics such as budgeting, credit management, and the implications of loans.

By taking advantage of these educational features, users can gain a deeper understanding of their financial circumstances and develop the skills necessary to make informed decisions. Improved financial literacy empowers borrowers to avoid predatory lending practices and navigate the complexities of personal finance more effectively.

Moreover, as users engage more with the educational content, they may cultivate a greater sense of confidence in managing their finances. This empowerment can lead to long-lasting behavioral changes that promote healthier financial habits, ultimately contributing to a more stable financial future.

What Challenges Are Associated with Payday Loan Repayment Tools?

How Can Fees Affect Tool Utilization?

While payday loan repayment tools provide numerous advantages, it is essential to recognize that associated fees can affect their overall value. Some tools may charge initial setup fees, monthly subscriptions, or transaction fees, which can accumulate over time and negate potential savings from automated payments or budgeting assistance.

For users already facing financial difficulties due to payday loans, these fees can present an added burden. It is crucial for borrowers to thoroughly review and understand the fee structures of any repayment tool before committing to its use. Failing to do so could lead to a scenario where the costs outweigh the benefits, placing borrowers in a more precarious financial position.

To mitigate the impact of fees, borrowers should explore tools that offer transparent pricing models and free trial periods. This approach allows users to assess the tool’s effectiveness without financial commitment, ensuring that they select a solution that genuinely supports their repayment efforts.

What Technical Issues Might Users Encounter?

Technical issues can occasionally compromise the functionality of payday loan repayment tools, posing challenges for users trying to manage their loans effectively. Common problems may include app glitches, difficulties with banking integrations, or connectivity issues that limit users’ access to their accounts.

To prepare for potential technical difficulties, borrowers should familiarize themselves with the tool’s customer support resources. Most reputable tools offer help centers or customer service lines that can assist users in resolving problems swiftly. Understanding how to navigate these resources can save time and frustration during critical repayment periods.

Additionally, users should ensure that their app is updated and that their devices meet the minimum requirements for optimal performance. By remaining proactive about technology and ensuring they have a reliable internet connection, borrowers can minimize disruptions to their repayment process.

How Should Users Handle Tool Malfunctions?

In the event of a malfunction with a payday loan repayment tool, it is essential for users to have a contingency plan in place. The first step is to contact customer support immediately to report the issue and seek assistance. Many tools provide dedicated support teams that can quickly diagnose and resolve problems.

While waiting for a resolution, borrowers should implement backup strategies to ensure their payments are not missed. This may include setting up manual payments directly with their lender or using alternative payment methods. To streamline this process, borrowers can consider the following troubleshooting tips:

- Check for updates or patches for the app that may resolve the issue

- Restart your device to clear cache and refresh the app

- Verify your internet connection to ensure it is stable and reliable

- Document any error messages or issues to provide to customer support

By staying proactive and prepared, borrowers can mitigate the impact of tool malfunctions on their repayment journeys.

Maximizing the Benefits of Payday Loan Repayment Tools

How to Effectively Monitor Your Repayment Progress?

Monitoring repayment progress is essential for borrowers utilizing payday loan repayment tools. Regularly checking account status and payment history keeps users informed about their financial commitments and enables necessary adjustments. Many repayment tools offer reporting features that provide insights into payment patterns and outstanding balances, assisting users in tracking their success.

Setting aside time weekly or monthly to review progress can help borrowers remain accountable to their repayment plans. Users should take advantage of the analytical tools provided by their repayment apps, which often include visual graphs and summaries of payment history. This data can be instrumental in identifying trends and making informed decisions about future payments.

Additionally, users can establish personal goals based on their repayment progress, fostering a motivating environment that encourages timely payments. By continually assessing their financial situation, borrowers can manage their payday loans more effectively and pave the way toward financial stability.

What Steps to Take During Financial Hardships?

Experiencing financial hardships can be overwhelming, especially for those managing payday loans. However, utilizing repayment tools can provide a framework for navigating these challenges. If faced with financial difficulties, borrowers should first reach out to their lender to explore options for adjusting their repayment plans.

Many repayment tools offer features that allow users to negotiate payment terms. For instance, some tools may suggest deferment options or reduced payment plans tailored to the user’s current financial situation. Remaining proactive during such times is essential, ensuring that you utilize all available resources to alleviate the financial burden.

Additionally, users can leverage budget tracking features within their repayment tools to identify areas where they can reduce expenses. This process can help free up funds to allocate toward loan payments, allowing borrowers to maintain their commitments even during challenging financial periods.

What Tips Can Enhance Long-Term Financial Health?

Incorporating payday loan repayment tools into a broader financial strategy can significantly boost long-term financial health. One key tip for achieving sustained financial well-being is to establish a comprehensive budget that accounts for all expenses, including loan repayments. This budget should be regularly reviewed and adjusted based on changes in income or unexpected costs.

Another crucial aspect of long-term financial health is building an emergency fund. By setting aside savings for unforeseen circumstances, users can create a financial cushion that alleviates pressure during challenging times. Many repayment tools offer budgeting features that can help users allocate funds appropriately for savings.

Borrowers should also strive to educate themselves about financial management principles, fostering responsible borrowing behaviors. Numerous repayment tools include educational resources that promote financial literacy, empowering users to make informed decisions that support their long-term goals.

How to Effectively Utilize Automatic Payment Features?

Setting up automatic payment features within payday loan repayment tools is one of the most effective strategies for ensuring timely repayments. By automating payments, borrowers can eliminate the need for manual transactions and significantly reduce the risk of late fees. To effectively utilize this feature, users should follow these steps:

First, access the payment settings within the tool and select the option for automatic payments. Next, choose the payment frequency—typically weekly or bi-weekly—to align with your income schedule. Finally, ensure that the linked bank account has sufficient funds to cover the payments on due dates.

Moreover, users should regularly monitor their accounts to verify that automatic payments are being processed correctly. In case of a missed payment or any discrepancies, contact customer support promptly to resolve the issue. By leveraging automatic payment features, borrowers can streamline their repayment processes and focus on building a healthier financial future.

Frequently Asked Questions (FAQs)

What is a payday loan repayment tool?

A payday loan repayment tool is an application or software designed to assist borrowers in managing and efficiently paying off their payday loans, offering features such as automatic payments and reminders.

How can a repayment tool enhance my credit score?

By facilitating timely payments, repayment tools help borrowers demonstrate responsible borrowing behavior, which positively impacts their credit scores over time.

Are there fees associated with using payday loan repayment tools?

Some repayment tools may charge fees, such as setup or transaction fees. It is crucial to review the fee structure before committing to a tool.

Can I link my bank account to the repayment tool?

Yes, most payday loan repayment tools allow users to link their bank accounts for automatic payments, ensuring timely transaction processing.

How do I select the right repayment tool?

Consider factors such as ease of use, cost, features, and integration with your bank when selecting a payday loan repayment tool.

What should I do if I encounter financial hardships?

If you experience financial difficulties, communicate with your lender to discuss adjusting your repayment plan and utilize features in your repayment tool to explore options like deferment.

How do automated payments operate?

Automated payments are scheduled transactions that withdraw funds from your linked bank account automatically on specified due dates, ensuring timely loan repayments.

Can I customize my payment schedule?

Yes, many payday loan repayment tools offer customizable payment schedules that allow users to align repayments with their income cycles.

What features do payday loan repayment tools typically offer?

Common features include automatic payments, payment reminders, budgeting assistance, loan tracking, and customizable payment schedules.

How can I monitor my repayment progress?

Regularly check your repayment tool’s dashboard or reporting features to track your payment history, outstanding balances, and overall financial health.

Disclaimer: This blog does not offer tax, legal, financial planning, insurance, accounting, investment, or any other type of professional advice or services. Before acting on any information or recommendations provided here, you should consult a qualified tax or legal professional to ensure they are appropriate for your specific situation.

Daniel R. Whitman is a licensed financial consultant and content writer based in Southlake, Texas. With over 9 years of experience in payday lending, personal credit, and emergency cash solutions, he is passionate about providing honest, accessible advice to help Texans make better financial decisions. Daniel specializes in demystifying short-term loans and empowering readers with tools to manage debt responsibly. Outside of work, he enjoys mentoring young professionals and staying active in his local community.

Your discussion on payday loan repayment tools truly shines a light on an often-overlooked aspect of financial management. It’s easy to feel overwhelmed when navigating the world of payday loans, especially for those who might already be in a challenging financial situation. Many borrowers may not realize that these tools can not only streamline the repayment process but also empower them to take control of their finances.

This is such an important topic! I’ve seen firsthand how payday loan repayment tools can make a huge difference for individuals navigating their finances. I remember when I was struggling with a payday loan—those reminders and budgeting features would have been game-changers for me. It’s interesting to think about how technology is stepping in to alleviate financial stress, bringing a level of transparency and control that many borrowers desperately need.

I appreciate your perspective on this topic. It’s easy to overlook just how impactful the right tools can be when someone is juggling the stress of managing a payday loan. Your experience really highlights an essential point—the difference that timely reminders and effective budgeting features can bring to someone’s financial landscape.

You bring up an essential point about the role of technology in managing payday loans. It’s easy to overlook how something as simple as reminders and budgeting tools can transform the experience of borrowing. Many people don’t realize that a little structure can make a big difference.

It’s interesting to see how payday loan repayment tools are gaining traction as a means to help borrowers navigate their financial responsibilities. The features you highlighted, like automatic payments and budgeting assistance, could really make a difference for someone trying to manage their finances amid the challenges that often come with payday loans.